Brazil: Senate approves tax treaty protocol with Chile

Signed 3 March 2022, this is the first amendment to the 2001 Brazil–Chile income tax treaty. Brazil's Senate (the upper house of parliament) approved the ratification of the protocol amending the 2001 tax treaty with Chile on 3 September

See MoreChile: SII issues rules on VAT exemption for low-value imports purchased via remote sellers, online platforms

The new rules exempt low-value imports (CIF value under USD 500) from VAT at import when purchased from non-resident remote sellers or DPIs registered under the simplified VAT regime, ensuring VAT is only charged at the sale stage, not at the time

See MoreChile: SII clarifies thin capitalisation exemption for financial entities

The tax administration clarified that to be exempt from thin capitalisation rules, an entity must engage solely in financial activities (with limited complementary activities), certain assets are excluded from the 90% threshold, and the commercial

See MoreChile: SII clarifies that tax treaty with US allows digital content creators to claim foreign tax credit

Ruling No. 1617-2025 permits digital content creators in Chile to claim a tax credit for US taxes paid, provided the US holds taxing rights over the income. Chile’s Tax Administration (SII) has published Ruling No. 1617-2025 of 14 August 2025

See MoreChile proposes bill to promote green hydrogen industry

The proposed tax incentives and special rules aim to boost Chile’s green hydrogen industry and strengthen its global leadership in clean fuel production. Chile’s Ministry of Finance has submitted a bill to the Chamber of Deputies to promote

See MoreChile: SII issues circular on overdue tax fines for September 2025

Chile’s SII issued Circular No. 52-2025 on 14 August 2025, setting September 2025 tax readjustments, fines, and a 0.0222222222% daily late payment interest rate. The Chile’s Internal Revenue Service (SII) has issued Circular No. 52-2025 on

See MoreChile clarifies indirect foreign tax credit treatment for CFCs

Ruling No. 1500-2025 confirms that the indirect foreign tax credit applies only if a treaty or information exchange agreement exists and the CFC owns at least 10% of the subsidiary. Chile’s tax administration (SII) issued Ruling No. 1500-2025

See MoreChile: SII updates rules for digital platforms to confirm users’ tax registration

The new rules mandates digital payment and intermediation platforms to verify users' compliance with business activity obligations through the SII platform’s “situación tributaria” option, API tax ID queries, or other SII-provided digital

See MoreChile: MoF revises criteria for fuel excise tax calculation

The readjusted fuel excise tax will take effect from 7 August 2025. Chile’s Ministry of Finance published Executive Decree No. 242 in the Official Gazette on 6 August 2025, revising the components used to calculate the excise tax on fuels, as

See MoreChile: SII sets VAT filing and payment rules for foreign e-sellers, digital platforms

SII’s new Resolution No. 93 requires foreign taxpayers registered to declare and pay 19% VAT on remote sales or facilitation of low-value goods. Chile’s tax authority (SII) has issued Resolution No. 93 of 30 July 2025, setting rules for VAT

See MoreChile: SII issues guidance on VAT, invoicing rules for outsourced services

The Ruling clarifies VAT treatment and invoicing requirements for outsourced services. Chile’s tax administration (SII) published Ruling No. 1394-2025 on its website on 24 July 2025, in which it provided clarification of value added tax (VAT)

See MoreChile waives interest and penalties for some non-resident taxpayers over technical glitch

The full waiver of interest and penalties only applies to non-resident taxpayers who submitted their digital VAT forms by 25 July 2025. Chile's Tax Administration (SII) has issued Resolution Ex. SII No. 89-2025 on the SII website on 22 July

See MoreChile updates daily late tax payment interest rate for July–December 2025

The updated daily interest rate for late tax payments is 0.0222222222% for the period from 1 July to 31 December 2025. Chile’s Internal Revenue Service (SII) has issued Resolution No. 75 on 26 June 2025, setting the daily interest rate for late

See MoreChile issues VAT registration rules for foreign B2C sellers

The resolution introduces VAT registration for foreign sellers and platforms handling low-value B2C goods from October 2025. The Chilean tax authority SII) issued Resolution No. 84 on 10 July 2025, establishing registration procedures for foreign

See MoreChile extends reduced tax rate for qualifying SMEs until 2028

The new law extends the reduced 12.5% rate through 2025-2027, with a 15% rate starting in 2028. Chile published Law No. 21755 in the Official Gazette on 11 July 2025, extending the temporary reduced corporate tax rate for qualifying SMEs under

See MoreChile sets rules for digital platforms to verify users’ tax registration and compliance

Chilean digital payment platforms must ensure users report business activity to the SII, starting 1 October 2025. Chile’s tax authority (SII) has published Resolution Ex. 79-2025 on the SII's website on 26 June 2025. This regulation

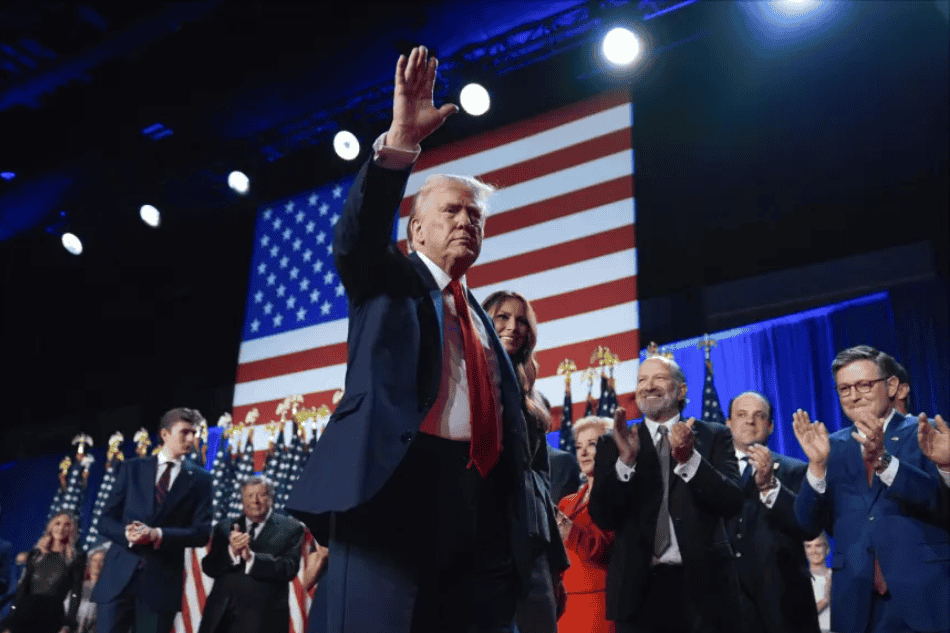

See MoreUS: Trump considering imposing 50% tariff on copper imports

The tariffs are expected to take effect by late July or 1 August 2025, with Chile, Canada, and Mexico being impacted the most by the increases. US President Donald Trump announced plans for a 50% tariff on copper imports during a White House

See MoreParaguay, Chile negotiating to revise income tax treaty

The technical negotiations aim to update the 2005 Paraguay-Chile tax treaty, incorporating it with updated OECD and UN standards. According to the Paraguay Information Agency, on 30 June 2025, Paraguay and Chile are nearing the conclusion of

See More