Oman ratifies income tax treaty with Iraq

Oman issued the Royal Decree No. 105/2025 on 14 December 2025 ratifying the income tax treaty with Iraq. Iraq and Oman signed the income and capital tax treaty on 3 September 2025. The agreement aims to eliminate double taxation and prevent

See MoreIraq, Oman sign tax treaty

Iraq and Oman sign income and capital tax treaty Iraq and Oman signed the income and capital tax treaty on 3 September 2025. The agreement aims to eliminate double taxation and preventing evasion. It will take effect once the ratification

See MoreCzech Republic, Iraq to negotiate for tax treaty

The first round of negotiations will be held from 21 - 24 July 2025. Officials from the Czech Republic and Iraq will hold the first round of negotiations for a new income tax treaty from 21 - 24 July 2025. The treaty aims to prevent double

See MoreIraq, Switzerland sign income tax treaty

The Iraqi Ministry of Finance announced that Iraq had signed an income tax treaty with Switzerland on Thursday, 26 February 2025 . The agreement aims to prevent double taxation and enhance economic cooperation between the two countries. This

See MoreIraq, Oman finalise tax treaty negotiations

Iraq and Oman finalised negotiations by initialling an income tax treaty on 21 February 2025. Earlier, the Iraq Council of Ministers has approved the negotiation of an income tax treaty with Oman on 28 January 2025. A tax treaty, also known as

See MoreCzech Republic, Iraq finalise income tax treaty

Iraq’s new agency announced in a release that officials from the Czech Republic and Iraq met on 13 February 2025 to discuss bilateral cooperation, including plans to finalise an income tax treaty. The tax treaty aims to eliminate double

See MoreIraq approves negotiation of first income tax treaty with Oman

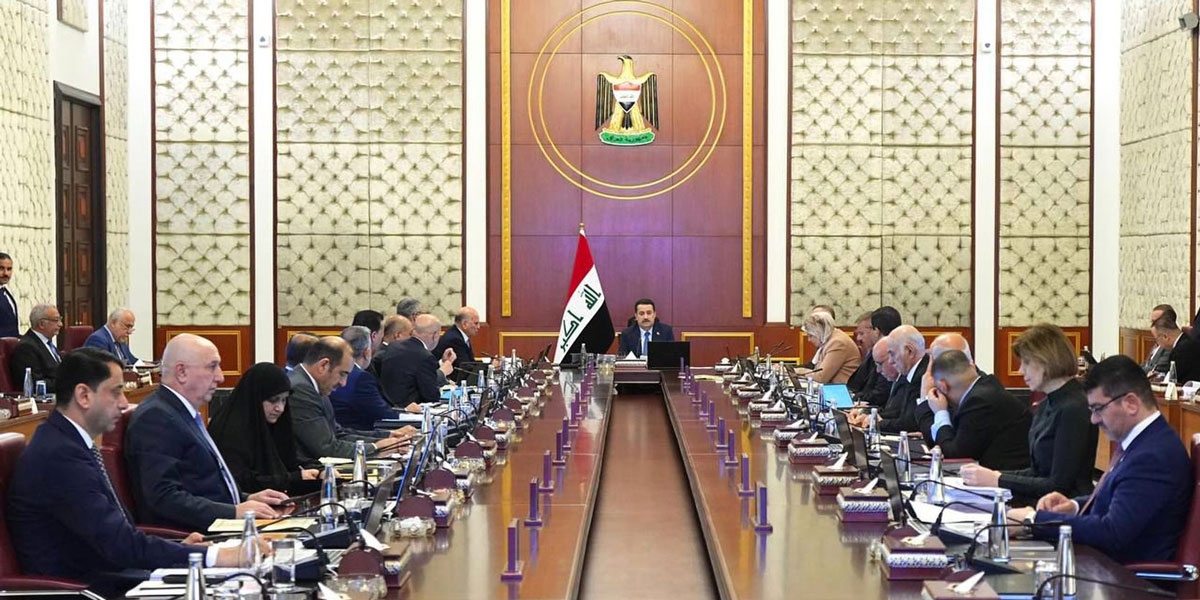

The Iraq Council of Ministers has approved the negotiation of an income tax treaty with Oman on 28 January 2025. A tax treaty, also known as a double tax agreement (DTA) or double tax avoidance agreement (DTAA), is an agreement between two

See MoreIraq: Council of Ministers terminate tax treaty negotiations with Croatia

Iraq’s Council of Ministers revoked its authorisation for tax treaty negotiations with Croatia on 1 October 2024. This decision nullifies earlier approvals granted under Decision No. 103 of 2023 and No. 23396 of 2023, which allowed the drafting

See MoreUS: Treasury releases list of boycott countries

The US Treasury published a notice in the Federal Register regarding the current list of countries that may necessitate participation in or cooperation with an international boycott on 1 October 2024. The countries identified include Iraq,

See MoreIraq to negotiate income and capital tax treaty with Bulgaria

The Iraqi Council of Ministers approved the negotiation and signing of an income and capital tax treaty with Bulgaria on 1 October 2024. The council has authorised the Director General of the General Commission for Taxes to initiate discussions

See MoreKuwait ratifies tax treaty with Iraq, amending treaty protocol with South Africa and Switzerland

Kuwait ratified income tax treaty with Iraq and amending protocol to the treaty with South Africa and Switzerland on 18 September 2024, published in Official Gazette No. 1705 on 22 September 2024. The income and capital tax treaty with Iraq was

See MoreKuwait ratifies tax treaty with Iraq

Kuwait ratified the income and capital tax treaty with Iraq on 18 September 2024. The agreement aims to eliminate double taxation, curb tax evasion, and strengthen economic ties between the two nations. Article 1 of the agreement specifies that

See MoreIraqi Cabinet approves DTA between Iraq and Saudi Arabia

On 6 August 2019, the Iraqi Cabinet approved the draft Double Taxation Agreement (DTA) with the Kingdom of Saudi Arabia. The agreement was signed on 17 April

See MoreGovernment of Iraq issued 2018 Federal Budget

The Iraqi Parliament passed its 2018 Budget Act (the Budget) on 3 March 2018. The Budget includes several measures to support economic growth and fiscal stability as Iraq recovers after the 2017 military defeat of the Islamic State of Iraq and Syria

See MoreUAE: DTA signs with Iraq

The Double Taxation Agreement (DTA) between Iraq and the United Arab Emirates was signed on October 3, 2017, for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on

See MoreDTA between Iraq and South Korea signed

On 23 August 2017, the Council of Ministers of Iraq has authorized to sign a revised Double Taxation Agreement (DTA) with South

See MoreIraq: Income Tax Treaties with Hungary, Sri Lanka, and Turkey

Draft income tax treaties with Hungary, Sri Lanka and Turkey have been approved by the Iraqi cabinet. The treaties will enter into force after they have been signed and ratified by the contracting

See MoreTurkey-Iraq Income and Capital Tax Treaty has authorized and signed by Iraq

The Iraqi Council of Ministers has certified the Finance Ministry to negotiate and sign an Income and Capital Tax Treaty with Turkey on 13th November 2014. Details information regarding this treaty will be reported

See More