Kyrgyzstan, Japan agree in principle on new income tax treaty

Kyrgyzstan and Japan agreed in principle on a new income tax treaty to prevent double taxation and boost cooperation. Kyrgyzstan and Japan have reached an agreement in principle on a new income tax treaty following talks in Bishkek from 6 to 9

See MoreKyrgyzstan implements tax arrears relief, revives patent tax, updates simplified tax rules

A newly enacted law implements tax debt write-offs, abolition of transport tax, new benefits and exemptions, changes to the simplified single tax regime, revised sales tax rates, and restrictions on deductions to curb tax evasion. The

See MoreKyrgyzstan establishes 49-year tax-exempt special financial and investment zone

The territory aims to attract investment by offering income tax exemption to residents and permitting activities such as asset management, fintech, banking, Islamic finance, insurance, tourism, and other commercial ventures. Kyrgyzstan's

See MoreEurasian Economic Union (EAEU), Mongolia sign temporary FTA

The FTA will be valid for three years, with a mutual option to extend for another three years. The Eurasian Economic Union (EAEU), comprising Armenia, Belarus, Kazakhstan, Kyrgyzstan, and Russia, signed a temporary free trade agreement (FTA)

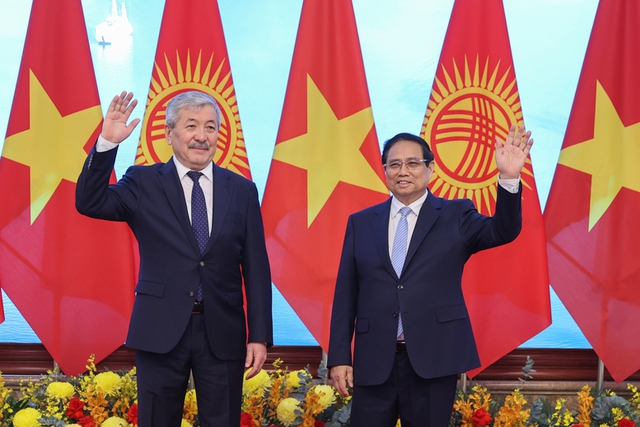

See MoreKyrgyzstan, Vietnam agree to accelerate tax treaty talks

Kyrgyzstan and Vietnam agreed to expedite the finalisation of a tax treaty. Kyrgyzstan and Vietnam committed to expediting the finalisation of a tax treaty during a meeting on the sidelines of the annual World Economic Forum "Summer Davos" in

See MoreItaly, Kyrgyzstan sign investment protection agreement

Italy and Kyrgyzstan signed an investment protection agreement (IPA) on 30 May 2025. Italy and Kyrgyzstan signed an investment protection agreement (IPA) on 30 May 2025. The IPA between Italy and Kyrgyzstan aims to promote and protect

See MoreKyrgyzstan ratifies amending protocol to tax treaty with Korea (Rep.)

Kyrgyzstan ratified the protocol on 22 May 2025 Sadyr Japarov, Kyrgyzstan’s President, signed the law for the ratification of the amending protocol to the 2012 income and capital tax treaty with Korea (Rep of.) on 22 May 2025. It will take

See MoreKyrgyzstan: Parliament approves amending protocol to the tax treaty with Korea (Rep.)

The parliament of Kyrgyzstan approved the law for the ratification of the amending protocol to the 2012 income and capital tax treaty with Korea (Rep.) on 23 April 2025. Earlier, the National Assembly of Korea (Rep.) approved the ratification of

See MoreKyrgyzstan, Vietnam agree to tax treaty negotiations

Kyrgyzstan and Vietnam have agreed to sign a tax treaty and an investment protection agreement (IPA) during the official visit of the Chairman of the Kyrgyz Cabinet of Ministers to Vietnam from 6 to 7 March 2025. This announcement was made by the

See MoreKorea (Rep.): National Assembly approves ratification of tax treaty protocol with Kyrgyzstan

The National Assembly of South Korea (Rep.) has approved the ratification of the protocol to the 2012 income and capital tax treaty with Kyrgyzstan on 13 March 2025. The treaty was signed on 3 December 2024. The protocol will come into effect

See MoreKyrgyzstan approves tax treaty with Cyprus

Kyrgyzstan's Cabinet of Ministers has approved an income tax treaty with Cyprus on 28 January 2025 following negotiations that concluded in April 2024. The treaty aims to eliminate double taxation on income while preventing tax evasion and

See MoreKyrgyz, Ethiopia Finance Ministers meet to strengthen trade relations

A meeting took place in Addis Ababa between the First Deputy Minister of Foreign Affairs of the Kyrgyz Republic, Asein Isaev, and the Minister of Finance of Ethiopia, Ahmed Shide. Asein Isaev provided detailed information on the country's

See MoreAzerbaijan, Kyrgyzstan tax treaty enters into force

The income tax treaty between Azerbaijan and Kyrgyzstan came into force on 8 January 2025. Signed on 24 April 2024, this agreement is the first tax treaty established between the two nations. As per the agreement, withholding taxes are applicable

See MoreSlovak Republic, Kyrgyzstan income tax treaty enters into force

The income tax treaty between Kyrgyzstan and the Slovak Republic is set to take effect on 1 March 2025. This agreement seeks to prevent double taxation and tax evasion. Withholding taxes are applied at rates of 5% on dividends, 10% on interest,

See MoreHong Kong, Kyrgyzstan conclude tax treaty talks

Kyrgyzstan's Ministry of Economy and Commerce announced that it has concluded negotiations for an income tax treaty with Hong Kong on 17 January 2025. The treaty aims to eliminate double taxation of income and prevent tax evasion between the two

See MoreNetherlands: Tax treaties with Moldova, Kyrgyzstan, and Andorra enter into force

The amended protocol to the 2000 Netherlands-Moldova Income and Capital Tax Treaty, signed on 4 September 2023, will officially enter into force on 31 December 2024. This is the first amendment to the tax treaty and its provisions will take effect

See MoreKyrgyzstan, Korea(Rep.) sign multiple agreements to strengthen bilateral cooperation

An amending protocol to the 2012 income and capital tax treaty between Kyrgyzstan and Korea (Rep.) was signed on 3 December 2024. The announcement was made in a release from the President of Kyrgyzstan. Earlier, Kyrgyzstan’s Cabinet of

See MoreKyrgyzstan approves amending protocol to 2012 tax treaty with Korea(Rep.)

Kyrgyzstan's Cabinet of Ministers has authorised the Minister of Economy and Commerce to sign an amendment protocol to the 2012 income and capital tax treaty with Korea (Rep.) on 19 November 2024. This protocol represents the first amendment to

See More