Serbia: MoF postpones launch of preliminary pre-filled VAT filings to 2027

Serbia’s Ministry of Finance has announced that the Law on Amendments and Supplements to the Law on Electronic Invoicing was approved on 3 December 2025. A significant change introduced by this update relates to the implementation of preliminary

See MoreGermany gazettesTax Amendment Act 2025, introduces individual tax relief, VAT cuts

Germany’s Tax Amendment Act 2025 was officially published in the Government Gazette on 23 December 2025, providing tax relief measures for individuals and other technical amendments to various tax laws. Income tax: Increase in commuter

See MoreTaiwan: MoF reminds businesses that prices must include VAT, uniform invoices are mandatory

Taiwan Northern Area National Taxation Bureau of the Ministry of Finance (MOF) stated that when business operators sell goods or services, the listed prices of taxable items must include value-added tax (VAT). Uniform Invoices must be issued in

See MoreBelgium announces VAT e-Invoicing measures from 2026

Belgium’s tax authority (SPF Finances) announced on 19 December 2025 that all Belgian companies subject to VAT must use electronic invoicing with each other from 1 January 2026. The draft law includes several measures concerning this mandatory

See MoreEgypt unveils second tax facilitation package to ease procedures, boost compliance

The Egyptian Ministry of Finance announced a second tax facilitation package on 15 December 2025, aimed at simplifying tax procedures, expanding the tax base, and strengthening trust with taxpayers, investors, and the business community. The

See MorePoland: MoF implements rules for national electronic invoicing system

Poland’s Ministry of Finance announced four implementing regulations governing the use of the National e-Invoicing System (Krajowy System e-Faktur – KSeF) on 16 December 2025. 1. Cases Exempt from Structured Invoices The regulation of 7

See MoreSri Lanka: IRD postpones adoption of new VAT invoice format

The Inland Revenue Department (IRD) has announced, on 12 December 2025, that the effective date for the new VAT Tax Invoice format has been postponed. Following requests from numerous VAT registered persons, the Commissioner General of Inland

See MoreItaly introduces fiscal measures for third sector, amateur sports, VAT, business crisis procedures, digital platforms

Italy’s Revenue Agency announced that it has published Legislative Decree No. 186 of 4 December 2025 in the Official Gazette on 15 December 2025. This decree introduces a coordinated package of fiscal measures affecting the third sector, amateur

See MorePortugal: Parliament publishes 2026 state budget law, expands scope of reduced VAT rate

Portugal’s parliament has published the final text of the 2026 State Budget Law on 12 December 2025, after it was approved by the parliament on 27 November 2025. The final version of the budget law largely mirrors the initial proposals;

See MoreDenmark: Economic Council prioritises emission taxes

Denmark’s Economic Council Chairmanship released its 2025 environmental economic report on 9 December 2025, highlighting that taxes on greenhouse gas emissions are a more cost-effective and precise tool for promoting the green transition than

See MoreSlovak Republic: Parliament approves mandatory e-invoicing, e-reporting

The Slovak Republic Parliament approved a draft law on 9 December 2025, introducing measures to tackle tax evasion, close the VAT gap, and implement the EU Directive 2025/516 on VAT in the digital era (ViDA). The law establishes mandatory electronic

See MoreCroatia: Parliament adopts streamlined VAT rules, mandatory e-invoicing from January 2026

Croatia’s Parliament approved amendments to the VAT Act concerning e-invoicing. The final version of the amendments was adopted on 5 December 2025. Key legislative actions include extending the reduced 5% VAT rate for specific supplies, such as

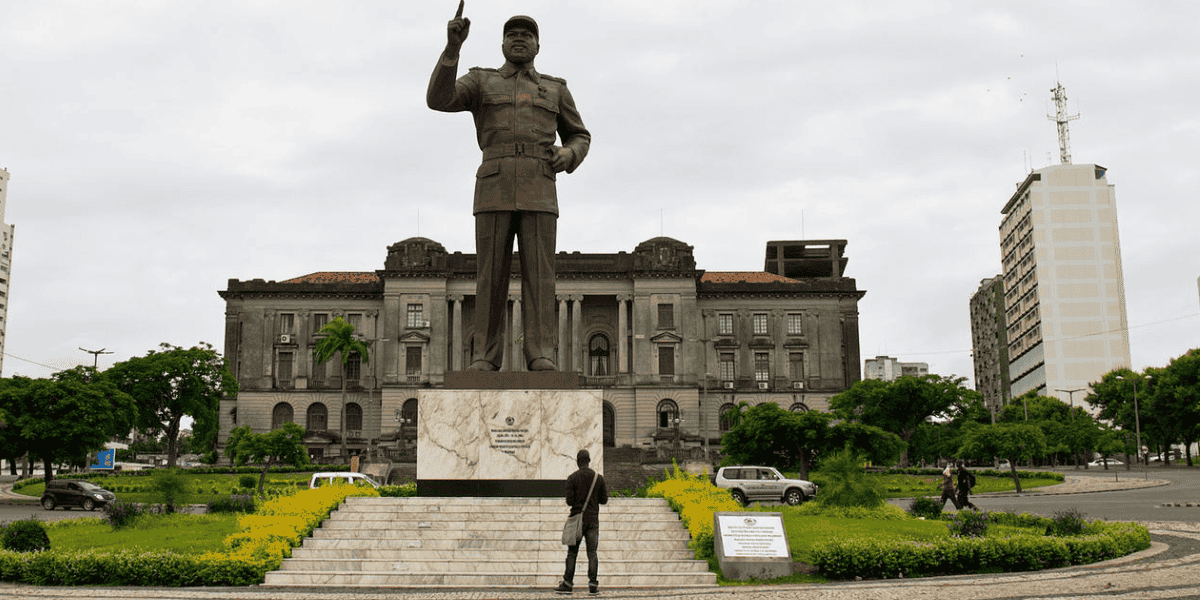

See MoreMozambique: Government adopts amendments to VAT law

Mozambique’s government adopted a draft Value Added Tax (VAT) law during the 41st Session of the Council of Ministers on 2 December 2025. The VAT law is designed to modernise and streamline the electronic submission of invoices and similar

See MoreUAE: MoF clarifies fines for e-invoicing non-compliance

The UAE’s Ministry of Finance (MoF) announced the issuance of Cabinet Resolution No. (106) of 2025 regarding violations and administrative fines resulting from non-compliance with the legislation regulating the Electronic Invoicing System, as part

See MoreUAE: FTA issues administrative exceptions VAT guide

The UAE’s Federal Tax Authority (FTA) issued the Administrative Exceptions VAT Guide on 5 December 2025. The guide explains how registrants can apply for VAT administrative exceptions, which provide concessions allowed under the VAT Law and its

See MoreSwitzerland: Federal Council consults on VAT amendments

The Swiss Federal Council opened a consultation on amendments to the Value Added Tax Act on 5 December 2025. The changes aim to implement two parliamentary motions: the extension of platform taxation to electronic services (Motion WAK-S 23.3012)

See MoreBahrain: NBR updates VAT guidance for real estate sector

Bahrain’s National Bureau for Revenue (NBR) has published Version 1.5 of its VAT Real Estate Guide, dated 18 November 2025, providing updated guidance on Value Added Tax in the Kingdom’s real estate sector. The update clarifies the VAT

See MoreOman: Tax Authority updates e-invoicing FAQs ahead of phased rollout

The Oman Tax Authority (OTA) has released an updated set of Frequently Asked Questions (FAQs) on e-invoicing, providing detailed guidance on the country’s electronic invoicing framework. The e-invoicing rollout, initially planned for 2024, was

See More