Ecuador: Constitutional Court strikes down public integrity law covering tax amnesty, interest on refunds changes

The Court's decision invalidates all provisions of the law, including the tax amnesty and refund interest adjustments. Ecuador's Constitutional Court declared the Organic Law on Public Integrity unconstitutional on 26 September 2025, which

See MoreBrazil: Senate passes second bill on new consumption tax framework

The Bill has now been forwarded to the Chamber of Deputies for additional review and discussion. Brazil’s Senate has passed Complementary Bill (PLP) 108/2024 on 30 September 2025, which is the second legislative effort to structure the

See MoreArgentina suspends export duties on aluminium, steel until December 2025

The temporary suspension of export duties will last until the end of 2025. Argentina's government has announced a temporary removal of export taxes on aluminium, steel, and related products, which went into effect on 8 October 2025. The

See MoreUruguay: Economy and Finance Minister proposes amendments to global minimum tax for 2025–29 budget bill

The 2025–29 Budget Bill proposes a new domestic minimum tax for large multinational groups from 2027. Uruguay’s Minister of Economy and Finance, Azucena María Arbeleche Perdomo, has introduced proposed changes to the global minimum tax

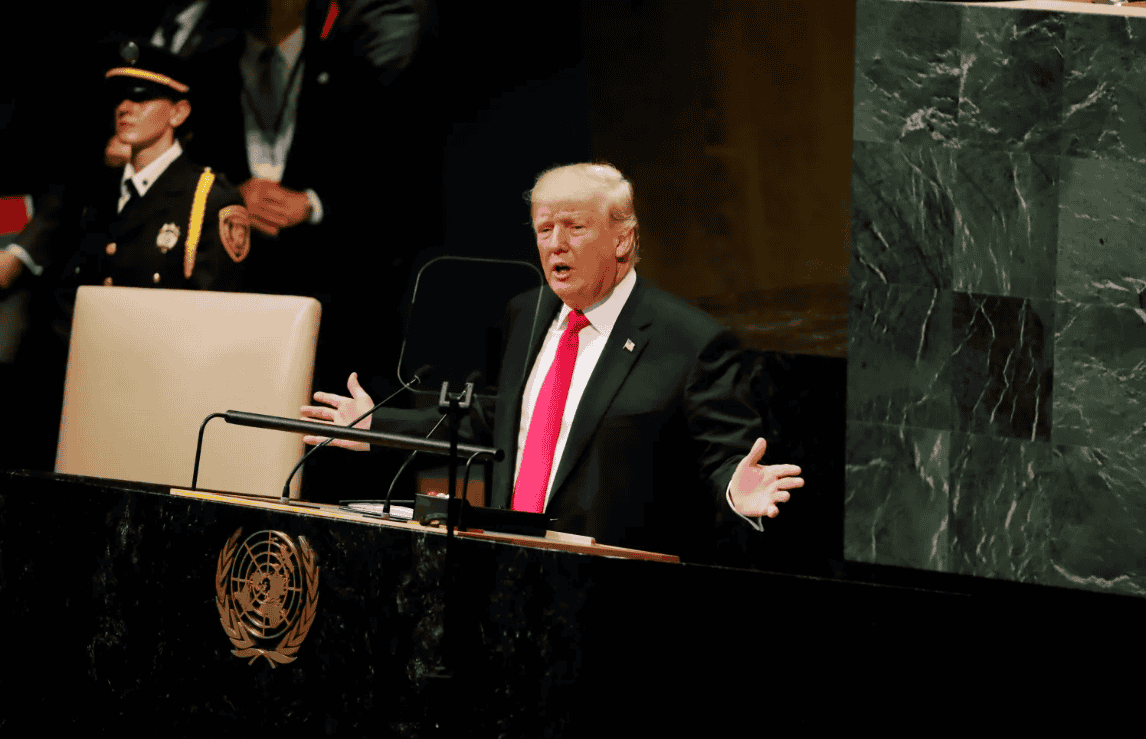

See MoreUS: Trump to postpone implementation of 25% tariff on trucks by one month

The tariff was initially announced as part of a broader package of import duties unveiled last month, aimed at strengthening domestic manufacturing and addressing what the administration has described as national security concerns. President

See MoreBrazil updates Contribution on Net Profit rules, aligns with QDMTT under Pillar 2

Brazil updated CSLL rules to align with Pillar 2 QDMTT, retroactively effective from 1 January 2025. Brazil’s Federal Revenue Service (RFB) has issued Normative Instruction No. 2.282 on 2 October 2025, amending Normative Instruction No. 2.228

See MoreUS: Treasury, IRS provide penalty relief for remittance transfer providers who fail to deposit excise tax under the OBBB

The US Department of the Treasury and the IRS have issued Notice 2025-55, granting limited penalty relief to remittance transfer providers for the first three quarters of 2026 as they adapt to the new 1% remittance transfer tax under the One, Big,

