Malta: MTCA publishes second edition of AEOI newsletter

Malta’s Tax and Customs Administration (MTCA) has published issue 2 of its AEOI Newsletter. The second issue highlights that MTCA has launched a redesigned website, which centralises information on international tax cooperation. The site now

See MoreEuropean Commission publishes follow-up assessment of direction on administrative cooperation (DAC)

The European Commission has launched its second evaluation of Council Directive 2011/16/EU on administrative cooperation in taxation (the Directive on Administrative Cooperation, or DAC) on 19 November 2025. The DAC is a key legislative

See MoreBelgium: Scholars assist CJEU in reviewing Pillar 2 UTPR’s compliance with EU legal standards

A group of law professors filed an amicus curiae brief on 19 November 2025 with the Court of Justice of the European Union (CJEU) concerning a question referred by the Belgian Constitutional Court on whether the Pillar 2 UTPR is compatible with EU

See MoreEU Commission sets import limits on ferro-alloys to protect market

The EU Commission announced on 18 November 2025 that it has imposed three-year import quotas on steel alloys containing manganese and silicon to protect domestic producers from a surge of low-cost imports. This decision brings to a close an

See MoreHungary: Parliament proposes tax measures to ease business taxes

The Hungarian National Assembly is reviewing Bill T/13110, which aims to reduce the tax burden on businesses by introducing a range of changes to tax rules and thresholds. This legislative package, titled "Measures to Reduce the Tax Burden on

See MoreEU Parliament endorses protocols to expand AEOI-CRS agreements with Andorra, Monaco, San Marino, Liechtenstein, Switzerland

The European Parliament approved Legislative Resolution Nos. P10_TA(2025)0269 (Andorra), P10_TA(2025)0270 (Monaco), P10_TA(2025)0271 (San Marino), P10_TA(2025)0272 (Liechtenstein) and P10_TA(2025)0273 (Switzerland), authorising the conclusion of

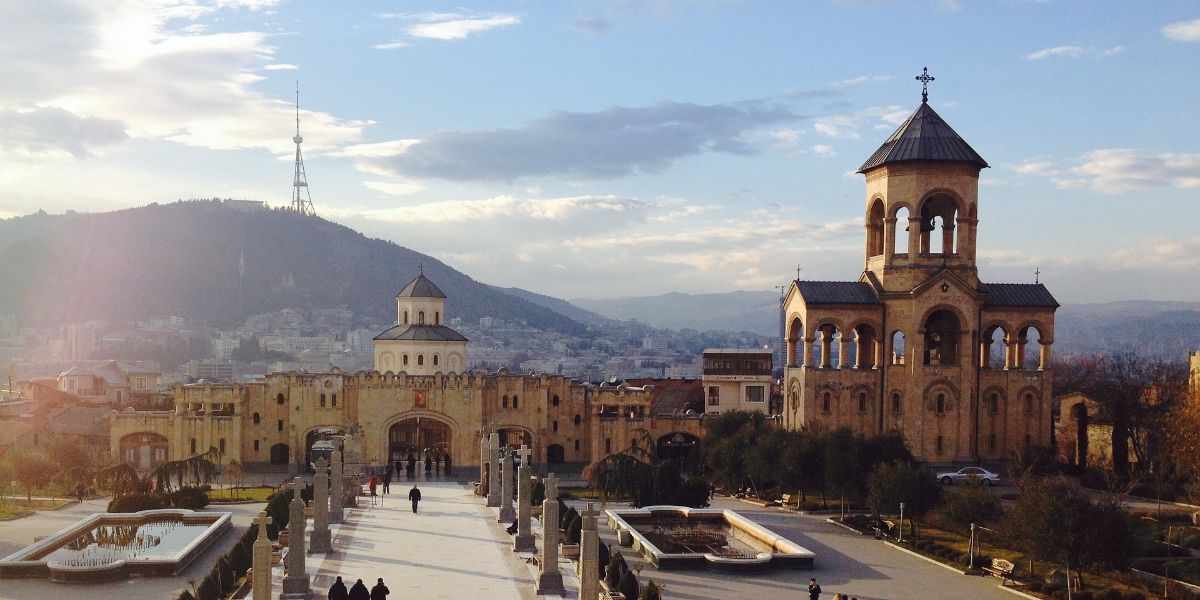

See MoreGeorgia: Parliament ratifies amending protocol to tax treaty with Luxembourg

