The Swiss Council of States has not accepted the text of a revised inheritance tax (IHT) agreement with France and has instead suggested that it should be renegotiated. Switzerland had asked for a renegotiation after France had communicated its intention to rescind the original agreement that dated back to 1953. The original agreement was no longer in line with the current treaty policy pursued by France. The upper house has now suggested that new negotiations should begin in an attempt to find a way out of the deadlock. If the revised agreement is passed it will permit France tax impose tax in certain circumstances on heirs and beneficiaries of citizens of Switzerland who are resident in France. Also, French IHT could be imposed where certain assets of deceased Swiss persons are located in France.

Sweden to Investigate Tax Incentives for SMEs

Switzerland Adopts Anti-Tax Evasion Bill

Related Posts

Switzerland: FTA sets 2026 Safe-Harbour rates for related-party loans

The Swiss Federal Tax Administration ( FTA) has released circulars outlining the safe-harbour interest rates for loans between shareholders and related parties. The circular covering loans in Swiss Francs (CHF) was issued on 29 January 2026,

Read More

Switzerland to adopt FATCA Model 1 with US from 2028

Switzerland’s transition to a Foreign Account Tax Compliance Act (FATCA) Model 1 agreement with the United States is now expected to take effect on 1 January 2028, one year later than previously anticipated, the State Secretariat for International

Read More

Switzerland updates CbC reporting list

Switzerland has updated its list of jurisdictions for the automatic exchange of Country-by-Country (CbC) reports under the Multilateral Competent Authority Agreement on Automatic Exchange of Country-by-Country Reports (CbC MCAA). Decision No. RO

Read More

US to reduce Swiss tariffs under new trade deal

The US will reduce tariffs on Swiss goods from 39% to 15% under a new trade framework, the Swiss government announced today. The agreement also includes a commitment by Swiss companies to invest USD 200 billion in the US by 2028. The framework

Read More

Switzerland: Federal Council consults on VAT amendments

The Swiss Federal Council opened a consultation on amendments to the Value Added Tax Act on 5 December 2025. The changes aim to implement two parliamentary motions: the extension of platform taxation to electronic services (Motion WAK-S 23.3012)

Read More

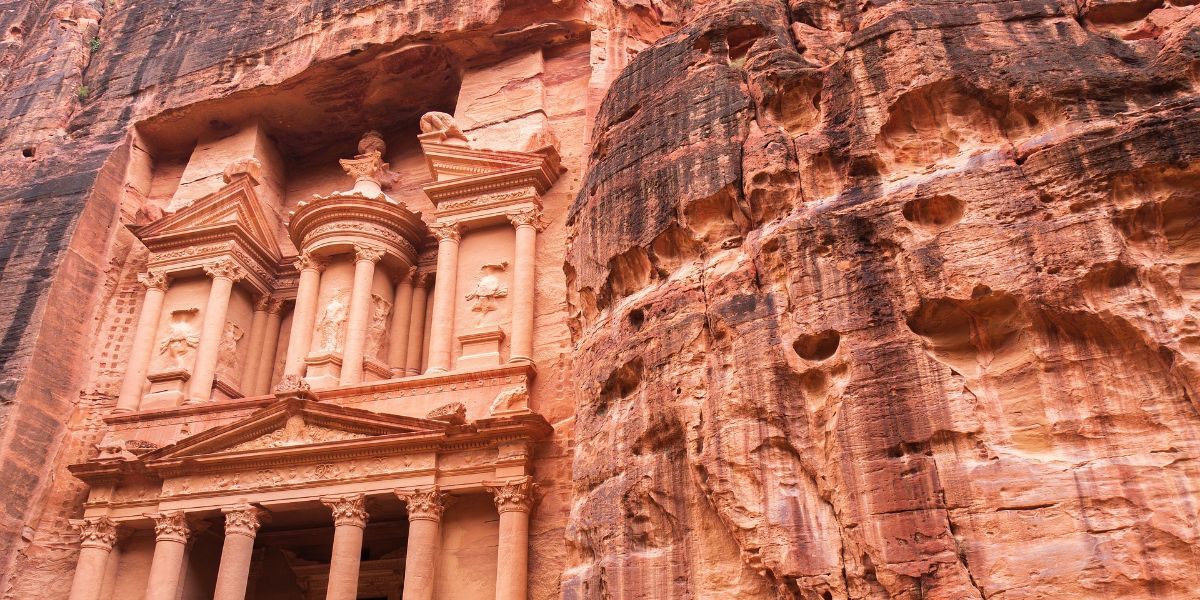

Jordan, Switzerland income tax treaty enters into force

The income tax treaty between Jordan, Switzerland entered into force on 4 December 2025. Signed on 13 December 2023, the agreement aims to prevent double taxation on income and curb tax evasion between Jordan and Switzerland. It applies to

Read More