India: NITI Aayog proposes tax clarity for foreign investors

The working paper recommends that the Ministry of Finance consider the proposed framework for inclusion in future Finance Bills, following consultations with industry, experts, and treaty partners. NITI Aayog’s tax policy group in India has

See MoreIndia, Uzbekistan IPA enters into force

The agreement encourages investment, ensures protection and transparency, provides mechanisms for resolving disputes, and supports a strong investment climate to strengthen economic ties between the two countries. The India–Uzbekistan

See MoreBrazil, India tax treaty protocol enters into force

This protocol to the tax treaty will enter into force on 18 October 2025. The amending protocol to the tax treaty between Brazil and India (1988), as amended by the 2013 protocol, will enter into force on 18 October 2025. This protocol,

See MoreIndia: CBDT further extends income tax returns (ITRs) deadline for AY 2025–26

The filing deadline has been further extended by one day. India’s Central Board of Direct Taxes (CBDT) has announced another extension for filing Income Tax Returns (ITRs) for the Assessment Year 2025-26. Initially, the deadline was set

See MoreBrazil: National Congress ratifies tax treaty protocol with India

This protocol is the second modification to the 1988 Brazil-India tax treaty. Brazil’s National Congress has ratified the amending protocol to its 1988 tax treaty with India through Legislative Decree No. 200, which was issued on 11 September

See MoreBrazil: Senate approves tax treaty protocol with India

This protocol is the second modification to the 1988 Brazil-India tax treaty. Brazil’s Senate (the Upper House of the National Congress) gave its approval to ratify a protocol amending the 1988 tax treaty with India on 10 September

See MoreIndia cuts GST on solar, wind equipment

The GST on solar and wind equipment has been lowered to 5%, reducing project costs. India’s government reduced the GST on solar photovoltaic modules and wind turbine generators from 12% to 5%, effective 3 September 2025. The move is part of

See MoreIndia announces ‘next-generation GST’

The aim is to simplify India’s indirect tax framework, improve ease of doing business, and make goods and services more affordable for citizens across all sectors. The new rates are set to come into effect on 22 September 2025. The Press

See MoreIndia to cut GST on consumer goods and hybrid cars

India plans to cut GST on 175 products, including consumer goods, small cars, and export items, to boost domestic consumption and support manufacturers. India plans to reduce the goods and services tax (GST) on about 175 products, including

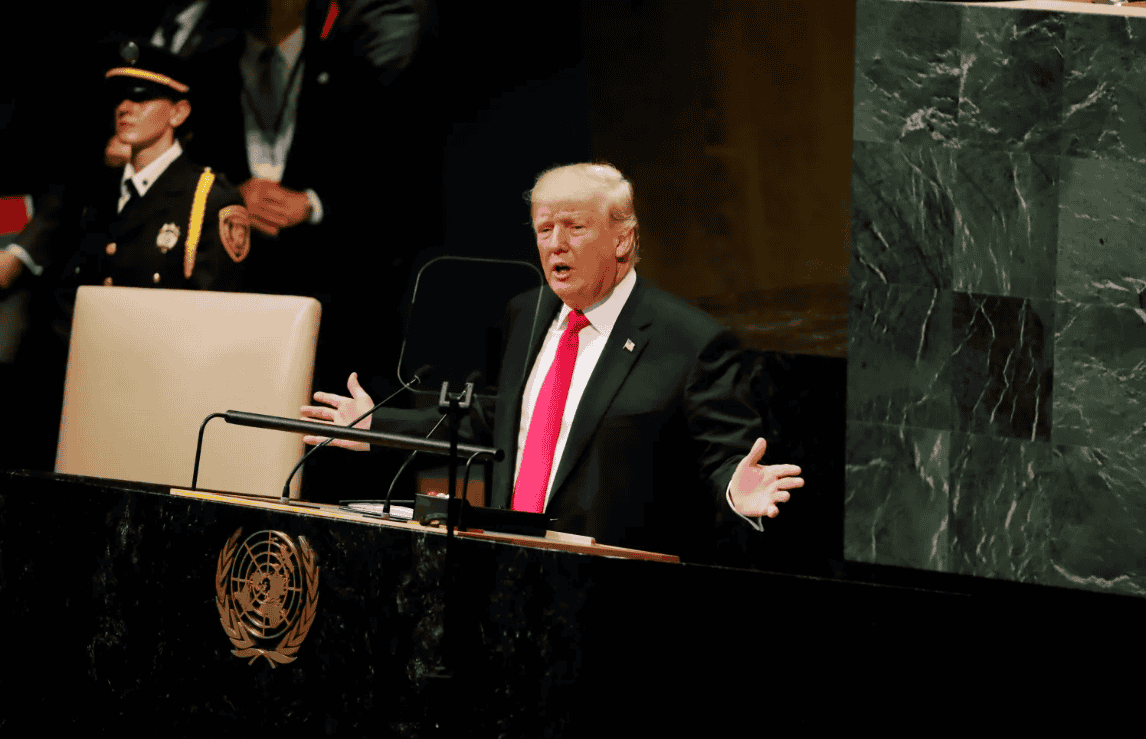

See MoreIndia: Trump says zero tariffs offered on US goods

India offers to cut tariffs on US goods to zero, Trump calls trade “one-sided.” US President Donald Trump said on 1 September 2025 that India had offered to reduce tariffs on American goods to zero. He described the trade relationship

See MoreIndia, Belgium amending protocol to tax treaty enters into force

The Protocol expands the existing framework for exchanging tax information, aiming to reduce tax evasion and avoidance between the two countries while also facilitating mutual assistance in tax collection. The amending protocol to the 1993

See MoreUS: 50% tariffs on Indian imports enters into force

US to impose extra 25% tariffs on Indian imports from 27 August 2025, raising total duties to 50%. The US’ tariffs on Indian imports under Executive Order 14329 is taking effect today, 27 August 2025, starting 12:01 AM EDT. Most Indian

See MoreIndia defends trade negotiations as US tariffs loom

India’s Foreign Minister says trade talks with the US are continuing, but New Delhi will defend key “redlines” as additional tariffs of up to 50%. India’s Foreign Minister Subrahmanyam Jaishankar stated on 23 August 2025 that trade

See MoreBarbados seeks tax and investment deals with India

Barbados plans its first income tax treaty and investment protection agreement with India. Barbados has expressed its interest in negotiating an income tax treaty and an investment protection agreement (IPA) with India. The announcement came

See MoreIndia introduces Pillar Two disclosure requirements under national accounting standard

India has amended Ind AS 12 to align with International Accounting Standard 12 and introduce new disclosure requirements for the OECD’s Pillar Two global minimum tax. India’s Ministry of Corporate Affairs has issued the Companies (Indian

See MoreIndia to cut GST on small cars, health and life insurance premiums

The government proposed cutting GST on small cars from 28% to 18% and reducing GST on health and life insurance premiums to as low as 5% or zero. India’s government has proposed reducing the Goods and Services Tax (GST) on small cars from 28%

See MoreIndia plans to slash GST rates

India to cut consumption tax by October, introducing a two-tier GST system of 5% and 18%, affecting most items in the current 12% slab. India’s government will reduce consumption tax by October, introducing a two-tier GST system of 5% and 18%,

See MoreIndia to reduce GST by Diwali

India plans to simplify GST and lower taxes on common goods by Diwali. Indian Prime Minister Narendra Modi announced today, 15 August 2025, that the government will introduce “next generation” reforms in the Goods and Services Tax (GST),

See More