Italy, Kosovo income tax treaty enters into force

The income tax treaty between Italy and Kosovo, signed on 22 June 2021, entered into force on 21 December 2025 and applies from 1 January 2026. This agreement aims to eliminate double taxation on income and prevent tax evasion and avoidance

See MoreHong Kong,Turkey income tax treaty comes into force

The income tax treaty between Hong Kong and Turkey entered into force on 30 January 2026. The treaty, signed on 24 September 2024, is the first income tax agreement between the two jurisdictions. It aims to prevent double taxation and promote

See MoreCuracao, Cyprus tax treaty enters into force

The Curacao–Cyprus Income Tax Treaty (2025) will enter into force starting 28 February 2026. Signed on 23 April 2025, the agreement is based on the OECD Model Tax Convention (2017 Model). The treaty applies to various taxes, including Cyprus

See MoreSaudi Arabia, Iceland income tax treaty enters into force

The income tax treaty between Iceland and Saudi Arabia entered into force from 1 January 2025. Signed on 4 December 2024, the agreement aims to prevent double taxation and is expected to encourage trade and investment by addressing tax

See MoreTax treaty between Estonia, Liechtenstein enters into force

Estonia’s Ministry of Finance has confirmed that the income and capital tax treaty between Estonia and Liechtenstein entered into force on 26 December 2025. Signed on 10 July 2025, the agreement seeks to eliminate double taxation and prevent

See MoreTax treaty between Gabon, Italy enters into force

The income tax treaty between Gabon and Italy, signed on 28 June 1999, entered into force on 19 December 2025. The agreement applies to Gabon’s corporate tax, flat-rate minimum tax, individual income tax, and tax on income from immovable

See MoreNew tax treaty between Romania, UK enters into force

A new income and capital tax treaty between Romania and the UK, signed on 13 November 2024, entered into force on 22 December 2025, replacing the 1975 treaty. The agreement covers Romanian income and profit taxes, as well as UK income tax,

See MoreEstonia, Oman income tax treaty enters into force

The income tax treaty between Estonia and Oman entered into force on 24 November 2025. Signed on 27 October 2024, the agreement seeks to prevent double taxation and fiscal evasion between the two nations. It will take effect after the

See MoreAndorra, UK tax treaty comes into force

The income and capital tax treaty between Andorra and the UK entered into force on 22 December 2025. The agreement, signed on 20 February 2025, marks the first bilateral tax treaty concluded between the two jurisdictions. The treaty applies to

See MoreAzerbaijan releases consolidated text of tax treaty with Bosnia and Herzegovina under BEPS MLI

Azerbaijan's State Tax Service (STS) has released the consolidated versions of its tax treaty with Bosnia and Herzegovina, reflecting the changes introduced by the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base

See MoreAzerbaijan releases consolidated text of tax treaty with Belgium under BEPS MLI

Azerbaijan's State Tax Service (STS) has released the consolidated versions of its tax treaty with Belgium reflecting the changes introduced by the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit

See MoreAzerbaijan releases consolidated text of tax treaty with Austria under BEPS MLI

Azerbaijan's State Tax Service (STS) has released the consolidated versions of its tax treaty with Austria reflecting the changes introduced by the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit

See MoreRomania, Andorra tax treaty enters into force

The income and capital tax treaty between Andorra and Romania, signed on 27 September 2024, officially entered into force on 11 December 2025. The treaty addresses a range of taxes, including Andorran corporate and personal income taxes, taxes on

See MoreItaly, Libya income tax treaty enters into force

The Italy–Libya income tax treaty of 2009 entered into force on 10 December 2025, following the exchange of ratification instruments, as confirmed by a memorandum of understanding signed in Tripoli on the same day. Signed on 10 June 2009, this

See MoreChile: SII publishes circular on MFN clause activation in tax treaties with five countries

Chile’s tax authority (SII) issued Circular No. 65 on 3 December 2025, addressing the activation of Most-Favoured-Nation (MFN) clauses in Chile’s tax treaties with Belgium, New Zealand, Norway, Switzerland, and Uruguay. These clauses are

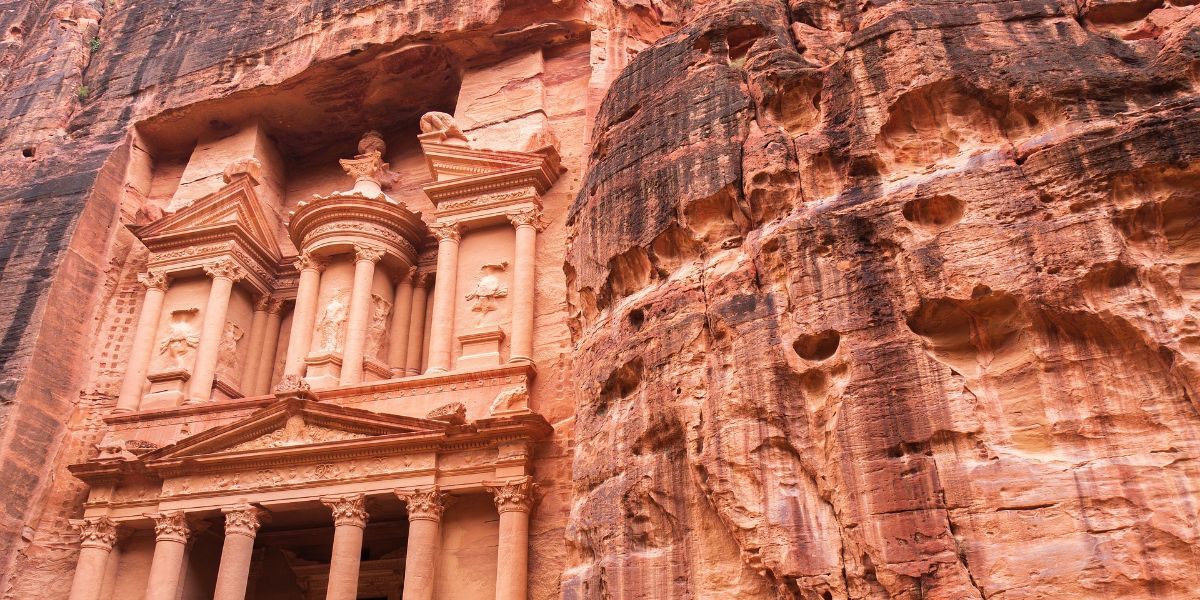

See MoreJordan, Switzerland income tax treaty enters into force

The income tax treaty between Jordan, Switzerland entered into force on 4 December 2025. Signed on 13 December 2023, the agreement aims to prevent double taxation on income and curb tax evasion between Jordan and Switzerland. It applies to

See MoreMalaysia, Russia income tax treaty enters into force

The new income tax treaty between Malaysia and Russia entered into force on 3 September 2025. The agreement covers Malaysian income tax and petroleum income tax, as well as Russian corporate profit and individual income taxes. Withholding tax

See MoreUAE, Sierra Leone tax treaty takes effect

The UAE Ministry of Finance has announced that its income and capital tax treaty with Sierra Leone entered into force on 24 January 2023. Signed on 22 December 2019, the treaty states that a permanent establishment is considered to exist when an

See More