Russia mandates transfer pricing method in controlled transaction notifications

Russia's Federal Tax Service (FTS) issued Letter No. ШЮ-4-13/2827@ on 13 March 2025 about the notification of controlled transactions. It clarifies that from 2024, taxpayers must disclose the transfer pricing method used to justify the market

See MoreIsrael seeks input on local R&D centres and IP valuations

Israel’s tax authority (ITA) released a draft Tax Circular on 27 February 2025 for public comment. The circular outlines criteria and requirements for local R&D centres and post-acquisition IP sales, offering potential certainty from the

See MorePoland proposes changes to DAC6 disclosure rules

Poland’s Ministry of Finance has proposed amendments to the mandatory disclosure rules (MDR) for potentially aggressive tax arrangements on 17 February 2025. The draft law aims to improve relations between taxpayers and tax authorities and

See MoreVietnam updates regulations on related-party transactions, transfer pricing

The Vietnam government has issued Decree No. 20/2025/ND-CP amending Decree No. 132/2020/ND-CP on transfer pricing on 10 February 2025, addressing the treatment of lenders or guarantors as related parties. A borrowing or guaranteed enterprise is

See MoreBrazil extends commodity transaction registration deadline

Brazil has extended the deadline for commodity transaction registration deadline, issued in Normative Instruction No. 2.249 of 6 February 2025 which outlines amendments to Normative Instruction RFB No. 2.161 of 28 September 2023 regarding transfer

See MoreIsrael clarifies CbC reporting rules for MNEs

The Israel Tax Authority (ITA) issued Income Tax Circular No. 1/2025 on 11 February 2025, which clarifies amendments to the Income Tax Ordinance. The amendments pertain to transfer pricing and country-by-country (CbC) reporting requirements. The

See MoreCosta Rica issues draft resolution on annual transfer pricing reporting obligation

Costa Rica's Directorate-General of Taxation has published a notice in the Official Gazette announcing a public consultation on a draft resolution on 13 February 2025. The resolution pertains to submitting the informative statement on transfer

See MoreAlgeria clarifies transfer pricing documentation and asset depreciation rules

Algeria’s Ministry of Finance has issued two key orders: the Order of 15 February 2024, outlining transfer pricing documentation requirements, and the Order of 25 February 2024, setting depreciation periods for fixed assets to calculate taxable

See MoreAustralia: ATO updates guidance on transfer pricing for inbound-related private group funding

The Australian Taxation Office (ATO) has released new guidance on transfer pricing for inbound related party funding within private groups that receive funding from an overseas related party or associate for property and construction on 15 January

See MoreCambodia issues transfer pricing rules from 2025

Cambodia's Ministry of Economy and Finance has announced Prakas 574 on 19 September 2024 introducing revised transfer pricing regulations, which went into force on 1 January 2025. The key changes include: Updated definition of "related

See MoreSingapore: IRAS updates 2025 transfer pricing guidance, lowers indicative margin for related-party loans

The Inland Revenue Authority of Singapore (IRAS) released updated transfer pricing guidelines on 2 January 2025. The indicative margin for related-party loans has been revised to +170 basis points (1.70%) from +220 basis points (2.20%) for the

See MoreAzerbaijan amends tax code: Cuts branch profit tax, introduces new corporate tax and VAT exemptions

Azerbaijan has approved several amendments to the Azerbaijan Tax Code on 27 December 2024. Key amendments include a reduction of branch profit tax rate, new corporate income tax exemptions, and revised transfer pricing penalties. Reduction of

See MoreAustralia: ATO issues guidance for local file and master file, private property and construction sector company transfer pricing for 2025

The Australian Taxation Office (ATO) has published updated guidance on the local and master file requirements – which applies to reporting periods beginning on or after 1 January 2024 –, and transfer pricing guidance for the private property and

See MoreNetherlands updates low-tax and non-cooperative jurisdictions list for 2025

The Netherlands has revised its lists of low-tax and non-cooperative jurisdictions for tax purposes, announcing the removal of Antigua and Barbuda, Belize, and the Seychelles. The lists are used for Dutch tax rules, targeting jurisdictions with

See MoreBrazil: Revenue authority publishes updated guidance on commodities transfer pricing

Brazil’s revenue authority (Receita Federal) has issued new guidelines for Normative Instruction RFB No. 2246 of 30 December 2024, outlining rules for companies regarding the management of transfer pricing for transactions that involve commodities

See MoreOECD introduces new tools to simplify transfer pricing (Amount B)

The OECD has announced the launch of new tools to streamline the implementation of Amount B under Pillar One aimed at simplifying transfer pricing rules. Amount B under the Two-Pillar Solution to Address the Tax Challenges of the Digitalising

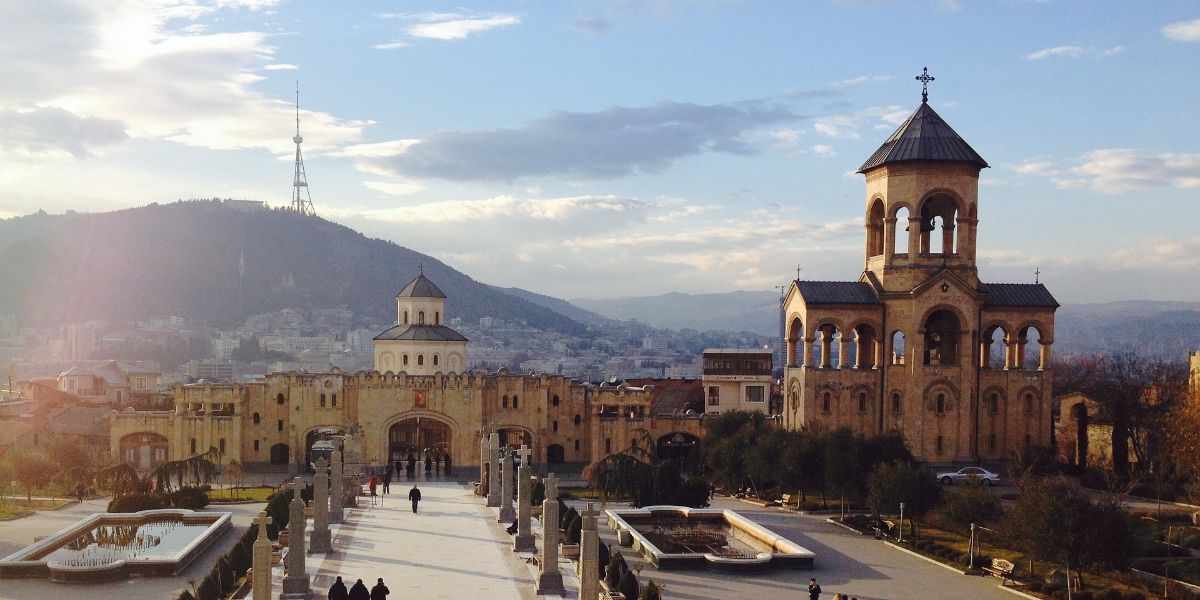

See MoreGeorgia amends transfer pricing regulations for 2025

Georgia’s Ministry of Finance has announced that it has amended its international controlled transaction regulations through Order No. 331 (issued on 2 October 2024) to align with the latest OECD Transfer Pricing Guidelines. The amendment also

See MoreUS: Treasury, IRS clarify stance on OECD’s simplified transfer pricing rules

The US Treasury Department and the Internal Revenue Service (IRS) released Notice 2025-04, “Application of the Simplified and Streamlined Approach under Section 482”, on 18 December 2024, clarifying the US government’s stance on using the

See More