Malaysia: IRB revises capital gains tax guidance for unlisted shares

The guidelines outline the CGT treatment for gains from disposing of unlisted shares and relevant company shares. Malaysia’s Inland Revenue Board (IRB) has published the updated guidelines on capital gains tax for unlisted shares on 21 July

See MoreSingapore: IRAS rules capital gains from property interest transfers are tax-exempt

IRAS ruled on 1 August 2025 that gains from intra-group transfer of long-held investment properties are capital and not taxable. The Inland Revenue Authority of Singapore (IRAS) released an advance ruling summary no. 16/2025 on 1 August 2025,

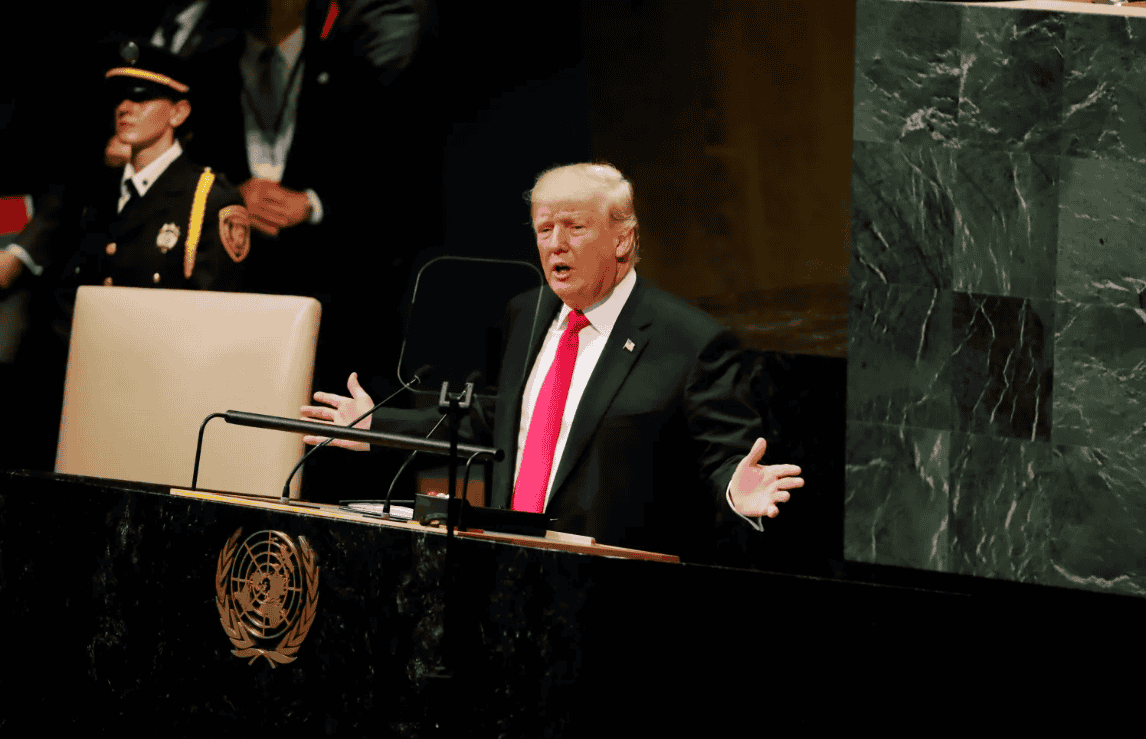

See MoreUS: Trump administration considers eliminating capital gains tax on home sales

Under current law, US residents can exclude up to USD 250,000 in capital gains from taxable income when selling their primary residence. US President Donald Trump announced on 22 July 2025 that his administration is considering eliminating

See MoreAustralia: ATO issues guidance on foreign capital gains withholding credits from property sales

Clients subject to the foreign resident capital gains withholding (FRCGW) are required to file a tax return to claim withheld credits, regardless of income level. The Australian Taxation Office (ATO) has issued a guidance on 18 July 2025, on

See MoreKazakhstan introduces 10% corporate tax on select income

Law No. 208-VIII ZRK is effective from 1 January 2025. Kazakhstan has introduced a new 10% corporate tax rate for certain incomes under Law No. 208-VIII ZRK, signed by the President on 15 July 2025 and published on 16 July 2025. The rate

