Tanzania, Qatar conclude negotiations for DTA

The talks, hosted by the Tanzanian Embassy and Qatar’s General Tax Authority, aimed to prevent double taxation and strengthen measures against tax avoidance and evasion between the two nations. Tanzania and Qatar completed the third round of

See MoreAngola, UAE sign CEPA to strengthen trade

Angola and the UAE signed a CEPA on 25 August 2025 to boost trade, investment, and sectoral cooperation. Angola and the UAE signed a Comprehensive Economic Partnership Agreement (CEPA) on 25 August 2025 in Angola. The agreement aims to reduce

See MoreCyprus, Oman tax treaty enters into force

Cyprus and Oman’s first income tax treaty enters into force, effective 1 January 2026. The income tax treaty between Cyprus and Oman entered into force on 5 March 2025. Signed on 8 December 2024, the agreement is a first between the two

See MoreUAE: FTA updates EmaraTax user manuals for payments, returns, period changes, de-registration

FTA updates EmaraTax user manuals covering corporate tax payments, returns, period changes and de-registration. The UAE Federal Tax Authority (FTA) has released updated user manuals for taxpayers using the EmaraTax portal. The revised

See MoreTurkey: Revenue Administration publishes guidance detailing tax obligations for heirs in 2025

The guide outlines heirs’ tax obligations, including filing rules, exemptions, thresholds, asset valuation, and related income, VAT, and special consumption tax requirements for 2025. The Turkish Revenue Administration has issued a guide for

See MoreUAE signs multilateral agreement on crypto asset tax reporting

The UAE has signed the OECD’s Multilateral Competent Authority Agreement under the Crypto-Asset Reporting Framework, joining 51 countries in standardising automatic tax information exchange for crypto transactions. The UAE signed the

See MoreOECD: Zimbabwe joins mutual assistance convention

Zimbabwe must ratify the Convention and deposit the ratification instrument for it to take effect in the country. The OECD reported that Zimbabwe signed the OECD-Council of Europe Convention on Mutual Administrative Assistance in Tax Matters (as

See MoreBotswana: Government proposes taxing digital services from non-residents

Botswana introduces VAT amendment bill to tax digital services, apply reverse charge, and modernise compliance. The Government of Botswana has introduced Value Added Tax (VAT) Amendment Bill (Bill No. 22 of 2025) on 12 August 2025, proposing

See MoreTurkey sets real estate tax construction costs for 2026

Turkey has set standard construction costs to calculate real estate tax for 2026. Turkey has published General Communiqué No. 87 on Real Estate Tax Law in the Official Gazette on 9 August 2025, setting standard construction costs per square

See MoreTurkey issues draft on R&D tax exemptions

Turkey has clarified the new rules for income tax on R&D wage exemptions and related incentives. Turkey released a draft Communiqué on Income Tax on 20 August 2025, clarifying amendments under Law No. 7555 to the Technology Development

See MoreNigeria: President abolishes 5% excise duty on telecom services

The abolition of the 5% excise tax on telecommunication services is aimed at improving affordability and service standards in the telecom sector. Nigeria’s President Bola Tinubu has officially abolished the 5% excise tax on telecommunication

See MoreTurkey: Government consults scope, application of the reduced corporate tax regime

Turkey has initiated a public consultation on the scope and application of the reduced corporate income tax regime for investments made under an investment incentive certificate issued by the Ministry of Industry and Technology. Turkey’s

See MoreEstonia: Government approves income tax treaty with Oman

The tax treaty will take effect after ratification instruments are exchanged and apply from 1 January of the following year. Estonia’s government has approved the income tax treaty with Oman on 21 August 2025. Signed on 27 October 2024, the

See MoreGhana: GRA to enact FED Act in early 2026

The GRA will fully enforce the Taxation (Use of Fiscal Electronic Device) Act 2018 by early 2026. The Ghana Revenue Authority (GRA) Commissioner-General announced on 15 August 2025 that it plans to fully implement and enforce the Taxation (Use of

See MoreUAE: FTA urges corporate taxpayers to file returns, pay within the specified deadlines

UAE’s Federal Tax Authority has urged corporate tax taxpayers to finalise records, file returns, and pay tax due by the deadlines, stressing compliance, early preparation, and use of the EmaraTax platform to avoid penalties. The Federal Tax

See MoreSouth Africa: Treasury proposes strengthening anti-avoidance rules for hybrid equity instruments

South Africa proposes more rigid tax rules on hybrid equity instruments, expanding the scope and taxing dividends as income from 1 January 2026. The South African National Treasury has proposed changes to section 8E of the Income Tax Act to

See MoreSouth Africa: Government proposes limiting deferral of foreign exchange gains under draft tax bill

South Africa proposes tighter rules on deferring foreign exchange gains for certain related-party debts from January 2026. South Africa’s government has proposed amendments to section 24I(10A) of the Income Tax Act through the Draft Taxation

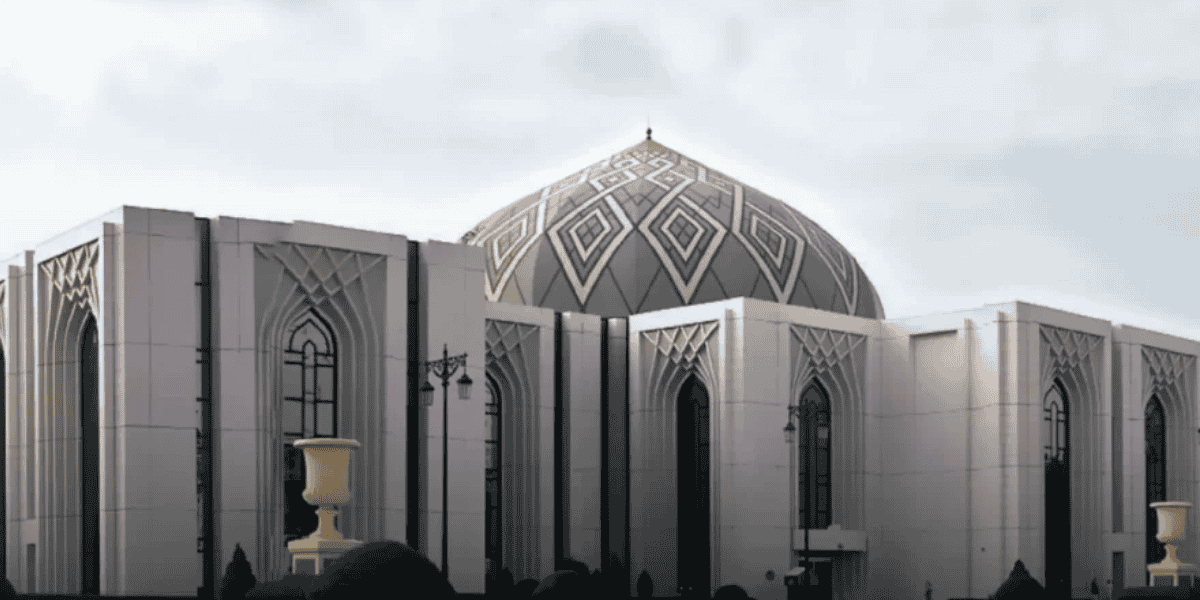

See MoreSaudi Arabia, Syria sign IPA

The agreement seeks to strengthen bilateral cooperation by promoting quality investments and fostering a supportive business environment for the private sector in both countries. Saudi Arabia and Syria signed an investment protection agreement

See More