Decree 17-2025 streamlines VAT refunds for exporters and exempt entities by introducing a special refund regime with strict timelines and a dedicated account managed by the Bank of Guatemala.

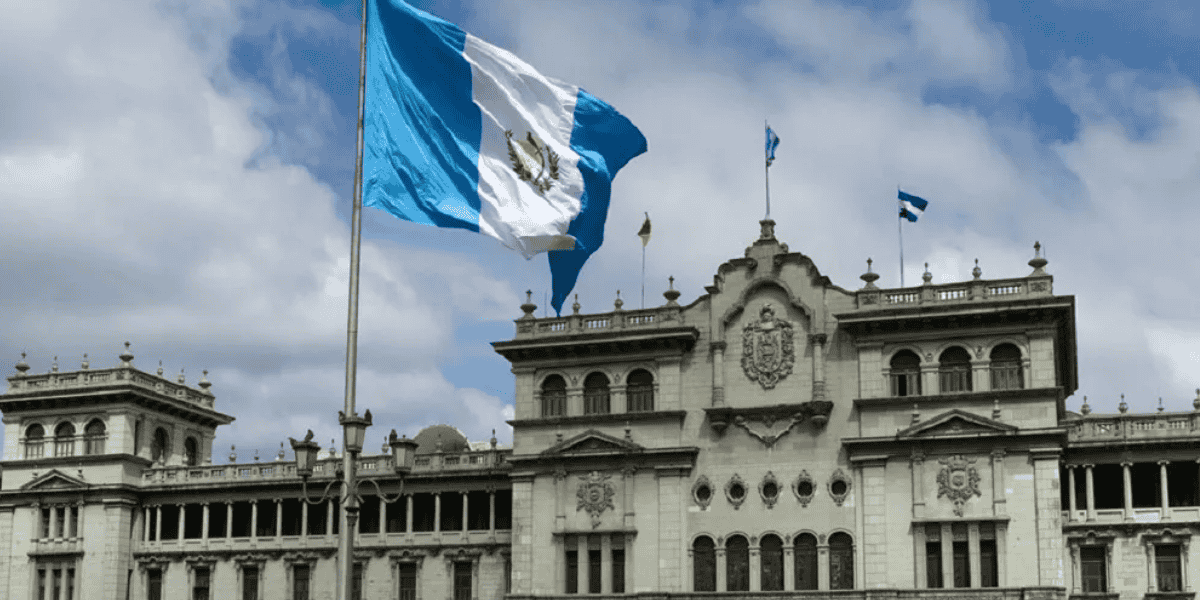

Guatemala issued Decree No. 17-2025 in the Official Gazette, introducing amendments to the Tax Code, the Value Added Tax Law, and the Law on Legal Provisions for Strengthening Tax Administration.

Decree 17-2025 establishes a new law intended to simplify and expedite the tax credit return process, focusing specifically on the refund or accreditation of Value Added Tax (VAT) for exporters and those dealing with exempt entities. This legislation introduces a special refund regime with strict verification timelines. It mandates the creation of a dedicated account managed by the Bank of Guatemala to process these restitution payments.

The key changes and procedures are:

The Tax Administration (AT) keeps a full record of each taxpayer’s account, tracking everything from taxes owed and payments made to interest, penalties, and surcharges. This account shows whether a taxpayer needs to pay more, is due a refund, or has a credit available.

If a taxpayer has a positive balance, they can choose to apply it to future taxes instead of receiving a refund, with all such applications carefully recorded until the balance is fully used.

Refunds are usually processed within 30 days of approval, but interest only applies to overpayments or incorrect payments—balances from VAT do not earn interest since this tax is collected from consumers.

Special regime for exporters and exempt service providers

A special regime for fiscal credit refund is established for exporters and those providing services to exempt entities. The rules for VAT credit balances have been updated to allow exporters and businesses supplying goods or services to VAT-exempt customers domestically to claim monthly refunds, provided there is no suspicion of fraud, false documentation, or other irregularities flagged by the tax authority.

These groups may apply for monthly refunds via bank transfer.

- If the requested refund is up to GTQ 500,000, they may receive 75% of the declared fiscal credit.

- If the refund exceeds GTQ 500,000, they may receive 60% of the declared fiscal credit.

The AT must resolve these special regime requests within thirty business days for quarterly periods or sixty business days for semi-annual periods. If the AT fails to issue and notify the resolution within these maximum deadlines, the petition is automatically considered unfavorably resolved, allowing the contributor to appeal.

To ensure that refunds are processed efficiently, a specialised account is created at the Bank of Guatemala.

New rules allow taxpayers subject to withholding to claim a refund if they hold a tax credit balance that cannot be used against debits for two consecutive years.

Decree No. 17-2025 came into effect on 29 November 2025.