Bulgaria: MoF updates transfer pricing rules

Bulgaria’s Ministry of Finance (MoF) issued Ordinance H-3 of 7 November 2025, updating the country’s transfer pricing framework to align with the latest OECD Transfer Pricing Guidelines. The ordinance was published in the State Gazette on 11

See MoreBulgaria consults proposed transfer pricing reforms, positions to match OECD standards

The consultation is set to conclude on 23 October 2025. Bulgaria has initiated a public consultation on its proposed draft regulations to update its transfer pricing regulations as part of its efforts to join the Organisation for Economic

See MoreOECD: Finland, Liechtenstein, and Norway join GIR MCAA

In total, 20 countries have signed the agreement as of 30 September 2025. According to an OECD update on 30 September 2025, Finland, Liechtenstein, and Norway have signed the Multilateral Competent Authority Agreement on the Exchange of GloBE

See MoreSouth Africa: SARS consults draft rules for CARF implementation, CRS amendments

The consultation concludes on 3 October 2025. South Africa’s National Treasury and the South African Revenue Service (SARS) introduced draft regulations on 15 September 12025, aimed at enhancing the country's approach to cryptoasset oversight

See MoreOECD releases updated signatory list for GIR MCAA

Switzerland is the latest signatory to join the GIR MCAA. The OECD has released the list of 16 countries that have signed the Multilateral Competent Authority Agreement on the Exchange of GloBE Information (GIR MCAA) as of 19 September

See MoreOECD extends comment period on copper pricing toolkit

The deadline for submitting comments has been extended to 17 September 2025. The OECD announced an extension for public comments on its draft toolkit in August 2025, designed to help developing countries address transfer pricing challenges in

See MoreArgentina joins CRS MCAA

As of 25 July 2025, 55 jurisdictions have signed the Addendum to the CRS MCAA. Argentina signed the Addendum to the Multilateral Competent Authority Agreement on Automatic Exchange of Financial Account Information (CRS MCAA) on 1 July

See MoreFrance approves Amount B simplified transfer pricing method for transactions with developing countries

France will restrict the use of the OECD's Amount B transfer pricing method to transactions with developing nations that have adopted the method and have a bilateral tax treaty with France, excluding non-qualifying jurisdictions. France

See MoreEuropean Commission adopts proposal for council decision on amending protocol to AEOI-CRS agreement with Andorra

The European Commission adopted a decision on 17 July 2025 to authorise signing a protocol with Andorra for automatic exchange of financial account information under the OECD's common reporting standard. The European Commission (EC) adopted

See MoreBelgium revises CRS list, adds Armenia and Uganda

The updated CRS exchange list for 2024 now includes Armenia and Uganda. Belgium’s government has published the Royal Decree of 2 July 2025 in Official Gazette No. 2025004947 of 8 July 2025. The Royal Decree updates the list of jurisdictions

See MoreGabon: Council of Ministers ratifies BEPS MLI and mutual assistance convention

Gabon approved the ratification of the Multilateral Convention to Prevent Base Erosion and Profit Shifting (MLI) on 30 May 2025. Gabon's Council of Ministers approved ratifying the Multilateral Convention to Prevent Base Erosion and Profit

See MoreArgentina ratifies BEPS multilateral instrument (MLI)

Argentina's President ratified the Multilateral Convention to Prevent BEPS (MLI) on 28 May 2025. Argentina’s President has signed Decree No. 361/2025, ratifying Law No. 27.788 and the Multilateral Convention to Implement Tax Treaty Measures to

See MoreFinland updates CRS participating jurisdictions list

The Finnish Tax Administration has published an updated list of participating jurisdictions for exchanging financial account information under the Common Reporting Standard (CRS) on 15 May 2025. The Common Reporting Standard (CRS), developed in

See MoreOECD consults Ukraine’s transfer pricing rules

The OECD is working with Ukraine's Ministry of Finance to align Ukraine's Transfer Pricing Framework with OECD Transfer Pricing Guidelines, as part of the implementation of Ukraine's National Revenue Strategy. Project description To ensure

See MoreCape Verde joins OECD agreement on exchange of CbC reports

Cape Verde has signed the OECD Multilateral Competent Authority Agreement on the Exchange of Country-by-Country Reports (CbC MCAA) on 9 April 2025. Under BEPS Action 13, all large multinational enterprises (MNEs) are required to prepare a

See MoreOECD introduces new tools to simplify transfer pricing (Amount B)

The OECD has announced the launch of new tools to streamline the implementation of Amount B under Pillar One aimed at simplifying transfer pricing rules. Amount B under the Two-Pillar Solution to Address the Tax Challenges of the Digitalising

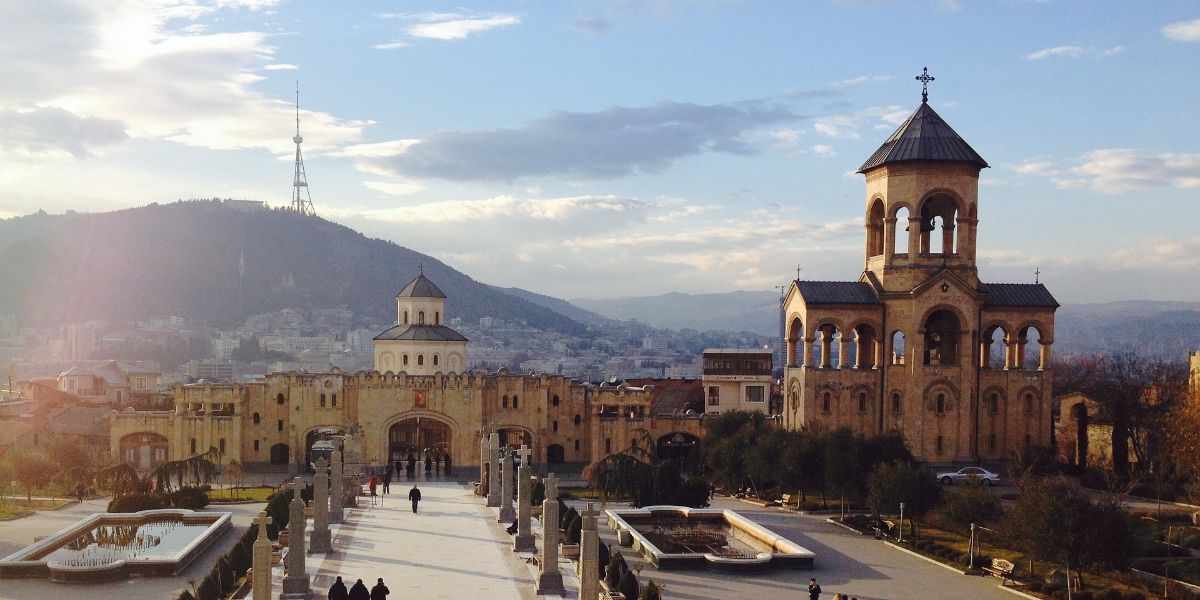

See MoreGeorgia amends transfer pricing regulations for 2025

Georgia’s Ministry of Finance has announced that it has amended its international controlled transaction regulations through Order No. 331 (issued on 2 October 2024) to align with the latest OECD Transfer Pricing Guidelines. The amendment also

See MoreUS: Treasury, IRS clarify stance on OECD’s simplified transfer pricing rules

The US Treasury Department and the Internal Revenue Service (IRS) released Notice 2025-04, “Application of the Simplified and Streamlined Approach under Section 482”, on 18 December 2024, clarifying the US government’s stance on using the

See More