See MoreEl Salvador: MoF publishes guidance on preferential tax jurisdictions

El Salvador lists low- and no-tax jurisdictions for 2026, with related tax rules and treaty guidance. El Salvador's Ministry of Finance ( MOF) issued guidance MH.UVI.DGII/006.002/2025 on countries considered to have preferential tax regimes with

See MoreUS: IRS, Treasury issues guidance to streamline interest capitalisation for property improvements

The guidance includes final regulations for eliminating the associated property rule and related provisions for interest capitalisation on improvements to designated property. The US Treasury and the Internal Revenue Service (IRS) have released

See MoreUS: IRS extends treaty benefits to reverse foreign hybrids subject to branch profits tax

The IRS Chief Counsel ruled that reverse foreign hybrids may qualify for reduced branch profits tax on dividend equivalent amounts attributable to treaty-eligible owners. The US Internal Revenue Service (IRS) Chief Counsel has determined that

See MoreUS: IRS retracts proposed rules on corporate divisions, reorganisations

The U.S. Treasury and IRS have withdrawn the 30 September 2025 proposed regulations on corporate separations, incorporations, reorganisations, and multi-year tax reporting for related transactions. The U.S. Department of the Treasury and the

See MoreEcuador, Romania sign CRS MCAA addendum

The two countries signed the addendum on 3 September 2025, updating CRS rules to cover crypto-assets and strengthen reporting and due diligence. The OECD has announced that Ecuador and Romania signed the Addendum to the Multilateral Competent

See MoreArgentina: ARCA extends deadline for tax payment plan on incorrectly calculated losses

ARCA extends the deadline to 28 November 2025 for companies to join the payment plan for incorrectly calculated tax losses, allowing regularisation of debts with reduced down payments and up to 120 installments. The Argentine Revenue and Customs

See MoreEcuador: SRI updates e-filing rules for large taxpayers

Under this resolution, taxpayers must submit their declarations and pay their taxes at the same time, by the statutory due date. Ecuador’s tax authority (SRI) issued Resolution NAC-DGERCGC25-00000030 on 23 September 2025, updating the

See MoreChile: SII extends deadline for digital platforms to confirm user tax details

The deadlines for platforms to verify users’ business registrations with the SII and for DIPs to validate and submit this information have been postponed: verification now starts 2 January 2026, DIP validation by 1 January 2026, and the final

See MoreBrazil, US sign agreement on automatic tax data sharing

The arrangement creates a formal system for Brazil and the U.S. to automatically share tax information under their 2007 agreement. The U.S. Internal Revenue Service (IRS) and Brazil have published a competent authority arrangement on 27 August

See MoreUS: Court of Appeals determines tax authorities cannot reallocate income beyond a taxpayer’s legal entitlement

The IRS sought to reallocate an additional USD 23.7 million in royalties to 3M under the arm’s-length standard, despite the company’s Brazilian subsidiary being legally limited to paying only USD 5.1 million. The US Court of Appeals for the

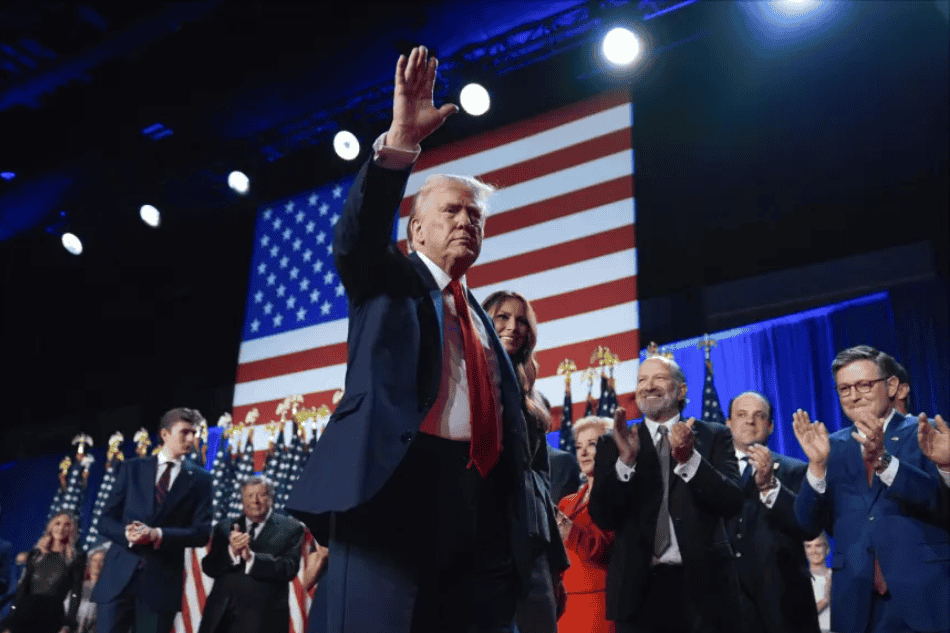

See MoreUS: Trump weighs major tariff relief to boost US auto manufacturing

The proposal aims to cut costs for major U.S. carmakers by rewarding companies that assemble vehicles domestically, supporting Trump’s job creation goals. US President Donald Trump is considering a major tariff relief plan aimed at boosting US

See More