US: Trump administration terminates trade talks with Canada

President Trump halted all trade talks with Canada, citing a “fraudulent” Ontario government and misrepresenting former President Reagan’s views. US President Donald Trump announced on Thursday, 23 October 2025, that his administration has

See MoreCanada: Government to introduce anti-fraud plan, financial crimes agency

The government plans to strengthen Canada’s fight against financial fraud by requiring banks to implement anti-fraud policies, exploring broader sector-wide measures, and establishing a new Financial Crimes Agency. Canada’s Department of

See MoreCanada grants tariff exemptions on select US and Chinese steel, aluminium products

The tariff relief on certain US and Chinese steel and aluminium imports is aimed at supporting local industries and advancing trade negotiations with both countries. Canada has introduced tariff relief measures on certain steel and aluminium

See MoreCanada: CRA simplifies tax adjustments through revised voluntary disclosures program

The VDP lets taxpayers voluntarily correct past tax errors for potential penalty and interest relief, but only for tax years overdue by at least one year. The Canada Revenue Agency (CRA) announced, on 10 September 2025, that it will update the

See MoreCanada: PM Carney confirms US trade discussions to shift into USMCA review stage

Prime Minister Mark Carney stated that trade talks with the U.S. are ongoing, with several unresolved issues set to be addressed in the upcoming USMCA review. Canada’s Prime Minister Mark Carney announced yesterday, 23 September 2025, that

See MoreCanada announces GST/HST filing deadlines for distributed investment plans

These rules also impose responsibilities on both investors and securities dealers. Canada’s government announced that distributed investment plans, such as mutual fund trusts and investment limited partnerships are required to reach out to

See MoreCanada: Central bank cuts interest rate to 2.50%

Bank of Canada lowered interest rate amid economic slowdown Canada’s central bank, the Bank of Canada, lowered its key interest rate by 25 basis points to 2.50% on Wednesday, 17 September 2025, marking its first rate cut since March. The

See MoreCanada: CRA outlines updates to voluntary disclosures program

CRA will implement changes to its Voluntary Disclosures Program, which covers disclosures related to various taxes and charges, including income tax, GST/HST, excise duties, luxury tax, digital services tax, effective 1 October 2025. The Canada

