China issues new guidance on VAT deductions

China’s Ministry of Finance and State Taxation Administration has issued Announcement No. 13 of 2026 on 30 January 2026, clarifying rules on the deduction of input value-added tax (VAT). Effective 1 January 2026, the guidance overrides previous

See MoreBolivia: Ministry of Economy and Public Finance proposes 100% VAT credit restoration for fuel purchases

Bolivia’s Ministry of Economy and Public Finance submitted a draft law on 31 December 2025 to repeal the 70% cap on VAT tax credits for fuel purchases, aiming to restore full (100%) credit recognition for gasoline and diesel. The move follows

See MoreUruguay updates rules on investment incentives for priority sectors

Uruguay issued Decree 329/025 on 13 January 2026, introducing updated rules for the investment incentive regime established under Law 16,906 of 1998 for promoted sectoral activities. The regulation establishes a merit-based system where companies

See MoreItaly issues legislative decree updating VAT rules

Italy’s government has published Legislative Decree No. 186/2025 in the Official Journal No. 288 of 12 December 2025 as part of its ongoing tax reform under Law No. 111/2023. The Legislative Decree No. 186/2025 introduces significant updates

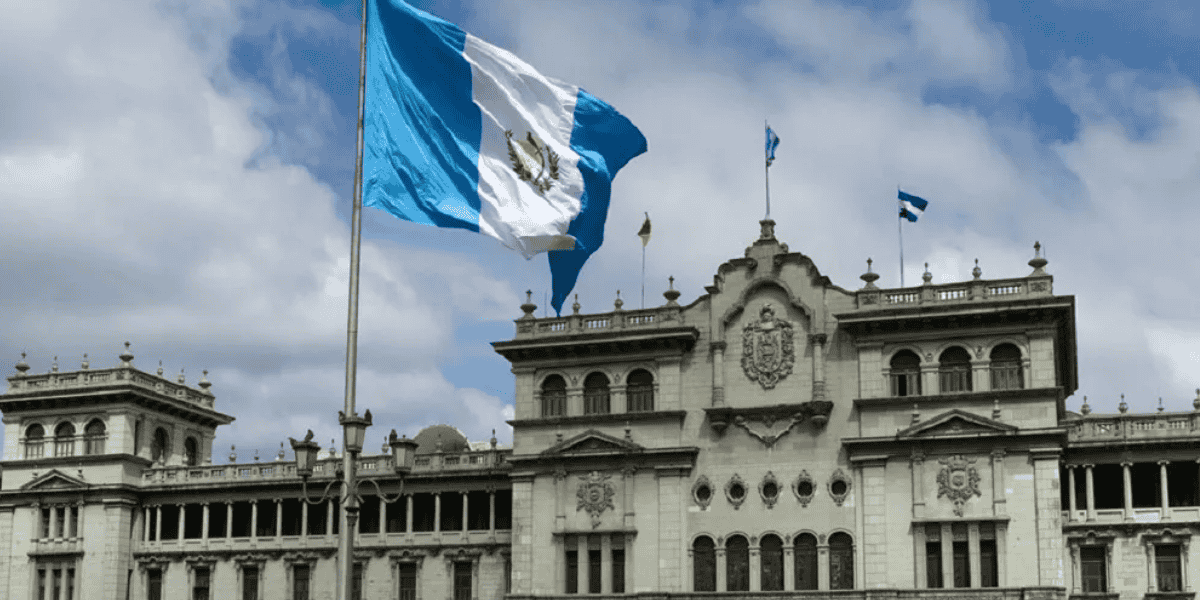

See MoreGuatemala revises regulations on tax credit offsets, refund procedures

Guatemala issued Decree No. 17-2025 in the Official Gazette, introducing amendments to the Tax Code, the Value Added Tax Law, and the Law on Legal Provisions for Strengthening Tax Administration. Decree 17-2025 establishes a new law intended to

See MoreEU Council approves extension of Poland’s 50% VAT deduction limit

The VAT deduction cap is extended until 31 December 2028. The EU Council issued Implementing Decision (EU) 2025/1986 on 22 September 2025, permitting Poland to extend its current VAT deduction restrictions on motorised road vehicles. This

