Indonesia: DJP establishes specific criteria for identifying domestic, foreign tax subjects

Indonesia's Directorate General of Taxation (DJP) issued Regulation PER-23/PJ/2025, which was enacted on 9 December 2025, establishing the specific criteria for identifying domestic and foreign tax subjects. It defines domestic subjects as

See MoreUS: Department of Commerce to rule on solar import duties from India, Indonesia, Laos

The US Department of Commerce is expected to announce a preliminary ruling on 23 February 2026 on whether it will impose anti-subsidy duties on solar cells and panels from India, Laos, and Indonesia. This follows after a coalition of US solar

See MoreIndonesia secures 19% tariff deal with US

Indonesia and the US have finalised a trade agreement on 19 February 2026 that reduces US tariffs on Indonesian goods from 32% to 19%, with key exemptions secured for Indonesia's major exports. The deal was signed in Washington by Indonesia's

See MoreIndonesia updates CRS jurisdiction lists for 2026

Indonesia's Directorate General of Taxes has issued Announcement No. 1/PJ/2026 on 20 January 2026, detailing the participating and reportable jurisdictions for the 2026 automatic exchange of financial account information under the Common Reporting

See MoreIndonesia revises rules governing tax treaty application

The Indonesian Ministry of Finance issued Regulation No. 112 of 2025 (PMK-112/2025) on 30 December 2025, introducing a comprehensive update to the framework governing the application of tax treaties in line with international standards. The

See MoreIndonesia deposits MLI entry-into-force notification for tax treaty with Mongolia

According to an update from the OECD, Indonesia deposited, on 12 January 2026, an updated notification confirming the completion of its internal procedures for the entry into effect of the Multilateral Convention to Implement Tax Treaty Related

See MoreIndonesia deposits MLI entry-into-force notification for tax treaty with Czech Republic

According to an update from the OECD, Indonesia deposited, on 12 January 2026, an updated notification confirming the completion of its internal procedures for the entry into effect of the Multilateral Convention to Implement Tax Treaty Related

See MoreRussia, Indonesia sign free trade agreement

On 21 December 2025, during a meeting of the Supreme Eurasian Economic Council in Saint Petersburg, representatives from Russia and Indonesia signed a Free Trade Agreement (FTA). This announcement was made on 21 December 2025. The FTA provides

See MoreIndonesia: Central bank maintains key interest rate

Bank Indonesia will continue monitoring the transmission effectiveness of accommodative monetary policy, economic growth, and inflation, as well as rupiah exchange rate stability, to consider further room for BI-Rate reductions. Indonesia’s

