Malaysia grants tax exemptions on payments to/from Labuan firms

Malaysia has released the Income Tax (Exemption) Order 2025 in its Official Gazette on 13 February 2025. This order grants tax exemptions on specific payments made to or received from Labuan companies. A Labuan company is incorporated under the

See MoreMalaysia clarifies ruling on tax incentives for BioNexus firms

The Inland Revenue Board of Malaysia (IRBM) has amended the Public Ruling (PR) to clarify the tax incentives available to an investor who has invested in a BioNexus status company (BSC) in Malaysia. The key updates outlined in Public Ruling No.

See MoreMalaysia Gazettes Finance Act, Labuan Business Activity Tax (Amendment) (No. 2) Act 2024

Malaysia published the Finance Act 2024 (Act No. 862) and Labuan Business Activity Tax (Amendment) (No. 2) Act 2024 in the Official Gazette on 31 December 2024. Measures include amendments to income tax, global minimum tax, real property gains tax,

See MoreMalaysia announces tax breaks for Special Economic Zone with Singapore

Malaysia announced several tax incentives to attract investments to the joint special economic zone with Singapore today, 8 January 2025. Jointly announced by the Johor state government and Malaysia’s Ministry of Finance, the incentives

See MoreMalaysia updates transfer pricing guidelines, audit framework

Malaysia’s Inland Revenue Board (IRB) has updated transfer pricing guidelines and transfer pricing audit framework. The transfer pricing guidelines have been updated in accordance with the amendments made to section 140A, the introduction of

See MoreMalaysia publishes guidance on Pillar Two global minimum tax, updates FAQs

The Inland Revenue Board of Malaysia has updated its guidance on the Pillar Two Global Minimum Tax (GMT) regarding its administration and interpretation, which goes into force on 1 January 2025. The updates include newly released Guidelines on

See MoreMalaysia: House of Representatives pass Finance Bill 2024

Malaysia’s House of Representatives (Dewan Rakyat) have passed the Finance Bill 2024, Labuan Business Activity Tax (Amendment) (No.2) Bill 2024, and Measures for the Collection, Administration, and Enforcement of Tax Bill 2024 (the Bills) after

See MorePhilippines plans to revise tax treaties with Indonesia, Malaysia, Singapore

The Philippines government is reportedly planning to enter into negotiations to revise the 1981 tax treaty with Indonesia, the 1982 tax treaty with Malaysia, and the 1977 tax treaty with Singapore. The agreement between the Philippines and

See MoreMalaysia updates global minimum tax, Labuan self-assessment rules in Finance Bill 2024

Malaysia’s Deputy Minister of Finance has presented the Finance Bill 2024 and the Labuan Business Activity Tax (Amendment)(No. 2) Bill 2024 to the Parliament, on 19 November 2024, proposing amendments to the Income Tax Act 1967 (ITA), Real

See MoreMalaysia updates service tax rules, includes new taxable services and expands group relief

The Royal Malaysian Customs Department has released the Service Tax (Amendment) (No. 2) Regulations 2024 which broadens intra-group relief to include maintenance and repair services while also revising the range of taxable services. Amendments to

See MoreMalaysia updates green tech tax incentives for businesses, solar leasing

The Malaysian government is taking a strong stance on renewable energy targets, increasing the share of renewable energy in the electricity generation capacity mix to 70% by 2050; in line with Malaysia’s aspiration to be an inclusive, sustainable,

See MoreRussia ratifies income tax treaty with Abkhazia, Malaysia

The President of Russia signed the Law No. 372-FZ for the ratification of the income tax treaties with Abkhazia and Malaysia on 2 November 2024. Earlier, the Russian government approved draft laws for the ratification of pending income tax

See MoreMalaysia implements new rules for higher capital allowance for ICT equipment, software

Malaysia Ministry of Finance published two regulations in the Official Gazette on 30 October 2024 – the Income Tax (Accelerated Capital Allowance) (Information and Communication Technology Equipment) Rules 2024 and the Income Tax (Capital

