Slovak Republic releases 2023 transfer pricing documentation guidelines

Slovak Republic's Ministry of Finance has issued guidelines (MF/020061/2022-724) outlining the requirements for transfer pricing documentation for 2023. These guidelines categorise transfer pricing documentation into three types: Full-scope

See MoreCyprus announces updates to its transfer pricing FAQs

On 28 March 2024, the Cyprus Tax Department released the updated version of its English-language Frequently Asked Questions (FAQs) on transfer pricing. The FAQs present the questions and the corresponding answers as published on the Tax

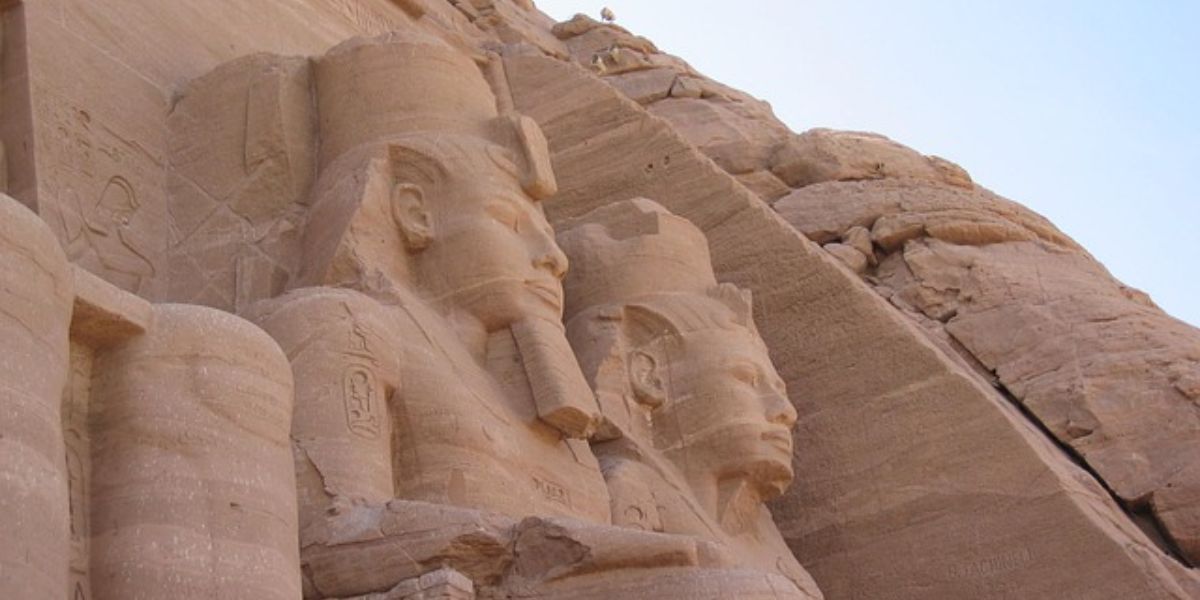

See MoreEgypt raises materiality threshold for master file and local file for 2024

On 15 February 2024, Egypt published the Ministerial Decree No. 52 of 2024 in the Official Gazette, providing updated transfer pricing documentation requirements for Egyptian taxpayers. This decree came into effect on 22 February 2024. In this

See MoreEgypt preparing draft for new income tax law

Egypt’s Minister of Finance for Tax Policy and Reforms has announced plans to draft a new iteration of the Income Tax Law. The details of the new law has been fully published, but the main proposals of the new law include: A focus on

See MoreCyprus revises thresholds for transfer pricing documentation

On 1 February 2024, the Cyprus Tax Department released updated thresholds regarding the requirement for taxpayers to prepare a Cyprus Local File for intercompany transactions covered by Section 33 of the Income Tax Law (ITL). These revised

See MoreMalta issues guidelines for transfer pricing rules

On 19 January 2024, Malta's Commissioner for Revenue published Guidelines in relation to the Transfer Pricing Rules. These guidelines are issued in terms of Article 96(2) of the Income Tax Act (Chapter 123 of the Laws of Malta) and are to be read in

See MoreKazakhstan’s Transfer Pricing Legislative Amendments 2023

Kazakhstan is undergoing a pivotal transformation in its transfer pricing framework, marked by the Majilis' approval of substantial amendments to the existing legislation. The aim is to curb revenue losses, prevent capital outflow, and align with

See MoreEcuador releases updated technical sheet for standardizing the analysis of transfer pricing

On 22 November 2023, the Ecuadorian Tax Authority released a new edition of the technical sheet for the standardization of transfer pricing analysis, effective for fiscal year 2023. This updated document introduces significant changes to filing

See MoreFrance: Tax authority updates transfer pricing guidelines for SMEs

On 22 November 2023, the French tax authority published an updated transfer pricing guide for small and medium-sized enterprises (SMEs). The guide covers a wide range of topics, including the concept of transfer pricing, the arm's length principle,

See MoreAustralia extends deadline for submitting CbC reports, Master file & Local file

The Australian Tax Office (ATO) has announced that taxpayers with country-by-country (CbC) reporting obligations for the year ending 31 December 2022 will now have until 31 January 2024 to submit their reports. This extension applies to the CbC

See MoreEgypt releases explanatory instructions on transfer pricing reporting obligations

On 19 September 2023, the Egyptian Tax Authority issued Explanatory Instruction No. 78 introducing mandatory transfer pricing reporting obligations for related party transactions. Accordingly, the Tax Authority has set deadlines for submitting

See MoreChile declares revised tax return deadlines for 2024

On 4 October 2023, the Chilean federal tax agency published Resolution No. 116 with revised filing deadlines of different forms for the 2024 tax year. The deadlines of forms are as follows: March 1: Forms 1811, 1822, 1834, 1891, 1900, 1902,

See MoreBrazil releases normative instruction for its new transfer pricing rules

On 28 September 2023, Brazil published Normative Instruction Nº 2,161 (IN 2,161/23) that governs Brazil’s recently established new transfer pricing law. The new legislation explicitly adopts the arm's length principle into the Brazilian legal

See MorePoland releases notice providing clarification on TPD documentation

On 4 September 2023, the Polish Official Gazetted a notice aimed at providing comprehensive clarification regarding the regulations governing transfer pricing documentation for corporate income tax purposes. This notice encompasses several key

See MoreUK updates transfer pricing documentation requirements

The United Kingdom (UK) has published the Transfer Pricing Records Regulations 2023, which updated transfer pricing documentation requirements by introducing Local file and Master file requirements. The UK has officially updated its transfer

See MoreFrance updates list of exempted countries for CbC report local filing requirements

On 13 August 2023, Government published the Decree which amends the Order 6 July 2017 pursuant to II of Article 223 quinquies C of the General Tax Code. The new Decree updates the the list of country exemption from local filing Country-by-Country

See MoreSouth Korea: MOEF announce tax reform proposal for 2023

On 27 July 2023, South Korea’s Ministry of Economy and Finance (MOEF) announced the tax reform proposal for 2023. The tax reform proposal includes changes in the Korean Pillar two global minimum tax rules and transfer pricing compliance

See MoreCyprus: Tax department issues transfer pricing simplification measures

On 6 July 2023, the Cyprus Tax Department released a new circular (6/2023) entitled "Simplification measures for persons exempt from the obligation to maintain a Cyprus local file". The Circular provides guidance for persons exempt from the

See More