See MoreIndonesia, EU conclude free trade agreement to counter US tariffs

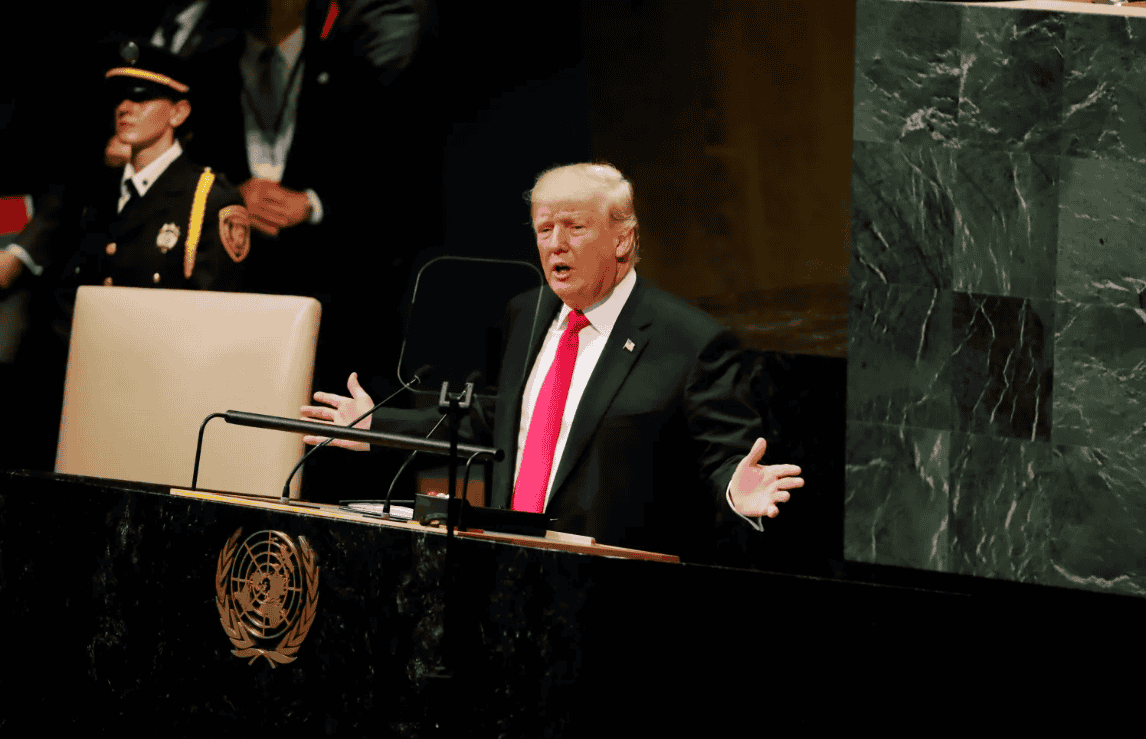

Nearly ten years of negotiations between the EU and Indonesia were accelerated by the threat of former US President Donald Trump’s aggressive tariff measures, resulting in a free trade deal that will eliminate most tariffs between the two

See MoreIndonesia: Central bank again cuts interest rate to 4.75%

Bank Indonesia (BI) previously cut its benchmark interest rate by 25 basis points to 5.00% on 20 August 2025. Indonesia's central bank, Bank Indonesia (BI), has announced its sixth interest rate cut since starting its easing cycle in September

See MoreIndonesia: Central Bank cuts interest rate to 5.00%

This marks the fifth rate cut since September 2022, bringing rates down by a total of 125 basis points to their lowest level since late 2022. Indonesia’s central bank, Bank Indonesia (BI), announced it has cut its benchmark interest rate by 25

See MoreIndonesia introduces no new taxes for 2026 budget, plans to generate additional revenue from internal reforms

The 2026 budget will not introduce any new taxes; instead, additional revenue will come from internal tax reforms. Indonesia’s President Prabowo Subianto has proposed a USD 234 billion budget for 2026 on 15 August 2025, marking a 7.3% increase

See MoreIndonesia, Peru sign FTA

The FTA aims to strengthen cooperation on combating narcotics, illegal trade, and collaboration across food, mining, energy transition, fisheries, and defence sectors between Indonesia and Peru. Indonesia and Peru signed a free trade agreement

See MoreIndonesia to increase tax rates on cryptocurrency transactions

Indonesia will increase taxes on crypto trades and remove VAT for buyers starting August 2025. Indonesia will increase taxes on cryptocurrency transactions starting 1 August 2025 under new regulations issued by the Ministry of Finance. The move

See MoreIndonesia to reduce tariffs, ease trade barriers in US trade deal

Indonesia and the US have reached a trade agreement that eliminates tariffs on over 99% of US goods and reduces non-tariff barriers. In return, the US lowered tariffs on Indonesian products to 19%, alongside significant purchases of US jets, energy,

See MoreIndonesia: Chief Economic Minister says 19% US tariff may take effect before 1 August

Trump imposed a 19% tariff on Indonesian goods as part of a new trade agreement, effective 1 August Indonesia's Chief Economic Minister, Airlangga Hartarto, announced on 21 July 2025 that the 19% tariff on Indonesian goods entering the US could

See MoreUS: Trump imposes 19% tariff on Indonesia after trade talks

The trade agreement imposes stricter penalties for transhipment and Indonesia’s commitment to purchasing 50 Boeing jets and USD 19.5 billion in US energy and agricultural products. US President Donald Trump announced a 19% tariff on Indonesian

See More