US: IRS updates reporting rules for research tax credit (Form 6765)

The updated Form 6765 now includes mandatory sections E and F for all taxpayers, while section G is optional for tax years before 2025 and mandatory starting in 2025. The US Internal Revenue Service (IRS) has introduced a revised Form 6765,

See MoreUS: IRS opens applications for 2026 Compliance Assurance Program

The 2026 Compliance Assurance Process (CAP) program application period will run from 3 September to 31 October 2025. The US Internal Revenue Service (IRS) has released IR-2025-84 on 18 August 2025, in which it announced the opening of the 2026

See MoreUS: Tax rule revisions ease concerns for clean energy investors, IRS clarifies tax credit phaseout

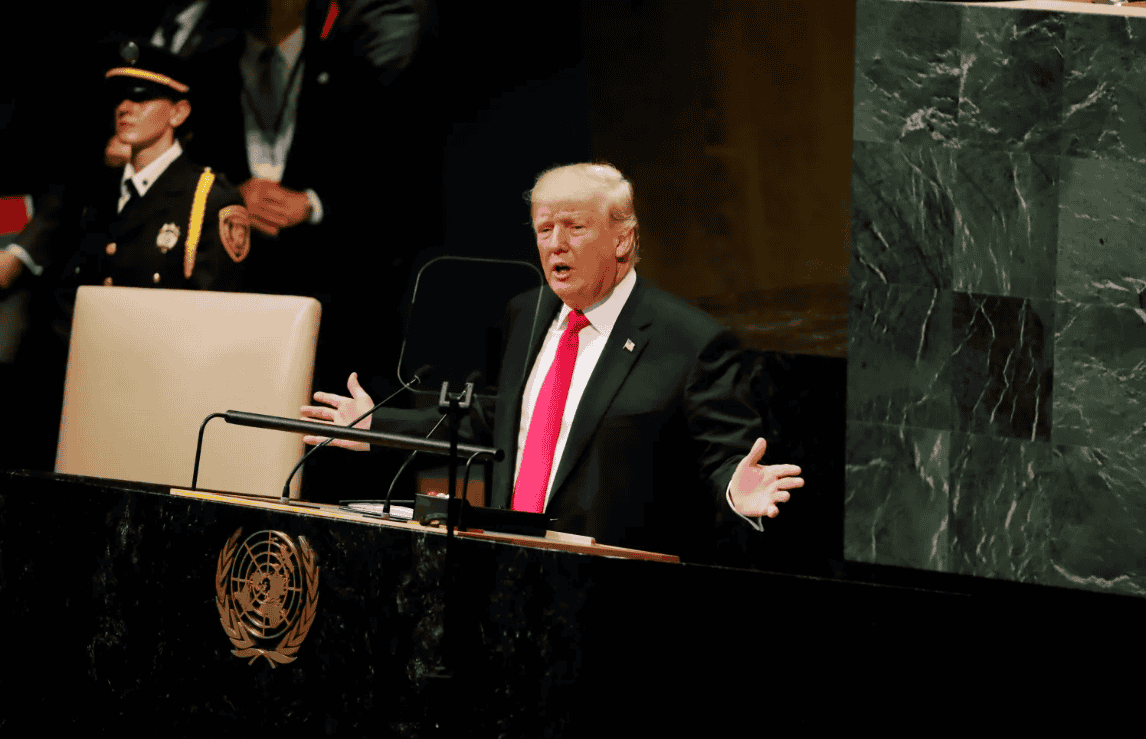

The Trump administration’s revised subsidy rules, effective 2 September, narrowed the “under construction” definition for solar and wind projects to qualify for a 30% federal tax credit, requiring substantial physical work while maintaining a

See MoreVenezuela prolongs state of economic emergency amid US tariff concerns

The state of emergency is set to remain in effect for 60 days, with the option to extend it for an additional 60 days. Venezuela published Executive Decree No. 5.157 in the Official Gazette on 8 August 2025, declaring a state of national

