Oman ratifies protocol amending tax treaty with India

Oman ratified the amending protocol to the India-Oman Income Tax Treaty (1997) on 27 March 2025 through Royal Decree No. 36/2025. Earlier, Oman and India signed an amending protocol to their existing tax treaty in Muscat, the announcement was

See MoreSerbia announces protocol to 2001 DTA with Hungary takes effect

The amending protocol to the tax treaty between Serbia and Hungary has entered into force. The Serbian Official Gazette made the announcement on 18 March 2025. It stated that the protocol to the 2001 double tax agreement (DTA) between Hungary and

See MoreSwitzerland: Parliament approves amending protocol to tax treaty with Germany

The Swiss parliament granted final approval to the amending protocol to the 1971 income and capital tax treaty with Germany on 21 March 2025. The protocol complies with BEPS standards and introduces additional provisions to clarify how national

See MoreNorway: Parliament approves amending protocol to tax treaty with Qatar

Norway’s parliament approved the amending protocol to the 2009 income tax treaty with Qatar on 25 March 2025. The protocol, signed on 4 September 2024, is the first amendment to the agreement. It will take effect 30 days after ratification

See MoreUN: New Article 12AA on Taxation of Services Presented for Approval

The 30th session of the UN Committee of Experts on International Cooperation in Tax Matters is being held from 24 to 27 March 2025. On 25 March 2025 the Subcommittee on Taxation Issues Related to the Digitalized and Globalized Economy presented

See MoreSwitzerland: Parliament approves tax treaties with Angola and Jordan

Switzerland's Parliament gave its final approval to the income tax treaty with Angola and Jordan on 21 March 2025. The agreement with Angola was signed on 30 November 2023 and with Jordan on 13 December 2023. These treaties will come into

See MorePeru advances tax treaty talks with Australia, France, Saudi Arabia, Singapore, UAE

The Peruvian Ministry of Economy and Finance announced that it is working to finalise tax treaty negotiations with Australia, France, Saudi Arabia, Singapore, and UAE on 20 March 2025. Peru has signed 10 agreements that provide a secure and

See MorePeru, UK sign income and capital gains tax treaty

Peru and the UK have signed an income and capital gains tax treaty on 20 March 2025. The agreement seeks to reduce tax base erosion and profit shifting by lowering withholding tax rates on cross-border income. It caps dividend withholding tax at

See MoreSwitzerland, Zimbabwe sign income tax treaty

Swiss federal authorities announced on 19 March 2025 that Switzerland and Zimbabwe signed a new income tax treaty. This will ensure the requisite legal certainty for the ongoing development of bilateral economic relations and tax cooperation between

See MoreMorocco ratifies tax treaty with Cape Verde

Morocco has completed ratifying the Cabo Verde-Morocco Income Tax Treaty (2023) on 20 February 2025. Morocco officially published in its Official Gazette the royal decree enacting Law No. 33-23, which ratifies the agreement On 6 March 2025. The

See MoreSaudi Arabia: Council of Ministers approve income tax treaty with Iceland

Saudi Arabia's Council of Ministers approved the ratification of an income tax treaty with Iceland on 18 March 2025. The agreement aims to prevent double taxation and is expected to encourage trade and investment by addressing tax challenges,

See MoreGabon, Turkey sign income tax treaty

Gabon and Turkey signed an income tax treaty on 3 March 2024. The treaty applies to various Gabonese taxes, including individual income tax, corporate tax, minimum flat-rate tax, supplementary salary tax, special rental property tax, and tax on

See MoreUK issues revocation order to suspend tax treaty with Belarus

The UK has issued the Double Taxation Relief and International Tax Enforcement (Belarus) (Revocation) Order 2025, which was made on 12 March 2025, revoking the 2018 Order that had implemented the 2017 tax treaty with Belarus. As a result, the

See MoreKorea (Rep.): National Assembly approves ratification of tax treaty with Andorra

The National Assembly of Korea (Rep.) approved the ratification of income tax treaty with Andorra on 13 March 2025, which was signed on 3 November 2023. The treaty will take effect once the ratification instruments are exchanged and will apply

See MoreHong Kong, Barbados commence first round of tax treaty negotiations

The Hong Kong Inland Revenue Department announced on 18 March 2025 that the first round of income tax treaty talks between Barbados and Hong Kong will take place from 24 to 28 March 2025. The agreement between Hong Kong and Barbados aims to

See MorePeru, Spain to resume tax treaty talks in March 2025

Peru and Spain will resume income tax treaty negotiations from 26 to 28 March 2025 in the fifth round of negotiations for an income tax treaty. Earlier, the announcement was made by Luis Ibérico, Peru’s ambassador to Spain, during an event on

See MoreBhutan, Singapore begin negotiations on first income tax treaty

Officials from Bhutan and Singapore met in Paro, Bhutan, from 10 to 14 March 2025 to begin negotiations on their first-ever income tax treaty. This treaty aims to address the issue of double taxation on the income of citizens in both

See MoreKyrgyzstan, Vietnam agree to tax treaty negotiations

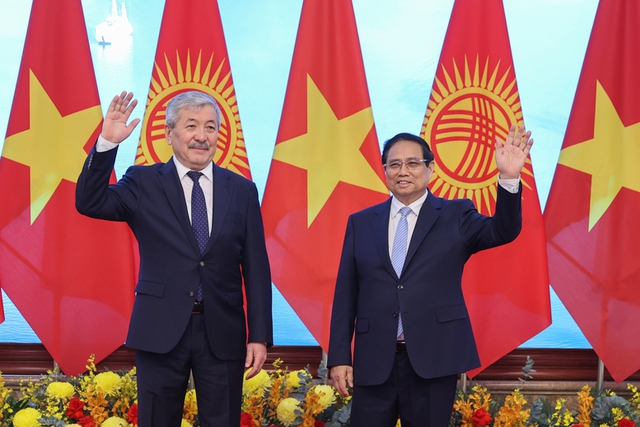

Kyrgyzstan and Vietnam have agreed to sign a tax treaty and an investment protection agreement (IPA) during the official visit of the Chairman of the Kyrgyz Cabinet of Ministers to Vietnam from 6 to 7 March 2025. This announcement was made by the

See More