Cameroon: Parliament adopts Finance Act for 2026, introduces significant economic presence (SEP) standard

Cameroon’s Parliament has adopted the 2026 Finance Act on 26 November 2025, introducing tax measures from the 2026 Budget designed to expand the country’s fiscal base and strengthen revenue mobilisation. The legislation establishes a new

See MoreUAE: MoF issues new resolution outlining fines for electronic invoicing non-compliance

The UAE’s Ministry of Finance has announced the issuance of Cabinet Resolution No. (106) of 2025, which establishes violations and administrative fines for non-compliance with legislation governing the Electronic Invoicing System. The measure

See MoreSouth Africa: SARS to enhance transfer duty declaration process to improve compliance

The South African Revenue Service (SARS) announced on 8 December 2025 a series of enhancements to the Transfer Duty Declaration (TDC01) on eFiling, aimed at simplifying compliance, reducing inaccurate declarations, and strengthening the collection

See MoreAlgeria launches online service for fuel consumption tax payments

Algeria’s General Directorate of Taxes has introduced a new online service allowing vehicle and truck owners travelling to neighbouring countries to pay the fuel consumption tax via the “Tabioucom” platform. The service enables users to pay

See MoreBahrain, Saudi Arabia sign income tax treaty

Bahrain and Saudi Arabia signed a tax treaty on 3 December 2025. The agreement aims to address double taxation and promote investment. The treaty is the first of its kind between the two countries and will enter into force upon the exchange of

See MoreLiberia: LRA to introduce revised VAT system in 2027

The Liberia Revenue Authority (LRA) has announced that training programs are underway to prepare for the rollout of a new VAT system, which will replace the existing GST framework starting 1 January 2027. Businesses will be able to register for

See MoreSouth Africa: SARS Updates Crypto Reporting Rules Under CARF, CRS

The South African Revenue Service (SARS) has issued new regulations implementing the OECD Crypto-Asset Reporting Framework (CARF) and revising the Common Reporting Standard (CRS) related to crypto assets. The updates include enhanced due diligence

See MoreQatar: GTA launches five-year strategy to modernise tax system

Qatar’s General Tax Authority (GTA) has launched its five-year strategy aimed at advancing a modern tax system that supports Qatar’s sustainable development during an official ceremony attended by GTA employees and partners. This announcement

See MoreUAE: MoF updates VAT law to enhance transparency and efficiency

The UAE’s Ministry of Finance (MoF) has announced on 3 December 2025, the issuance of Federal Decree-Law No. (16) of 2025 amending certain provisions of Federal Decree-Law No. (8) of 2017 on Value Added Tax, which will enter into force as of 1

See MoreQatar: GTA announces amendment to withholding tax forms

Qatar’s General Tax Authority (GTA) announced an amendment to the withholding tax forms on 26 November 2025, adding a field for the contract notification reference number issued through the “Tax” system, in addition to the contract reference

See MoreVietnam, South Africa move toward income tax treaty

Vietnam’s Ministry of Foreign Affairs has reported that representatives from Vietnam and South Africa met on 21 November 2025, during which both sides agreed to deepen bilateral cooperation and to pursue negotiations on an income tax

See MoreMalawi: MoF presents 2025-26 mid-year budget review, to introduce Minimum Alternate Tax

Malawi’s Ministry of Finance, Economic Planning, and Decentralisation (MoFEPD) presented the 2025-26 Mid-Year Budget Review Statement to the National Assembly on 21 November 2025. The 2025-26 Mid-Year Budget Review Statement proposes various

See MoreTurkey: Revenue Administration extends Domestic Minimum Top-Up Tax returns

Turkey’s Revenue Administration has issued Tax Procedure Law Circular No. 193 of 1 December 2025, extending the deadline for submitting the Local Minimum Supplementary (Complementary) Corporate Tax return and making the related payment for the

See MoreUAE, Sierra Leone tax treaty takes effect

The UAE Ministry of Finance has announced that its income and capital tax treaty with Sierra Leone entered into force on 24 January 2023. Signed on 22 December 2019, the treaty states that a permanent establishment is considered to exist when an

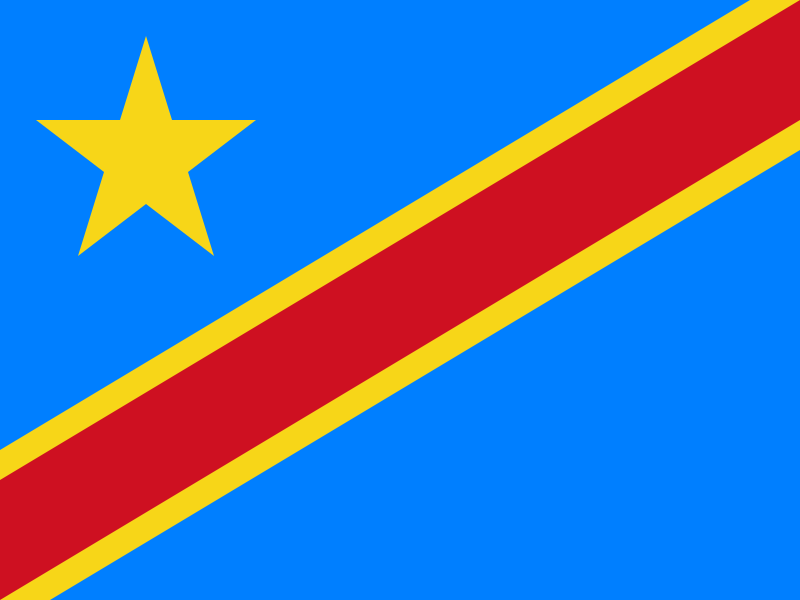

See MoreCongo (DRC) becomes 35th Yaoundé declaration signatory

The Democratic Republic of the Congo officially joined the Yaoundé declaration on 22 November 2025, when the Hon. Dudu Fwamba Likunde Li-Botayi, Minister of Finance, endorsed the initiative. The move underscores the country’s commitment to

See MoreOman: OTA issues draft e-invoicing data dictionary

The Oman Tax Authority (OTA) has released the draft e-invoicing data dictionary to selected taxpayers ahead of the August 2026 rollout. It defines standard data elements, validation rules, and code lists for all transaction types across B2B, B2C,

See MoreGhana: Parliament approves Value Added Tax Bill 2025

Ghana’s Parliament has passed the Value Added Tax 2025 on 27 November 2025. The purpose of the Bill is to revise and consolidate the framework governing the Value Added Tax. Presenting the Finance Committee’s report to Parliament, the

See MoreAngola, Vietnam conclude first round of tax treaty talks

Angola and Vietnam officials held their initial discussions on an income tax treaty from 25 to 27 November 2025 in Hanoi. If concluded, this agreement would mark the first tax treaty between the two nations. The treaty will need to undergo

See More