Kenya: KRA announces new market rates for fringe benefit tax, non-resident loans for 2026

Kenya’s revenue authority (KRA) released a public notice on 22 January 2026 regarding updates to the market interest rate for fringe benefit tax and the deemed interest rate on specific non-resident loans. The rates remain unchanged from the

See MoreKenya: Tax tribunal rules pre-2025 losses unaffected by new carryforward limit

Kenya’s Tax Appeals Tribunal delivered its decision in Patel v Commissioner for Legal Services & Board Co-ordination Services on 28 November 2025, which addresses how the loss carryforward restriction introduced under the Finance Act 2025

See MoreKenya: KRA releases list of jurisdictions for common reporting standards

The Kenya Revenue Authority (KRA) advised in a public notice on 19 December 2025 that under Regulation 2 of the Tax Procedures (Common Reporting Standards) Regulations, 2023, and the Commissioner’s powers under the Tax Procedures Act, Cap 469B,

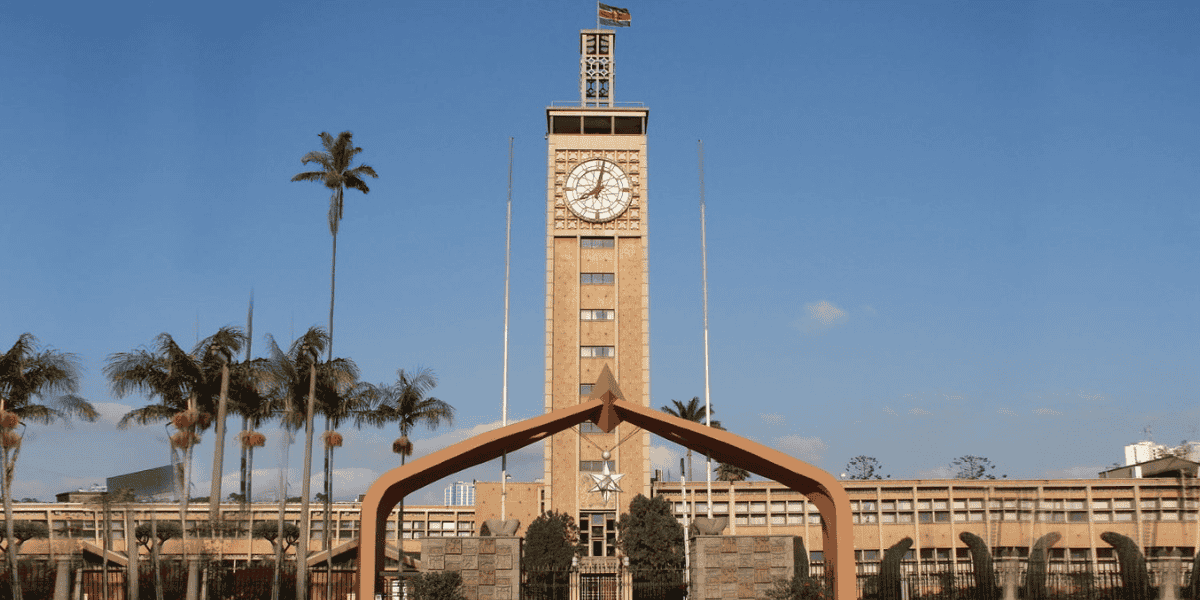

See MoreKenya: National Assembly ratifies income tax treaty with Singapore

Kenya’s National Assembly approved the ratification of a new income tax treaty with Singapore on 3 December 2025. This agreement, signed on 23 September 2024, replaces the 2018 treaty, which never came into effect. The tax treaty aims to

See MoreKenya: KRA issues reminder on implementation of electronic tax invoicing for fuel stations

The Kenya Revenue Authority (KRA) issued a public notice on 25 November 2025, reminding all petroleum product retailers of their obligation to implement the eTIMS Fuel Station System across their retail outlets. The compliance deadline for

See MoreKenya: KEBS imposes standards levy on manufacturers

The Kenya Bureau of Standards (KEBS) issued a notice to manufacturers on 4 November 2025 regarding the implementation of the Standards (Standards Levy) Order 2025, dated 8 August 2025. Under the Order, all manufacturers are required to pay a

See MoreKenya: KRA to cross-check tax returns against official data sources

The Kenya Revenue Authority announced on 11 November 2025 that, beginning 1 January 2026, it will start cross-checking income and expenses reported in both individual and non-individual tax returns against specific data sources. Validation of

See MoreKenya: KRA launches automated payment plan for tax liabilities

The Kenya Revenue Authority has released a public notice announcing the rollout of automated payment plans for outstanding tax liabilities on 10 November 2025. Roll-out of Automated Payment Plan for Tax Liabilities The Kenya Revenue Authority

See MoreKenya: KRA consults on draft income tax regulations for advance pricing agreement, minimum top-up tax for 2025

The Kenya Revenue Authority (KRA) released two draft regulations for public consultation, covering its global minimum tax regime and advance pricing agreement procedures for 2025, on 3 November 2025. In compliance with the Statutory Instruments

See MoreKenya: KRA announces tax compliance certificate (TCC) enhancements

To obtain a TCC, taxpayers must be registered in eTIMS/TIMS, file and pay all taxes on time, settle outstanding liabilities or have an approved payment plan, and maintain VAT compliance. The Kenya Revenue Authority (KRA) issued a public notice on

See MoreKenya: KRA announces fringe benefit, deemed interest rates for Q4 2025

The Kenya Revenue Authority has announced the applicable market and deemed interest rates for the final quarter of 2025, outlining the corresponding withholding tax obligations for employers under the Income Tax Act. The Kenya Revenue Authority

See MoreBelgium, Kenya sign income tax treaty

Representatives from Kenya and Belgium have signed a tax treaty aimed at eliminating double taxation and preventing tax evasion for individuals and businesses operating between the two countries. The agreement was signed on Tuesday, 30 September

See MoreKenya: Central Bank lowers key policy rate to 9.25%

The benchmark lending rate has been lowered from 9.50% to 9.25%. Kenya's central bank, Central Bank of Kenya (CBK), has reduced the Central Bank Rate (CBR) for the eighth consecutive time by 25 basis points to 9.25% from 9.50% on 7 October

See MoreKenya: KRA consults significant economic presence (SEP) tax implementation

The consultation is set to conclude on 7 October 2025. The Kenya Revenue Authority (KRA) has initiated a public consultation on the released Draft Income Tax (Significant Economic Presence Tax) Regulations 2025, on 22 September 2025. These

See MoreKenya pursues US trade agreement, requests five-year extension to Africa pact

Kenyan President William Ruto aims to finalise a landmark trade deal with the US by the end of 2025, seeking a five-year AGOA extension to boost exports like tea, coffee, and textiles, while exploring new export sectors. Kenyan President

See MoreCzech Republic, Kenya sign income tax treaty

This is the first-ever income tax treaty between the two countries. The Czech Republic and Kenya signed an income tax treaty on 23 September 2025. The agreement aims to eliminate double taxation of income and prevent tax evasion between the

See MoreKenya: KRA imposes new cap on carryforward of prior losses

The ruling limits loss carryforwards, applying to losses from 1 July 2025 onward and retrospectively disallowing deductions for losses before the 2020 income year. The Kenya Revenue Authority (KRA) issued a private ruling on 1 September 2025

See MoreKenya: KRA announces collection of sugar development levy

The collection of the sugar development levy went into effect on 1 July 2025. The Kenya Revenue Authority (KRA) announced on 31 July 2025 the commencement of sugar development levy collection, effective 1 July 2025. The KRA informed millers

See More