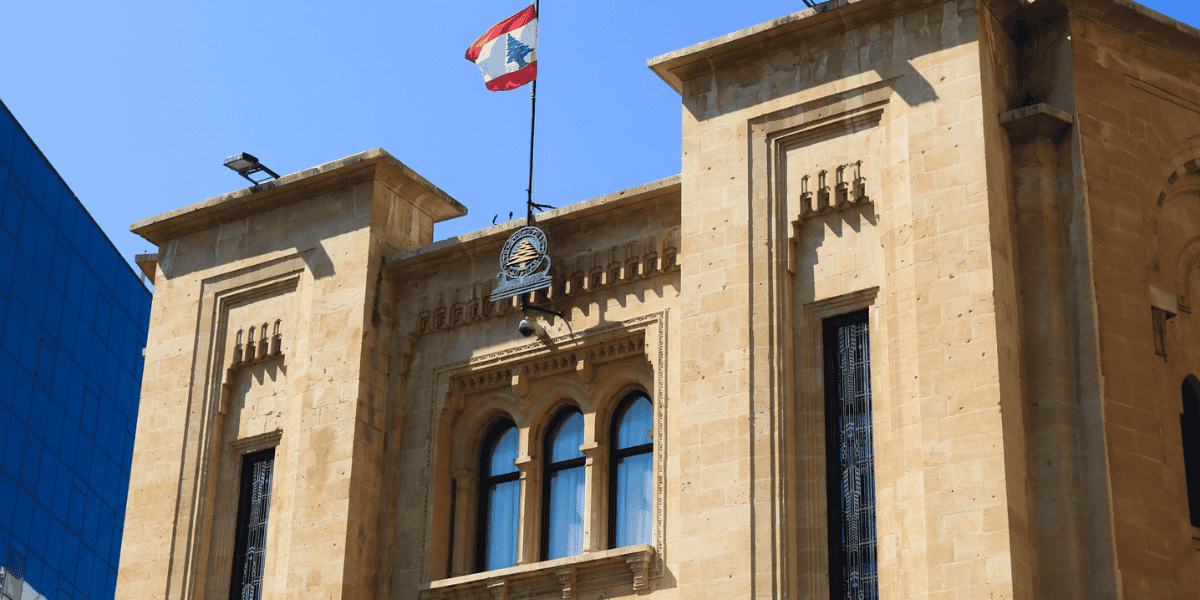

See MoreLebanon: Government tables 2026 budget law draft, introduces amendments to corporate income tax

Lebanon submitted its 2026 Draft Budget Law to the Council of Ministers, proposing wide-ranging reforms across corporate tax, VAT, customs, excise duties, digitalisation, and tax incentives, including stricter deduction rules, and targeted

See MoreChina introduces new VAT refund policy from next month

From September 2025, certain VAT taxpayers can apply for refunds of unused tax credits. China's Ministry of Finance and State Administration of Taxation released Announcement No. 7 of 2025 on 22 August 2025, introducing a new VAT refund policy.

See MoreChina: Finance Ministry consults on draft VAT law regulations

The new draft VAT law aligns with existing VAT policies while introducing key adjustments, organised into six chapters covering provisions, rates, payable taxes, incentives, administration, and supplementary rules. China's Ministry of Finance has

See MoreDenmark: Tax authorities alert businesses about VAT return deadlines for August 2025

In 2025, monthly VAT filers must submit their June report by 18 August, while quarterly or semiannual filers must submit their second-quarter or first-half reports by 1 September. The Danish Tax Agency (Skat) has issued a reminder for companies

See MoreCzech Republic issues guidance on VAT deduction adjustments for bad debts

VAT payers must reduce the VAT deduction for a taxable supply if the payment remains unpaid six months after its due date. The Czech Republic’s General Financial Directorate (GFD) released guidance on correcting VAT deductions for bad debts in

See MoreSpain announces 2024 VAT refund deadline

Spanish and EU businesses have until 30 September 2025 to claim VAT and IGIC refunds for 2024, subject to applicable procedures and reciprocity conditions. Spanish companies and foreign businesses have until 30 September 2025 to claim refunds for

See MoreNigeria: President approves four new tax reform bills

The new legislation comprises the Nigeria Tax Act, the Nigeria Tax Administration Act, the National Revenue Service (Establishment) Act, and the Joint Revenue Board (Establishment) Act. Nigeria’s President Bola Tinubu has signed four major tax

See MoreKenya: National Treasury publishes budget statement 2025-26, reduces corporate and digital tax rates

Kenya's National Treasury has released the 2025-26 Budget Statement on 12 June 2025. Kenya's National Treasury published the 2025-26 Budget Statement on 12 June 2025, outlining key tax measures aligning with proposals highlighted in the 2025

See MoreChile halts corporate tax cut, advances support for small businesses and tourism

Chile's Ministry of Finance released a statement on the first meeting of the High-Level Council for Strategic International Economic and Financial Policy, led by President Gabriel Boric. The release noted that income tax reform plans, including a

See MoreSlovak Republic limits input VAT deduction to 50% on motor vehicles and motorcycles

The Slovak Republic Ministry of Finance has announced that businesses can only claim a 50% VAT deduction on passenger vehicles, fuel, repairs, and maintenance, effective 1 July 2025. This will raise acquisition and operating costs by over

See MoreEuropean Commission proposes cutting VAT deductions for gas-powered fleet vehicles

The European Commission published a communication on 5 March 2025 outlining plans to decarbonise corporate fleets, which account for 60% of new car registrations in the EU. The communication mentioned that fleet operators can negotiate better

See MoreAustria: Lower House of Parliament approves Budget Restructuring Bill 2025

Austria's lower house of parliament (Nationalrat) passed the Budget Restructuring Measures Bill 2025 (Budgetsanierungsmaßnahmengesetz 2025) on 7 March 2025. The announcement was made in a release on 10 March 2025 by the Austrian Ministry of

See More