See MoreRussia: Lower house of parliament approves ratification of tax treaty with Malaysia

The Russian State Duma (lower house of parliament) approved the draft law for the ratification of the income tax treaty with Malaysia on 22 October 2024. Earlier, the two nations signed a new income tax treaty on 17 May 2024. This agreement

See MoreMalaysia: 2025 budget unveils dividend tax, new tax incentives, sales and service tax changes

Malaysia announced its 2025 Budget on 18 October 2024 with various tax measures. Dividend tax Starting from the year of assessment 2025, a 2% dividend tax will be applied to the annual chargeable dividend income of individuals exceeding MYR

See MoreMalaysia revises e-invoicing rules, implementation dates

The Inland Revenue Board of Malaysia (IRBM) released updated guidelines on the new electronic invoicing (e-invoicing) requirements on 4 October 2024. These include the new e-Invoice Guideline (Version 4.0) and e-Invoice Specific Guideline (Version

See MoreMalaysia exempts capital gains tax on share disposal for restructuring, IPOs

Malaysia’s Ministry of Finance (MoF) announced gazette orders exempting capital gains tax (CGT) on the capital gains or profits from the sales of shares during company restructuring and initial public offering (IPO) restructuring

See MoreMalaysia likely to introduce subsidy cuts, new taxes in 2025 budget

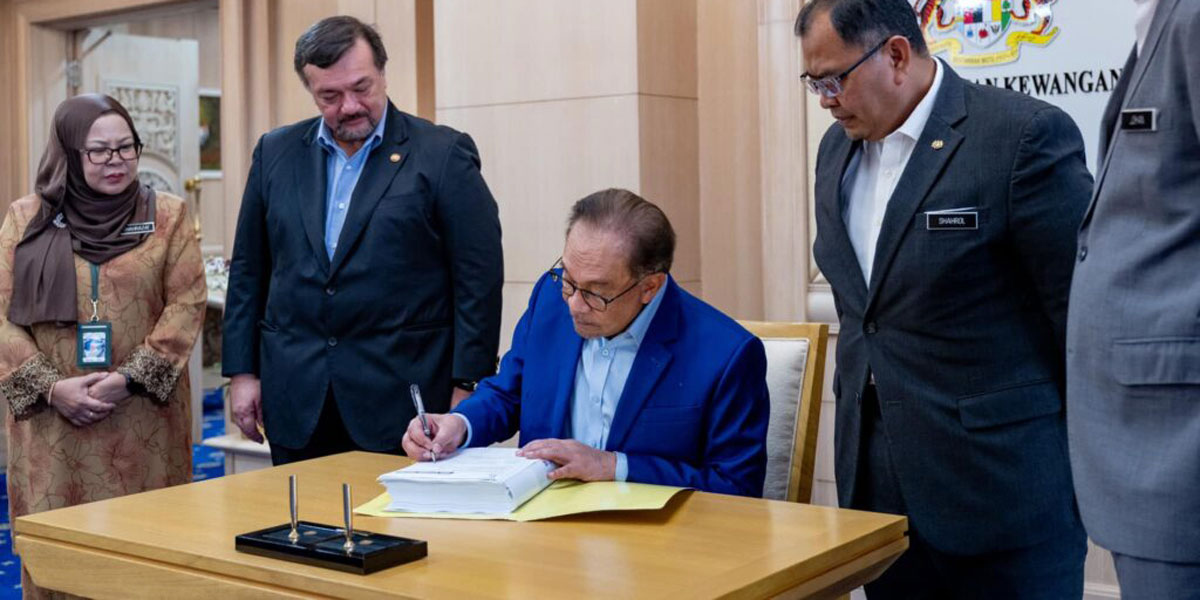

Malaysia’s Prime Minister Anwar Ibrahim will announce the 2025 budget in parliament on Friday, 18 October 2024. Analysts and economists suggest the government is likely to implement additional new taxes and reduce subsidies for its 2025 budget,

See More