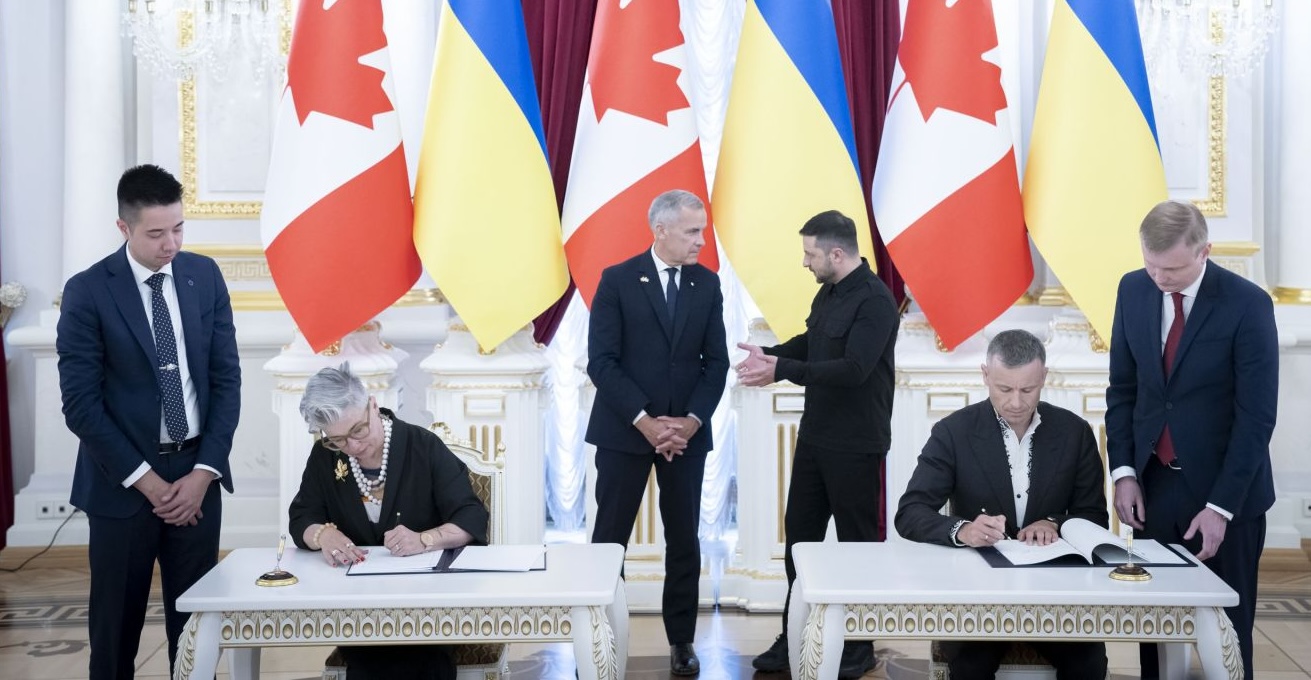

See MoreCanada, Ukraine sign agreement on mutual administrative assistance in customs matters

This agreement aims to address customs violations amid growing bilateral trade between the two countries. Canada and Ukraine signed an agreement on mutual administrative assistance in customs matters on 24 August 2025. The signing took place

See MoreCanada: CRA extends withholding tax relief for nonresident subcontractor reimbursements to June 2026

Taxpayers reimbursing non-residents for services in Canada via subcontracting can defer the 15% withholding tax and related interest or penalties until 30 June 2026. The Canada Revenue Agency (CRA) has extended its administrative relief policy

See MoreCanada consults draft tax legislation, includes several previously announced measures including amendments to global minimum tax Act

The government invites all interested Canadians and stakeholders to provide feedback on these draft legislative proposals by emailing their comments to consultation-legislation@fin.gc.ca by 12 September 2025. Canada’s Department of Finance

See MoreCanada to exempt retaliatory tariffs on US imports under CUSMA

Canada’s government decision to abolish all tariffs on US goods under CUSMA will take effect on 1 September 2025. Canada’s Prime Minister Mark Carney announced on 22 August 2025 that Canada will eliminate tariffs on US goods covered under the

See MoreCanada: DoF consults previously announced draft tax rules

The deadline for sending feedback is 12 September 2025. Canada’s Department of Finance has unveiled draft legislation for consultation on 15 August 2025, aimed at implementing various previously announced and additional tax measures. The

See MoreUS: Trump raises tariff on Canada to 35%

Goods transshipped to evade the 35% tariff will be subject, instead, to a transshipment tariff of 40%. US President Donald Trump signed an executive order on 31 August 2025, raising tariffs on Canadian goods from 25% to 35% for products not

See MoreCanada: Google ends 2.5% ad surcharge following move to repeal DST

The fee, introduced on 1 October 2024, applied to Google Ads and YouTube reservations to cover compliance costs under Bill C-69, which targeted large digital companies. Google has announced that it is scrapping its 2.5% "Canada DST Fee" on

See MoreCanada expands steel quotas, imposes surtax on Chinese imports amid rising global tariffs

Canada is implementing various trade defences, which include a CAD 1 billion investment in the industry, CAD 70 million in worker retraining, enhanced financing, tightened procurement, and the launch of a CAD 500 million fund to support the

See MoreUS: Trump to impose higher tariffs on major trading partners including Canada, EU, Mexico starting August ’25

Trump announced 35% tariffs on Canadian imports, 30% on imports from Mexico and the EU, and 20% to 50% tariffs on 23 other trading partners, including Japan and Brazil. US President Donald Trump announced a 35% tariff on Canadian imports and

See MoreUS: Trump considering imposing 50% tariff on copper imports

The tariffs are expected to take effect by late July or 1 August 2025, with Chile, Canada, and Mexico being impacted the most by the increases. US President Donald Trump announced plans for a 50% tariff on copper imports during a White House

See More