See MoreUS imposes 15% tariff on goods from Trinidad and Tobago

The US has imposed a 15% tariff on Trinidad and Tobago’s key exports like ammonia and methanol, but exempts tariffs on crude oil and natural gas. The US has implemented a 15% reciprocal tariff on imports from Trinidad and Tobago on 7 August

See MoreUS suspends de minimis duty exemption on low-value imports

The Trump administration has ended the duty-free treatment for imports valued at USD 800 or less, effective 29 August 2025. US President Trump signed an executive order on 30 July 2025, suspending the duty-free de minimis treatment for

See MoreUS: IRS issues guidance on safeguarding taxpayer identity with multi-factor authentication, IP PINs, and online accounts

The IRS and Security Summit urge taxpayers and tax professionals to use identity protection PINs, secure online accounts, and multi-factor authentication to safeguard against tax-related identity theft. The US Internal Revenue Service (IRS) has

See MoreChina pauses 24% tariff on US goods for 90 days, keeps 10% levy

China extends the suspension of 24% additional tariffs on US imports for 90 days, keeping 10% tariffs intact. China’s Customs Tariff Commission of the State Council announced on 14 August 2025 that it has temporarily suspended its additional

See MoreUS: IRS announces tax relief to West Virginia storm victims

Individuals and households residing in or having a business in Marion and Ohio counties qualify for tax relief. The US Internal Revenue Service (IRS) issued WV-2025-04 on 8 August 2025, announcing tax relief for individuals and businesses in

See MoreCambodia sets 0% duty on select US goods

Cambodia sets a 0% customs duty on new goods originating from and imported directly from the US. Cambodia’s government issued Sub-Decree No. 139 on 8 August 2025, establishing a 0% customs duty rate on goods originating from and imported

See MoreUS, China agree to 90-day tariff suspension

Without the extension, US tariffs on Chinese goods would have climbed to 145%, while Chinese tariffs on US goods would have reached 125% from 11 August. President Donald Trump signed an executive order on 11 August 2025, extending the tariff

See MoreSwitzerland to face 39% tariff as trade talks with the US falter

Switzerland faces 39% US tariffs on exports starting 7 August 2025. Switzerland is likely to face 39% US tariffs on its exports after the country’s President Karin Keller-Sutter failed to secure a trade deal with the US, which is set to take

See MoreUS implements tariffs on one-kilo gold bars

The US has imposed tariffs on imports of one-kilo gold bars, potentially affecting Switzerland. According to the Financial Times report on 7 August 2025, the US has imposed tariffs on imports of one-kilogram gold bars, citing a July 31 letter

See MoreUS: IRS Confirms 2025 individual filing rules and withholding tables unchanged under ‘One Big Beautiful Bill Act’

The IRS announced there will be no changes to certain information returns or withholding tables under the phased implementation of the One Big Beautiful Bill Act for the 2025 tax year. The US Internal Revenue Service (IRS) has issued

See MoreUS to levy 100% tariffs on imported semiconductors, exempts local manufacturers

President Donald Trump announced a 100% tariff on imported semiconductors, exempting companies manufacturing or planning to manufacture chips in the US. US President Donald Trump announced a 100% tariff on imported semiconductors on 6 August

See MoreKorea (Rep.): Chipmakers Samsung and SK Hynix excluded from 100% US tariffs

Chip manufacturers Samsung and SK Hynix will be exempted from 100% US tariffs due to local investments and MFN trade status. Korea ( Rep.) semiconductor giants Samsung Electronics and SK Hynix are set to avoid the 100% tariffs on chip imports

See MoreUS: Trump considers more China tariffs over Russian oil trade, cites India’s example

Trump has doubled tariffs on Indian imports to 50% over its continued Russian oil purchases and warned of further secondary sanctions, while giving China until 12 August to finalise a tariff deal. US President Donald Trump hinted on 6 August 2025

See MoreUS clarifies tax policy for digital assets

The report is the outcome of President Trump's executive order to establish a "working group" for developing a regulatory framework for digital assets. The US President’s Working Group on Digital Asset Markets has issued a report titled

See More