Ghana: GRA confirms major VAT reforms in 2025 Act

Ghana’s tax authority, the Ghana Revenue Authority (GRA), on 31 December 2025 issued a notice to all VAT-registered taxpayers outlining the VAT reforms enacted under the Value Added Tax Act, 2025, which will take effect from 1 January

See MoreWorld Bank: Data-driven policies can transform tax compliance

An event held at the World Bank Group Office in Rome from 1 to 5 December 2025 was attended by experts from the World Bank, the Ghana Revenue Authority (GRA) and some Italian institutions. The participants examined the effect of data-driven risk

See MoreGhana abolishes COVID-19 health recovery levy

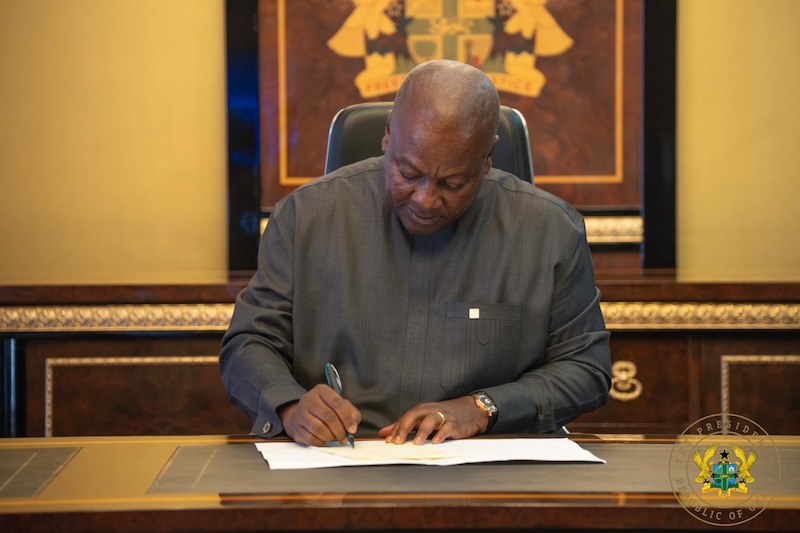

Ghana’s President John Dramani Mahama signed the COVID-19 Health Recovery Levy Repeal Act 2025 into law on 10 December 2025, ending the 1% levy on goods, services, and imports from January 2026. The repeal fulfills a key campaign promise, as

See MoreGhana: Parliament approves Value Added Tax Bill 2025

Ghana’s Parliament has passed the Value Added Tax 2025 on 27 November 2025. The purpose of the Bill is to revise and consolidate the framework governing the Value Added Tax. Presenting the Finance Committee’s report to Parliament, the

See MoreGhana: MoF presents 2026 budget, proposes VAT reforms

Ghana's Ministry of Finance has presented the 2026 Budget Speech to parliament on 13 November 2025, introducing various tax measures, including VAT reforms. The key tax measures are as follows: VAT reforms Ghana's government is proposing

See MoreGhana: GRA issues reminder on tax applicable to asset and liability gains

The notice mentions that a 25% tax applies to gains, with residents able to choose between the flat rate or regular income tax rates, while non-residents pay a final 25% tax on the gross proceeds. The Ghana Revenue Authority (GRA) has issued a

See MoreGhana: GRA to enact FED Act in early 2026

The GRA will fully enforce the Taxation (Use of Fiscal Electronic Device) Act 2018 by early 2026. The Ghana Revenue Authority (GRA) Commissioner-General announced on 15 August 2025 that it plans to fully implement and enforce the Taxation (Use of

See MoreGhana announces new tax measures in 2025 mid-year budget, removes exemption on marine gas oil

The 2025 mid-year budget introduces tax reforms, removing marine gas oil tax exemptions for non-artisanal fishing fleets, enhancing the modified taxation system with digital tools, and simplifying VAT to reduce rates and exempt small

See MoreGhana: Parliament passes 2025 budget measures

Ghana's Ministry of Finance announced that the Parliament approved several 2025 Budget measures on 26 March 2025. The passage of these bills marks a major leap for economic reform and a significant step in fulfilling the government’s commitment

See MoreGhana: 2025 budget to ease economic pressures on households, businesses

Ghana's Minister of Finance, Dr. Cassiel Ato Forson, presented the 2025 Budget Statement and Economic Policy on 11 March 2025 outlining tax policies and proposals designed to restore fiscal discipline, boost revenue generation, and ease economic

See MoreGhana publishes review of VAT system

Ghana's Ministry of Finance has published a "A Review of Ghana's Value-Added Tax (VAT) System" on 11 February 2025. This report, jointly produced with researchers from the Institute for Fiscal Studies (UK) analyses the design and administration

See MoreGhana introduces phase two of VAT e-invoicing

The Ghana Revenue Authority (GRA) released a public notice regarding the implementation of the second phase of the Electronic VAT Invoicing System. The system is expected to assist businesses and the tax authority in obtaining real-time monitoring

See MoreGhana negotiates tax treaties with Hungary, Israel, UAE, Korea, Egypt

Ghana announced that it is negotiating to establish income tax treaties with Hungary, Israel, UAE, Korea, and Egypt. Daniel Nuer, Head of the Tax Policy Unit at Ghana's Ministry of Finance, revealed that the Ministry plans to implement

See MoreGhana: 2024 mid-year budget introduces digital solutions, indirect tax measures

Ghana’s Minister of Finance, Mohammed Amin Adam, presented the 2024 mid-year budget review to the parliament on 23 July 2024. The key provisions of this year’s budget review aim to effectively implement existing tax policies, particularly those

See MoreGhana mandates transfer pricing compliance in CbC reporting

Ghana has made it mandatory for Multinational Enterprises (MNEs) operating in the country, that meet specific revenue thresholds, to provide detailed information on their worldwide operations through Country-by-Country Reporting (CbCR). MNEs are

See MoreGhana halts 15% VAT on residential electricity usage

On 7 February 2024, the Ministry of Finance in Ghana released a press statement regarding enforcing Value-Added Tax (VAT) on electricity consumption by residential customers. According to the statement, electricity suppliers were informed of the

See MoreIMF issues report following Article IV Consultation with Ghana

On 19 January 2024 the IMF issued a report following consultations with Ghana under Article IV of the IMF’s articles of agreement and the first review of Ghana’s Extended Credit Facility arrangement. The report notes that Ghana’s performance

See MoreOECD: Taxing the Informal Economy: Policy, Evidence and Lessons for the Future

On 4 April 2023 a webinar was held to present the results of two studies on presumptive tax regimes and the informal sector, and to draw lessons for the future design of such taxes. The webinar was co-hosted by the International Centre for Tax

See More