The Parliament of Georgia approved the ratification of the amending protocol to the 2007 income and capital tax treaty with Luxembourg on 11 November 2025. The protocol was signed on 3 July 2025 and it updates provisions related to exchange of

See MoreEstonia gazettes law reducing motor vehicle tax for families with children

Estonia gazetted amendments to the Motor Vehicle Tax Act on 12 November 2025, introducing new tax reductions for parents and guardians. Under the changes, adults with custody of at least one child aged 18 or younger will receive an automatic

See MoreHungary: Parliament adopts revised global minimum tax, reporting regulations

Hungary’s parliament approved two bills (T/12802/7 and T/12801/12) on 18 November 2025 that introduce significant updates to the country's tax framework and reporting obligations. Among the key changes, the legislation revises Hungary’s

See MorePoland secures boost in EU 2026 budget for key development programmes

The EU Council and the European Parliament announced that negotiations on the 2026 EU budget were concluded on 15 November 2025. The agreed budget allocates additional funding to several Polish priorities, including border security, transport

See MoreBulgaria: Council of Ministers approve new tax treaty with Malta

The Bulgarian Council of Ministers approved a new tax treaty with Malta on 21 October 2025. The treaty, originally signed in Brussels on 10 December 2024, aims to prevent double taxation and prevent fiscal evasion between the two countries. It

See MoreNetherlands issues new decree on VAT exemption for share transactions

The Netherlands has published a new Decree on 15 October 2025 regarding the VAT exemption for share transactions. The Decree clarifies the scope of “intermediary services” in securities transactions and provides a broad application of the VAT

See MoreLithuania: MoF consults DAC8 tax information exchange rule amendments

The Lithuanian Ministry of Finance (MoF) opened a public consultation on 17 November 2025, proposing changes to Order No. VA-114, which regulates mutual assistance and the exchange of tax information with EU Member States. The amendments are

See MoreLithuania: Parliament considers higher corporate tax for banks, credit Institutions

Lithuania has proposed an amendment to its Corporate Tax Law that would increase the additional tax on banks and credit institutions from 5% to 10%. The draft, registered with the Seimas on 10 November 2025 under project No. XVP-973, targets

See MoreSlovenia to introduce mandatory e-invoicing for B2B transactions from 2028

Slovenia has enacted the Act on the Exchange of Electronic Invoices and Other Electronic Documents, published in the Official Gazette on 6 November 2025, which establishes mandatory e-invoicing for domestic B2B transactions. Under the Act,

See MoreSweden: MoF proposes automatic exchange of top-up tax information under DAC9

The Swedish Ministry of Finance (MoF) submitted a proposal to the Legislative Council, on 13 November 2025, to introduce new rules for the automatic exchange of Top-up Tax information. The changes align Sweden’s framework with Council Directive

See MoreKuwait ratifies amending protocol to tax treaty with Luxembourg

Kuwait has ratified the 2021 amending protocol to its 2007 Income and Capital Tax Treaty with Luxembourg through Decree Law No. 138 of 2025 on 1 September 2025. The protocol was published in the Official Gazette No. 1755 of 7 September

See MoreEU Parliament endorses BEFIT corporate tax framework

The European Parliament has approved Legislative Resolution No. P10_TA(2025)0268 on the Business in Europe Framework for Income Taxation (BEFIT) on 13 November 2025. The resolution introduces a unified framework for corporate taxation across the

See More