Romania: ANAF publishes draft VAT form to reflect updated rates

The updated VAT return form now includes sections for both old and new VAT rates, with a separate section for reporting dwellings eligible for the reduced 9% VAT rate. Romania’s National Agency for Fiscal Administration (ANAF) released a

See MoreRomania: ANAF publishes form for declaring, paying the top-up tax

The form is used for declaring and paying the top-up tax. On 11 August 2025, Romania’s tax authority (ANAF) published Form No. 408 for declaring and paying the top-up tax. Earlier, ANAF issued Order No. 1729/2025, which establishes the

See MoreRomania gazettes application norms after VAT increase

Government Decision No. 602/2025 reflects the VAT rate increase effective 1 August 2025. Romania has published Government Decision No. 602/2025 (GD No. 602/2025) in the Official Gazette No. 715 on 31 July 2025. Government Decision No.

See MoreRomania gazettes legislation to amend APA, MAP

The legislation updates rules for Advance Pricing Agreements (APAs) and Mutual Agreement Procedures (MAPs) Romania’s government published Emergency Ordinance 11/2025 (GEO 11/2025) in the Official Gazette No. 695 on 24 July 2025, to amend the

See MoreRomania increases standard and reduced VAT rates, effective starting tomorrow

Starting 1 August 2025, Romania will unify the 5% and 9% VAT rates into a single 11% rate and raise the standard VAT rate from 19% to 21%. Effective from tomorrow, 1 August 2025, Romania’s reduced VAT rates of 5% and 9% have been unified and

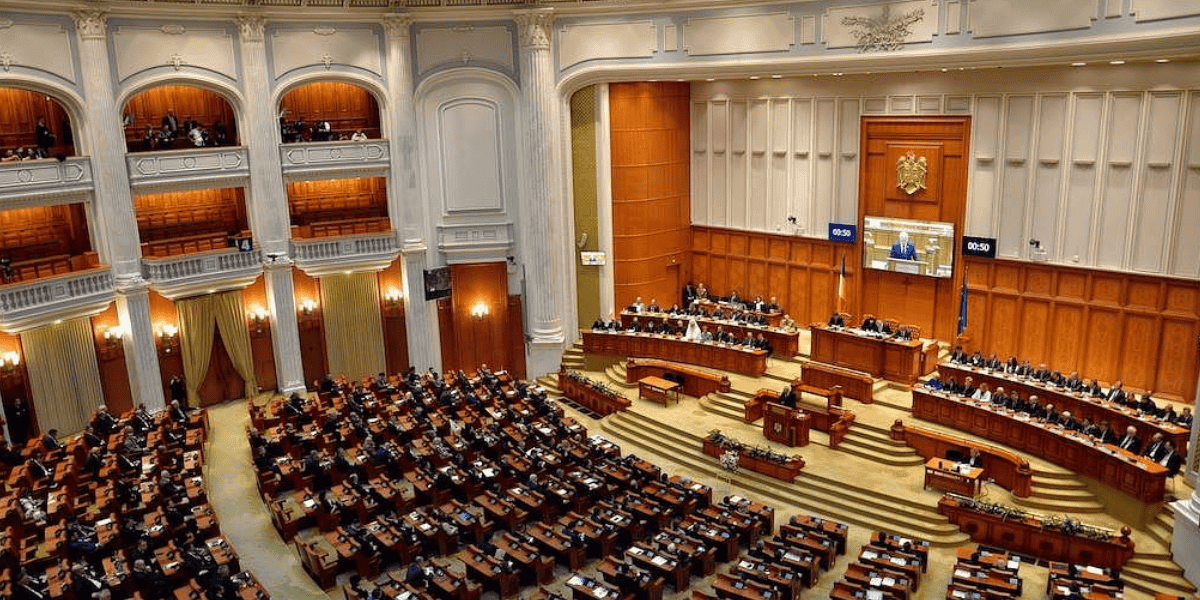

See MoreRomania: Parliament approves increases to VAT, bank levy, and dividend tax

The law introduces significant tax reforms, including increased VAT rates, a new reduced VAT rate, higher turnover tax for banks, and an increased dividend tax rate. Romania's parliament has passed the Law on certain fiscal-budget measures on 14

See MoreRomania gazettes form for top-up tax declaration, payment

This order was published in the Official Gazette No. 646 on 9 July 2025. Romania’s tax authority has issued Order No. 1729/2025, which establishes the notification form for declaring and paying the top-up tax. This order was published in the

See MoreRomania 2025–28 tax reforms include increased VAT, dividend tax

The proposed draft bill aims to simplify VAT rates from three (19%, 9%, and 5%) to two, starting 1 August 2025. Romania’s government submitted an amended draft bill to parliament on 4 July 2025, proposing changes to the VAT provisions of the

See MoreRomania issues draft form for pillar two top-up tax notification

The tax authority released a draft form for notifying and designating entities to handle domestic top-up tax under Pillar Two rules. Romania’s National Agency for Fiscal Administration (ANAF) released a draft order on 20 June 2025 outlining the

See MoreRomania announces 2025–28 tax reforms, raises dividend tax

The proposed tax reforms target increased taxes on dividends, reduced incentives, stricter expense deductions, and simplified VAT rates. Romania published its decision approving the 2025-2028 Government Programme in the Official Gazette on 23

See MoreRomania announces plan to streamline VAT to two rates

Romania’s parliament has approved the new government and its Government Plan, published in Official Gazette No. 580 on 23 June 2025. The plan proposes VAT system changes, including removing VAT incentives on real estate transactions and reducing

See MoreRomania: Government approves tax treaty with UK

The Romanian government has approved the 2024 Romania–United Kingdom income tax treaty on 16 April 2025. The agreement will come into force once the ratification instruments have been exchanged. Upon becoming effective, it will supersede the

See MoreRomania: Government approves tax treaty with Andorra

Romania’s government approved the ratification of the income and capital tax treaty with Andorra on 16 April 2025. Signed on 27 September 2024, it is the first treaty between the two countries, and aims to prevent double taxation and combat

See MoreRomania consults on draft legislation to ratify Pillar Two STTR instrument

Romania’s government has initiated a public consultation on a draft law to ratify the Multilateral Convention to Facilitate the Implementation of the Pillar Two Subject to Tax Rule (STTR MLI). In September 2023, the OECD/G20 Inclusive Framework

See MoreRomania brings amendments to construction tax

Romania introduced and enacted Government Emergency Ordinance no. 21/2025 (GEO 21/2025) on 4 April 2025, which amends the construction tax (pillar tax). The provisions of the ordinance take effect upon publication and will be applicable beginning

See MoreRomania publishes guidance on VAT registration and RO e-invoice

Romania’s tax authority published a playbook on VAT registration and RO e-invoice requirements for public authorities on 7 March 2025. The playbook includes legal provisions regarding VAT registration of public institutions and RO e-invoice

See MoreAndorra gazettes tax treaty with Romania

Andorra has gazetted the law ratifying the Andorra - Romania Income and Capital Tax Treaty (2024) in Official Bulletin No. 22 on 19 February 2025. Earlier, Romania and Andorra signed an income tax treaty on 27 September 2024. This is the first

See MoreRomania announces new tax on special constructions

Romania has made additional amendments to the Tax Code (Law no. 227/2015) reinstating the tax on special constructions, under Emergency Ordinance no. 156 of 30 December 2024. A new amendment is reintroducing a 1% tax on non-building constructions

See More