Zambia: Cabinet approves draft income tax treaty with Turkey

Zambia’s Ministry of Information and Media issued a statement, on 18 February 2026, outlining recent Cabinet decisions, among which was the approval of a draft income tax treaty with Turkey, designed to prevent double taxation and fiscal

See MoreZambia: ZRA opens voluntary disclosure programme to taxpayers

The Zambia Revenue Authority (ZRA) has issued a Public Notice to inform taxpayers about the availability of the Voluntary Disclosure Programme (VDP) on 12 December 2025, offering relief from penalties and interest on amounts voluntarily

See MoreZambia: ZRA announces signing of international tax co-operation pact

Zambia's Revenue Authority (ZRA) announced that Zambia had signed the Yaoundé Declaration on International Tax Co-operation and the fight against Illicit Financial Flows (IFFs) in Africa on 4 December 2025. ZRA Commissioner General Dingani Banda

See MoreZambia: MoF presents 2026 budget, promotes corporate investments in key sectors

Zambia’s Ministry of Finance and National Planning delivered the 2026 Budget Speech to the National Assembly on 26 September 2025, announcing a series of revenue measures aimed at strengthening domestic resource mobilisation, supporting small

See MoreZambia: ZRA introduces 10% excise duty on gaming, betting

Revenue Authority introduced a 10% excise duty on gaming and betting, effective from September 2025, with payments due by the 15th of the following month. The Zambia Revenue Authority (ZRA) has confirmed the introduction of a 10% excise duty on

See MoreZambia extends relief on copper concentrate exports

Zambia extended 10% copper export tax relief to deadline to address the growing stockpile of unprocessed copper concentrates resulting from disruptions at local smelters. Zambia has extended the suspension of its 10% export tax on copper

See MoreZambia: Government presents 2026 budget, proposes VAT refund incentives for energy sector

The national budget for 2026 proposes amendments to key tax laws to enhance revenue, provide targeted relief, promote equity, support economic formalisation, and align with international standards. Zambia’s Minister of Finance and National

See MoreZambia introduces 1% minimum tax, raises withholding tax on government bonds

Zambia’s 2025 tax update introduces a 1% turnover tax and raises government bond withholding tax to 20%. Zambia passed the Income Tax (Amendment) Act 2025 on 8 August 2025, with its publication in the Official Gazette following on 19 August

See MoreZambia: Supreme Court rules in ZRA v. Nestlé transfer pricing case

Zambia’s Supreme Court upholds ZRA’s transfer pricing audit on Nestlé Zambia, confirming low-risk distributor status and reinstating a ZMW 13.8 million tax assessment. The Supreme Court of Zambia delivered its decision on transfer pricing in

See MoreZambia: ZRA advocates compliance through trust-based approach

The ZRA hosted a cooperative compliance conference from 25 to 27 August to promote trust-based initiatives for improved trade facilitation and tax compliance. The Zambia Revenue Authority (ZRA) announced on 27 August 2025 that it is hosting a

See MoreZambia advances 2025 tax reform, proposes 1% minimum alternative tax for businesses

Key proposals include a 1% MAT on turnover, 15% to 20% withholding tax on government securities, and excise duty hikes on cigarettes, alcohol, sugary drinks, and betting services. Zambia's National Assembly has advanced the Income Tax

See MoreZambia announces broad tax reforms in 2025 budget

Zambia’s 2025 Budget introduces wide-ranging tax reforms across income, turnover, VAT, property transfer, and excise duties to boost revenue and compliance. Zambia has introduced a range of tax changes in its 2025 Budget, affecting income tax,

See MoreATAF launches working party to revise model tax agreement

The African Tax Administration Forum (ATAF) has revealed the formation of a specialised working group tasked with reviewing and updating its Model Tax Agreement. This announcement was made by ATAF on 29 April 2025. The African Tax

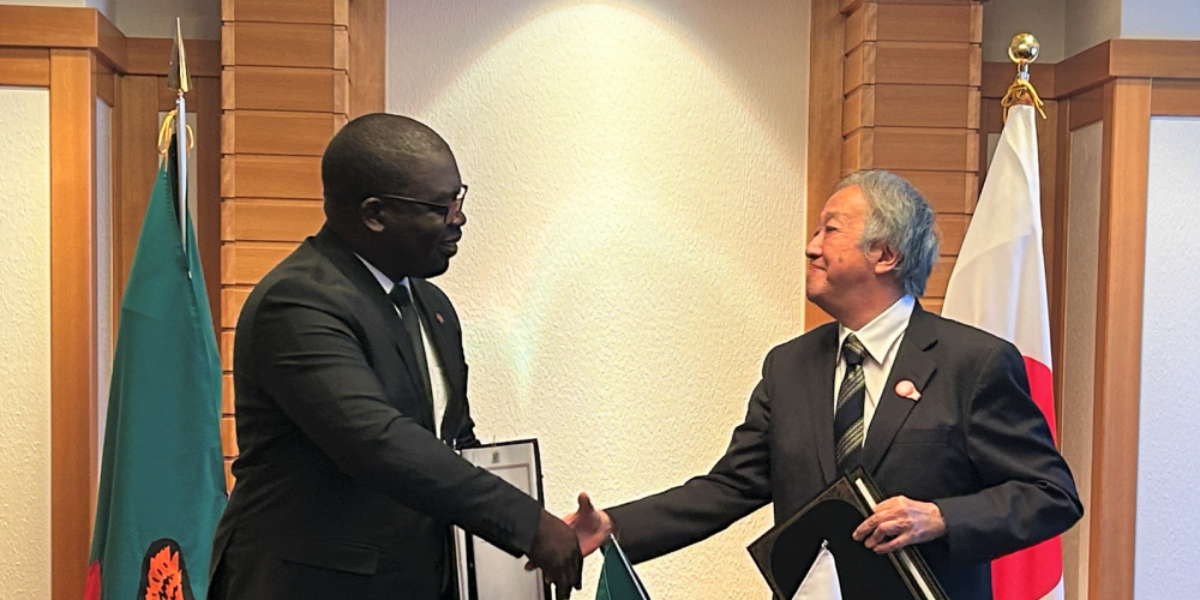

See MoreJapan, Zambia sign investment agreement

The “Agreement between Japan and the Republic of Zambia for the Promotion and Protection of Investment” (Japan-Zambia Investment Agreement) was signed in Tokyo by H.E. Mr. TAKEUCHI Kazuyuki, Ambassador Extraordinary and Plenipotentiary of Japan

See MoreZambia proposes new tax measures in 2025 budget draft

Zambia's Ministry of Finance and National Planning have introduced new tax measures in the draft 2025 Budget. The proposed tax changes include limiting the offset of carried-forward losses to 50% of taxable income across all sectors, a reduction

See MoreZambia presents 2025 budget, introduces limited tax measures

Zambia's Ministry of Finance and National Planning Minister Situmbeko Musokotwan presented the 2025 Budget Speech to the National Assembly on 27 September 2024. The budget focuses on revenue generation through limited tax measures without

See MoreZambia presents 2025 budget

Zambia’s Minister of Finance and National Planning, Situmbeko Musokotwane, presented the 2025 National Budget to the National Assembly on Friday, 27 September 2024. “The 2025 budget is premised on economic recovery and promoting growth to

See MoreKenya to revise tax treaties with Zambia, Germany, Iran

Kenya’s government has shown interest in restarting negotiations to revise its 1968 tax treaty with Zambia, the 1977 tax treaty with Germany, and the 2012 tax treaty with Iran. This follows after the Kenyan government decided to align its tax

See More