See MoreBelgium: Government submits tax reform proposals to parliament, includes investment gains tax, participation exemption

Key proposals include a 5% capital gains tax, a participation exemption for group contributions, revised deductions, and revised statute of limitations rules. Belgium’s Chamber of Deputies is reviewing a draft law submitted on 3 July 2025 to

See MoreTanzania enacts 2025-26 budget measures, includes new transfer pricing penalty

The measures will apply from 1 July 2025, unless otherwise specified. Tanzania's Finance Act 2025 was enacted on 30 June 2025, implementing tax measures from the 2025-26 Budget Speech with some adjustments to the initially announced

See MoreNigeria: President approves four new tax reform bills

The new legislation comprises the Nigeria Tax Act, the Nigeria Tax Administration Act, the National Revenue Service (Establishment) Act, and the Joint Revenue Board (Establishment) Act. Nigeria’s President Bola Tinubu has signed four major tax

See MoreRomania announces 2025–28 tax reforms, raises dividend tax

The proposed tax reforms target increased taxes on dividends, reduced incentives, stricter expense deductions, and simplified VAT rates. Romania published its decision approving the 2025-2028 Government Programme in the Official Gazette on 23

See MoreUganda presents 2025–26 budget, proposes income tax exemption for start-ups

Uganda's Ministry of Finance unveiled a UGX 72.136 trillion national budget for 2025-26. Uganda’s Ministry of Finance Planning and Economic Development has unveiled a UGX 72.136 trillion national budget for the 2025-26 financial year on 12

See MoreCzech Republic considers amendments to Income Tax Act, plans R&D tax incentive boost

The amendments propose abolishing withholding tax, removing the CZK 40 million capital gains cap, and increasing R&D allowances. The Czech Republic’s Chamber of Deputies is reviewing a draft legislation on the"Act on Single Monthly Employer

See MoreBrazil: Government to raise tax on interest on equity in fiscal package

Brazil's Finance Ministry plans to increase the income tax on interest on equity (JCP) payments from 15% to 20% as part of a new fiscal package. Brazil's Finance Minister, Fernando Haddad, announced on 10 June 2025 that the government is

See MoreEgypt to replace capital gains tax with stamp tax on stock transactions

Egypt's Cabinet replaces the capital gains tax on securities with a stamp tax. Egypt’s Cabinet has decided to cancel the capital gains tax on securities listed on the country’s stock exchanges on 4 June 2025. Ministers have decided to

See MorePhilippines enacts Capital Markets Efficiency Promotion Act (CMEPA)

Philippine President Ferdinand R. Marcos, Jr. has signed the Capital Markets Efficiency Promotion Act (CMEPA) into law on 30 May 2025, which goes into force on 1 July 2025. Philippine President Ferdinand R. Marcos, Jr., has signed the Capital

See MoreQatar approves tax exemption on capital gains from group restructuring

Qatar has approved a tax exemption on capital gains from group restructurings, aiming to boost investment, support business growth, and enhance economic competitiveness. Qatar’s General Tax Authority announced its support for the Cabinet’s

See MoreNetherlands: Government submits Box 3 tax reform bill to House of Representatives

The Netherlands Ministry of Finance has published a letter to the House of Representatives regarding the submission of a draft bill to reform Box 3 income taxation, which includes income from savings and investments, on 16 May 2025. The reform

See MoreAustria: Budget Accompanying Act 2025 awaits parliamentary approval, proposes amendments to VAT, income taxes amongst others

Austria’s Ministry of Finance (BMF) has released the draft Budget Accompanying Act 2025 (BBG 2025) on 2 May 2025. The Budget Accompanying Act 2025 is presently awaiting parliamentary approval. The proposed key tax measures include amendments to

See MoreBelgium unveils tax reforms, includes tighter exemptions, broader exit tax

The Belgian government has presented an overview of its tax reforms to the parliament on 24 April 2025. This follows after Belgium’s five political parties agreed on a coalition government program on 31 January 2025, outlining various tax

See More