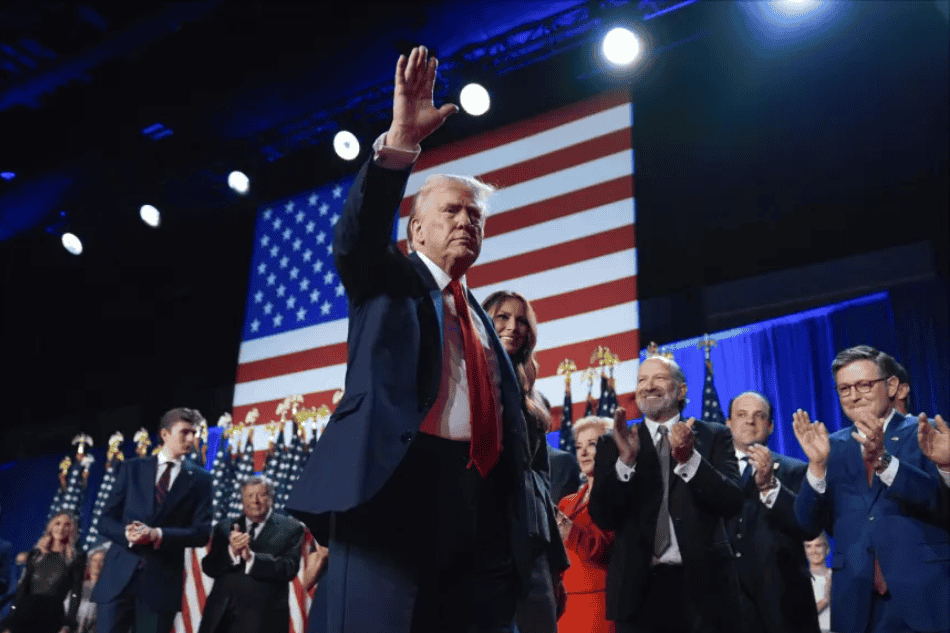

US: Trump raises tariff on Canada to 35%

Goods transshipped to evade the 35% tariff will be subject, instead, to a transshipment tariff of 40%. US President Donald Trump signed an executive order on 31 August 2025, raising tariffs on Canadian goods from 25% to 35% for products not

See MoreCanada: Google ends 2.5% ad surcharge following move to repeal DST

The fee, introduced on 1 October 2024, applied to Google Ads and YouTube reservations to cover compliance costs under Bill C-69, which targeted large digital companies. Google has announced that it is scrapping its 2.5% "Canada DST Fee" on

See MoreCanada expands steel quotas, imposes surtax on Chinese imports amid rising global tariffs

Canada is implementing various trade defences, which include a CAD 1 billion investment in the industry, CAD 70 million in worker retraining, enhanced financing, tightened procurement, and the launch of a CAD 500 million fund to support the

See MoreUS: Trump to impose higher tariffs on major trading partners including Canada, EU, Mexico starting August ’25

Trump announced 35% tariffs on Canadian imports, 30% on imports from Mexico and the EU, and 20% to 50% tariffs on 23 other trading partners, including Japan and Brazil. US President Donald Trump announced a 35% tariff on Canadian imports and

See MoreUS: Trump considering imposing 50% tariff on copper imports

The tariffs are expected to take effect by late July or 1 August 2025, with Chile, Canada, and Mexico being impacted the most by the increases. US President Donald Trump announced plans for a 50% tariff on copper imports during a White House

See MoreCanada announces legislation to ensure carbon rebates for small businesses are tax-free

The draft legislation ensures that all Canada Carbon Rebates for Small Businesses are provided tax-free. Canada's Department of Finance announced on 30 June 2025 that Carbon Rebates for small businesses will be tax-exempt, enabling eligible

See MoreCanada seeks resolution in US steel and aluminium tariff dispute

Canada stays open to de-escalation but keeps tariff options on the table as PM Mark Carney and President Trump discuss resolving the steel and aluminium trade dispute. Canada remains open to de-escalation but is keeping tariff options available

See MoreCanada withdraws 3% digital services tax to revive US trade talks

Canada canceled its planned 3% digital services tax on US tech firms to revive stalled trade talks between Prime Minister Mark Carney and President Donald Trump. According to Canada's finance ministry, Canada scrapped its 3% digital services tax

See MoreCanada revises aluminium and steel tariffs, introduces steel quotas amid US trade pressure

Canada will adjust counter-tariffs on US aluminium and steel imports from 21 July 2025 to protect its industry. Tariff-rate quotas on non-FTA steel imports, set at 2024 levels, will be applied retroactively and reviewed after 30 days to prevent

See MoreCanada: Carney considers imposing more duties on US steel, aluminium

This follows after US President Trump announced on 30 May 2025, that tariffs on Canadian steel and aluminium imports will increase from 25% to 50%. Canada’s Prime Minister Mark Carney, on 19 June 2025, cautioned that his government may impose

See MoreCanada: British Columbia to raise speculation and vacancy tax rates in 2026

The speculation and vacancy tax rates will increase for foreign owners from 2% to 3% and for Canadian residents from 0.5% to 1% from 2026. The Government of British Columbia announced on 12 June 2025 that speculation and vacancy tax rates will

See MoreUS, Canada agrees to finalise trade deal within 30 days

The US and Canada agreed to finalise a trade deal within 30 days to resolve issues caused by tariffs and countermeasures. The US President Donald Trump and Canada's Prime Minister Mark Carney agreed this week to finalise a trade deal within 30

See MoreJ5 Australia, Canada, Netherlands, UK, and US publish report on fintech use in tax evasion and money laundering

The J5 group—Australia, Canada, Netherlands, UK, and US—has released a report examining how fintech is used to facilitate tax evasion and money laundering. The Joint Chiefs of Global Tax Enforcement (J5) released three reports today –

See MoreCanada extends tariff exemptions on Ukraine imports for one year

Canada has extended its tariff-free policy for Ukrainian imports for another year, keeping Ukrainian goods free from customs duties until 9 June 2026. Canada’s Department of Finance announced on 6 June 2025 that it will continue to support

See MoreCanada: Government proposes GST rebate for first-time home buyers, repeal of consumer carbon price, middle-class tax cuts

Canada’s Finance Minister proposed the measures on 27 May 2025. Canada’s Finance Minister, François-Philippe Champagne, has tabled a notice of Ways and Means Motion in Parliament on 27 May 2025, proposing GST relief for first-time

See MoreCanada: Carney to announce 2025-26 federal budget in autumn

Canada’s Prime Minister Mark Carney said on 18 May 2025 that the federal government will present a budget this autumn. This follows Finance Minister François-Philippe Champagne's announcement on 14 May 2025 that the government won’t table a

See MoreCanada: Ontario unveils 2025 budget, proposes increased tax credit for corporations

Minister of Finance Peter Bethlenfalvy, of the Canadian province of Ontario, presented the 2025 Ontario Budget: A Plan to Protect Ontario on 15 May 2025. It confirms no new changes to corporate or personal income tax rates. However, qualifying

See MoreCanada: Alberta halts industrial carbon pricing at the current rate

The Canadian Province of Alberta announced on 12 May 2025 that it is freezing the industrial carbon price at the current rate of CAD 95 per tonne of emissions. The announcement was made by Alberta’s Premier, Danielle Smith. Previously, the

See More