April 15, 2025

Switzerland has scheduled a referendum deadline of 10 July 2025 for the proposed protocol amending the 1971 income and capital...

April 15, 2025

The Danish Minister of Taxation introduced Bill L 194 to align with the OECD’s Minimum Tax Guidelines and ease transfer...

April 15, 2025

Malta’s Commissioner for Tax and Customs published new guidelines on the VAT exemption for small enterprises on 7 April 2025,...

April 15, 2025

Ecuador’s Internal Revenue Service (SRI) has amended the Mining Annex reporting requirements through Resolution No. NAC-DGERCGC25-00000007, effective from 28 March...

April 15, 2025

New Zealand’s Inland Revenue released updated guidance outlining its expectations for tax control frameworks (TCFs) as part of increased reviews...

April 15, 2025

The Oman Tax Authority has reminded taxpayers subject to income tax with a fiscal year ending on 31 December 2024...

April 15, 2025

Taiwan’s Ministry of Finance has announced an extension to the application deadline for claiming tax treaty (agreement) benefits on 10...

April 11, 2025

Luxembourg’s Government Council has approved the ratification of the protocol to the 2019 tax treaty on income and capital with...

April 11, 2025

Luxembourg released the Law of 25 March 2025 in the Official Gazette on 7 April 2025, which facilitates the ratification...

April 11, 2025

The United Arab Emirates (UAE) and the Republic of the Congo signed a Comprehensive Economic Partnership Agreement (CEPA) aimed at...

April 11, 2025

Denmark issued Executive Order No. 366 on 7 April 2025 , published in Official Gazette A on 9 April 2025....

April 11, 2025

Uruguay has issued Decree No. 85/025 on 2 April 2025, extending the tax benefits for large investment projects in construction...

April 11, 2025

The Inland Revenue Authority of Singapore (IRAS) has published new presentations offering guidance on the Global Anti-Base Erosion (GloBE) Rules...

April 11, 2025

Malta’s Commissioner for Revenue has revealed the extended deadlines for submitting corporate income tax returns electronically in 2025. This announcement...

April 11, 2025

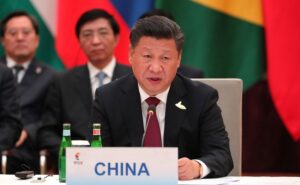

Beijing announced it has increased its tariffs on US imports to 125% earlier today, 11 April 2025. “The US side’s...

April 11, 2025

Germany’s new coalition government, formed by the conservative alliance led by Friedrich Merz and the centre-left Social Democrats (SPD), announced...

April 10, 2025

Luxembourg’s Chamber of Deputies gave its approval for the ratification of the tax treaty with Colombia concerning income and capital...

April 10, 2025

The German Ministry of Finance announced a new agreement on 28 March 2025 with Switzerland that permanently extends the 2019...