Mexico: Federal Executive Branch presents 2026 Economic Package to Congress, includes indirect tax reforms

Mexico’s Federal Executive Branch submitted the 2026 Economic Package to Congress, proposing major changes to VAT, excise, and income taxes, as well as the federal tax code, which are under review until 31 October 2025. Mexico’s Federal

See MoreThailand: Cabinet extends 7% VAT rate until September 2026

Normally, the VAT rate is 10% in Thailand, but it was reduced to 7% as part of economic measures after the 1997 financial crisis. The Thai Cabinet has extended the reduced VAT rate of 7% until 30 September 2026. This announcement was made by

See MoreSlovak Republic: MoF unveils 2026 public finance, tax reform measures

The key tax changes are in the corporate and investment sectors, which face higher taxes: the top corporate license fee rises to EUR 11,520, and the special levy jumps to 15%. Consumption taxes increase, with VAT on sugary/salty foods at 23% and

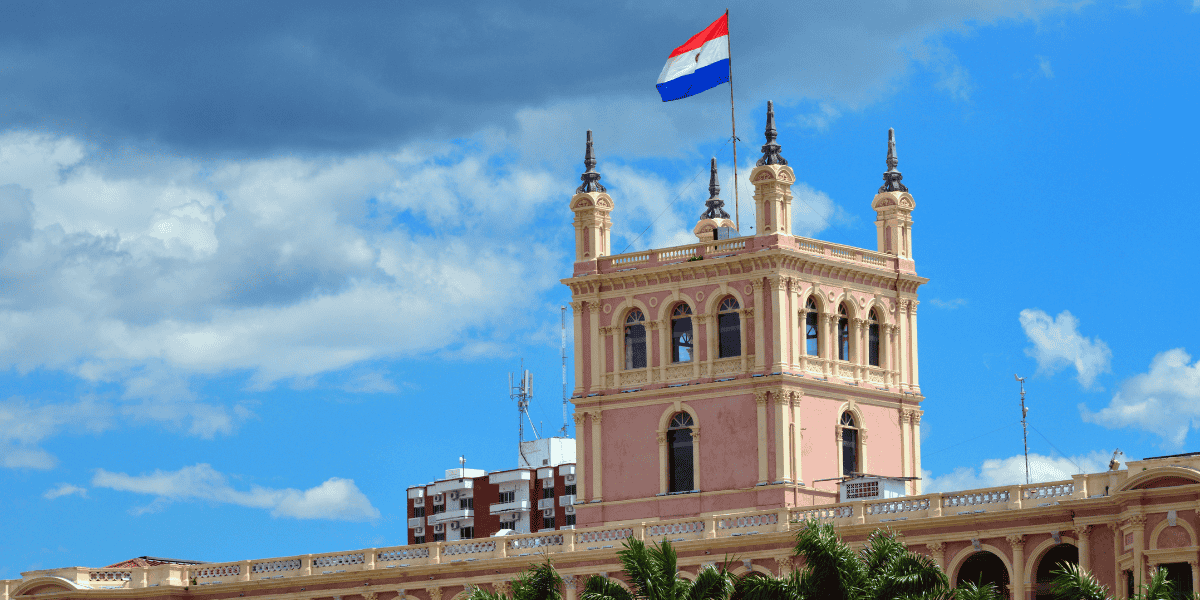

See MoreParaguay unveils new tax incentives for local, foreign investors

Key incentives include exemptions on customs duties, VAT, nonresident income tax, and dividend/profit tax for substantial investments in capital goods, industrial or agricultural production, and large-scale tourism or entertainment projects, subject

See MoreRussia proposes reduced VAT on essential goods

Russia proposes VAT cut on essential food items, children’s products, periodicals, and medical items. The Russian State Duma received draft law No. 1011590-8 on 8 September 2025, proposing a reduction of the value-added tax (VAT) rate from 10%

