UAE: FTA urges corporate taxpayers to file returns, pay within the specified deadlines

UAE’s Federal Tax Authority has urged corporate tax taxpayers to finalise records, file returns, and pay tax due by the deadlines, stressing compliance, early preparation, and use of the EmaraTax platform to avoid penalties. The Federal Tax

See MoreJapan, UAE hold fourth round of CEPA negotiations

The fourth round of CEPA negotiations between Japan and the UAE from 4–8 August 2025, focused on trade, competition, and intellectual property. The Ministry of Foreign Affairs of Japan reported on 8 August 2025 that the fourth round of

See MoreUAE: FTA establishes audited special-purpose financial statements preparation rules

UAE’s Federal Tax Authority issues Decision 7/2025 requiring tax groups to prepare annual audited aggregated financial statements in line with IFRS. The Federal Tax Authority of the UAE has published Decision No. 7/2025 on 16 July 2025,

See MoreUAE: FTA publishes corporate tax payment user manual

The manual is prepared to help registered corporate taxpayers to navigate through the Federal Tax Authority EmaraTax portal and make corporate tax payments. The UAE Federal Tax Authority (FTA) has published a Taxpayer User Manual for Corporate

See MoreUAE: FTA issues updated guide on private tax clarifications

The revised guidance incorporates new provisions and clarifies procedures for submitting clarification requests, including those related to Pillar Two rules The UAE Federal Tax Authority (FTA) released an updated version of its tax procedures

See MoreRussia, UAE tax treaty enters into force

The 2025 income and capital tax treaty between Russia and the UAE took effect on 18 July 2025, which replaces the 2011 limited tax treaty. The 2025 Russia–UAE income and capital tax treaty entered into force on 18 July 2025. The new

See MoreUAE issues depreciation rules for fair valued investment properties

The Decision allows depreciation deductions for fair-valued investment properties under new corporate tax rules from 2025. The UAE Ministry of Finance has issued Ministerial Decision No. 173 of 2025, effective for tax periods beginning 1 January

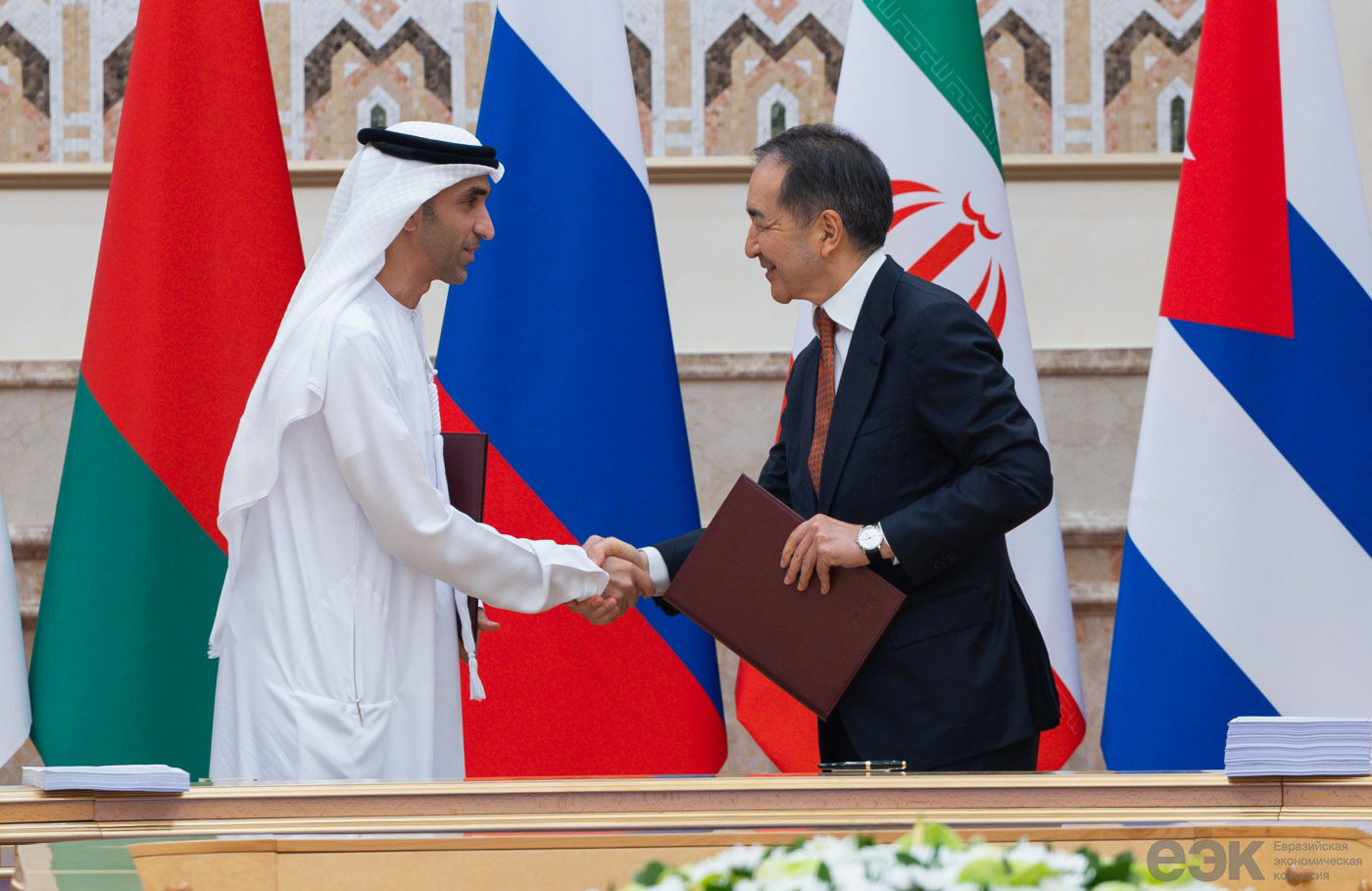

See MoreBelarus, UAE sign free trade in services and investments agreement

The agreement complements the EPA between the Eurasian Economic Union and the UAE, signed on the same day. Belarus and the UAE formalised an agreement in Minsk focusing on free trade in services and investments on 27 June 2025. This agreement

See MoreUAE clarifies VAT requirements on SWIFT charges for financial institutions

The Public Clarification outlines the VAT obligations and input tax documentation requirements for financial institutions incurring SWIFT-related interbank charges. The UAE Federal Tax Authority (FTA) issued Public Clarification VATP041 on 28

See MoreChad: Senate approves ratification of income tax treaty with UAE

Chad's upper house of Parliament (Senate) approved the law ratifying the income tax treaty with the UAE on 10 July 2025. Chad and the UAE signed their income tax treaty on 4 September 2018. It will enter into force after the exchange of

See MoreUAE: FTA offers penalty waiver for late tax registration

The FTA clarified conditions for waiving or refunding penalties for late corporate tax registration, requiring returns or declarations to be filed within seven months of the first tax period. The UAE Federal Tax Authority (FTA) has released

See MoreRussia: Federation Council ratifies new income and capital tax treaty with UAE

Russia’s Federation Council ratifies law for new income and capital tax treaty with UAE, replacing 2011 agreement. The Russian Federation Council approved the law ratifying the income and capital tax treaty with the UAE on 2 July 2025. The

See MoreChad approves ratification of income tax treaty with UAE

Chad approves ratification of its first income tax treaty with the UAE. Chad’s lower house of Parliament (National Assembly) passed legislation authorising the President to ratify the income tax treaty with the UAE on 24 June 2025. Chad and

See MoreUAE, Serbia trade deal enters into force

The UAE–Serbia CEPA entered into force on 1 June 2025, eliminating tariffs on over 95% of traded goods and expanding cooperation in services, investment, and digital trade. The Comprehensive Economic Partnership Agreement (CEPA) between the UAE

See MoreUAE issues MAP guidance on double taxation relief

The UAE Ministry of Finance has issued official guidance on the Mutual Agreement Procedure (MAP), outlining how businesses and individuals can seek relief from double taxation under the country’s international tax treaty network. The guidance was

See MoreBahrain, UAE tax treaty enters into force

The income tax treaty between Bahrain and the UAE will take full effect from 1 January 2026. Bahrain's National Bureau for Revenue announced that the income tax treaty with the UAE has entered into force starting 1 May 2025. The treaty was

See MoreRussia ratifies tax treaty with UAE

Russia ratifies UAE tax treaty to prevent double taxation and curb avoidance. The Russian State Duma ratified the agreement with the UAE on the elimination of double taxation with respect to taxes on income and capital on 24 June

See MoreUAE: FTA publishes updated corporate tax self registration manual

The updated corporate tax self-registration manual aims to simplify the registration process on the EmaraTax portal. The UAE Federal Tax Authority (FTA) released Version 3.0.0.0 of the Corporate Tax Self-Registration – Taxpayer User Manual on

See More