See MoreTanzania: TRA introduces 16% VAT on B2C online payments

The Tanzania Revenue Authority (TRA) has announced that a reduced VAT rate will apply to B2C online purchases made through banks or approved electronic payment platforms, effective 1 September 2025. TRA will implement a new VAT rate of 16%

See MoreFinland: Government announces 2026 budget measures

The 2026 budget proposal includes reduced corporate tax rates, tightened crypto reporting requirements, adjusted VAT rates, and cuts to CO2 fuel taxes, as well as increased taxes on vehicles, tobacco, alcohol, and soft drinks. Finland’s

See MoreDenmark announces 2026 Finance Bill, proposes reduced electricity and excise tax reliefs

The 2026 Finance Bill includes an electricity tax cut, excise duty removal on food products, VAT abolition on books, and tax adjustments for rural properties. Denmark’s government presented the 2026 Finance Bill on 29 August 2025, proposing tax

See MoreColombia: MoF proposes major tax reforms for 2026 budget

The proposed 2026 budget legislation introduces significant reforms to corporate surtax, VAT, personal income tax, net wealth tax, and capital gains tax, with new tax rules for crypto-asset transactions. Colombia’s Ministry of Finance submitted

See MoreRomania: ANAF publishes draft VAT form to reflect updated rates

The updated VAT return form now includes sections for both old and new VAT rates, with a separate section for reporting dwellings eligible for the reduced 9% VAT rate. Romania’s National Agency for Fiscal Administration (ANAF) released a

See MoreBelgium gazettes laws concerning participation exemption requirements, exit tax rules, and other tax reforms

The Belgian Chamber of Deputies approved the law on 17 July 2025. Belgium’s government has published the Programme Law of 18 July 2025 in the Official Gazette on 29 July 2025. The law introduces a new participation exemption requirement

See MoreChina expands VAT scope to include bond interest

Starting 8 August 2025, a 6% VAT will apply to interest income from newly issued treasury, local government, and financial bonds. China’s Ministry of Finance and State Taxation Administration issued Announcement No. 4 of 2025 on 31 July 2025,

See MoreRomania gazettes application norms after VAT increase

Government Decision No. 602/2025 reflects the VAT rate increase effective 1 August 2025. Romania has published Government Decision No. 602/2025 (GD No. 602/2025) in the Official Gazette No. 715 on 31 July 2025. Government Decision No.

See MoreGhana announces new tax measures in 2025 mid-year budget, removes exemption on marine gas oil

The 2025 mid-year budget introduces tax reforms, removing marine gas oil tax exemptions for non-artisanal fishing fleets, enhancing the modified taxation system with digital tools, and simplifying VAT to reduce rates and exempt small

See MoreRomania increases standard and reduced VAT rates, effective starting tomorrow

Starting 1 August 2025, Romania will unify the 5% and 9% VAT rates into a single 11% rate and raise the standard VAT rate from 19% to 21%. Effective from tomorrow, 1 August 2025, Romania’s reduced VAT rates of 5% and 9% have been unified and

See MoreIndonesia to increase tax rates on cryptocurrency transactions

Indonesia will increase taxes on crypto trades and remove VAT for buyers starting August 2025. Indonesia will increase taxes on cryptocurrency transactions starting 1 August 2025 under new regulations issued by the Ministry of Finance. The move

See MoreIreland clarifies VAT and income tax obligations for social media influencers

The Irish Revenue has confirmed that social media influencers must follow standard income tax and VAT rules. The Irish Revenue Commissioners have confirmed that social media influencers are subject to standard income tax and VAT rules, with no

See MoreKazakhstan adopts new tax code, introduces additional R&D tax deduction to 200%

The Tax Code, effective 1 January 2026, introduces a standard CIT rate of 20%, adjusted CIT rates for various sectors, a VAT increase from 12% to 16%, with various exemptions. Kazakhstan has introduced a new Tax Code, as per Law No. 214-VIII,

See More