Australia: ATO releases list of government entities eligible for e-invoicing

The Australian Taxation Office (ATO) released an updated list featuring 132 Australian government entities registered on the Peppol network On 22 October 2024. The Peppol is an extremely secure network used to exchange business-critical

See MoreAustria: Appointment of alternative Pillar Two taxpayer due by December

The appointment of an alternative Pillar Two taxpayer in Austria, for taxpayers operating on a calendar year basis, is required to be submitted to the relevant tax office by 31 December 2024. Evidence of this appointment must be uploaded to

See MoreGermany publishes final guidance on mandatory e-invoicing

The German Ministry of Finance has published the final guidance on mandatory e-invoicing on 15 October 2024. The principles of the guidance are to be applied to all sales made after 31 December 2024. As established by the Growth Opportunities

See MoreUS: IRS announces 2025 tax inflation adjustments

The US Internal Revenue Service (IRS) released IR-2024-273 on 22 October 2024 about the annual inflation adjustments for tax year 2025. The Revenue Procedure 2024-40 provides detailed information on adjustments and changes to more than 60 tax

See MoreUS: Treasury, IRS relieves tax-exempt organisations from CAMT form filing for 2023 tax year

The US Department of Treasury and the Internal Revenue Service (IRS), in a release – IR-2024-277, granted a filing exception for tax-exempt organisations on 23 October 2024; they do not have to file Form 4626, Alternative Minimum Tax –

See MoreUS: FinCEN clarifies public utility exemption for reporting beneficial ownership

The US Treasury Department's Financial Crimes Enforcement Network (FinCEN) issued a final rule that clarifies the public utility exemption within the beneficial ownership information reporting rule. The final rule was published in the Federal

See MoreKenya: KRA to leverage AI and tech to promote tax compliance

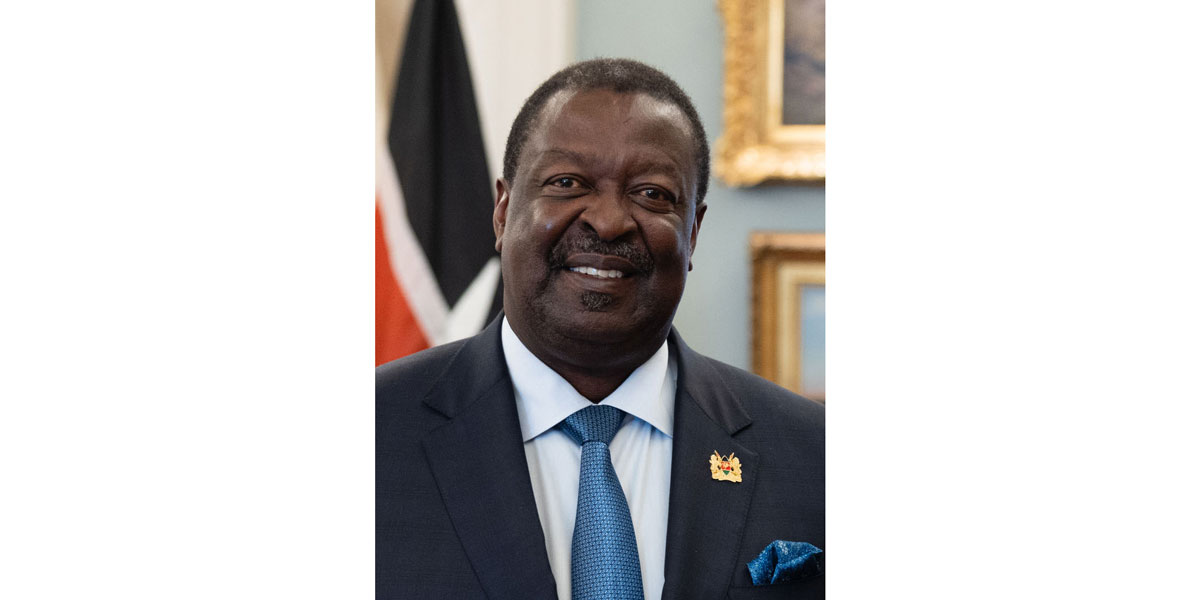

The Kenya Revenue Authority (KRA) Commissioner General (CG) HE Dr Musalia Mudavadi plans to use artificial intelligence (AI), the Internet of things (IoT), big data, and blockchain to improve tax administration, enhance transparency, and tackle tax

See MoreMalaysia revises e-invoicing rules, implementation dates

The Inland Revenue Board of Malaysia (IRBM) released updated guidelines on the new electronic invoicing (e-invoicing) requirements on 4 October 2024. These include the new e-Invoice Guideline (Version 4.0) and e-Invoice Specific Guideline (Version

See MoreUS: IRS grants six-month filing extension for Exempt Organisation Business Income Tax Return

The US Internal Revenue Service (IRS) has granted certain applicable entities that are making an elective payment election a six-month automatic extension of time to file an original or superseding Form 990-T, Exempt Organisation Business Income Tax

See MoreCroatia consults amendments to General Tax Act: Shareholders to be considered as guarantors for failing to file

Croatia’s government has published proposed amendments to the General Tax Act and launched a public consultation. The consultation is set to conclude on 24 October 2024. Once enacted, the amendment will take effect on 1 January

See MoreUS: IRS publishes list of entities, branches with qualified intermediary status

The US Internal Revenue Service (IRS) published its list of entities and branches that have achieved qualified intermediary (QI) status under the Foreign Account Tax Compliance Act (FATCA). The Qualified Intermediary (QI) Program administers

See MoreUS: IRS direct file to expand to 12 states, cover more tax situations for 2025 filing season

The US Internal Revenue Service released IR-2024-258 on 3 October 2024, announcing that Direct File will be available for the 2025 tax filing season in double the number of states than last year’s pilot, and it will cover a wider range of tax

See MoreArgentina extends tax amnesty opt-in deadlines

Argentina’s Executive Branch issued Decree 864/2024, which extends the deadlines to opt for the tax amnesty regime, published in the Official Gazette of 30 September 2024. The tax amnesty regime was introduced by Law 27,743 setting new

See MoreUS: IRS consults tax form for reporting Partner’s Report of Property Distributed by a Partnership

The US Internal Revenue Service (IRS) issued a news release (IR-2024-249) on 30 September 2024 requesting public comments on draft Form 7217 and Instructions for draft Form 7217. On 28 August 2024, the IRS posted a revised draft Form 7217 with

See MoreMalaysia exempts qualifying unit trusts from capital gains, foreign income tax

Malaysia has exempted qualifying unit trusts from capital gains and foreign income tax, issued the Income Tax (Unit Trust) (Exemption) Order 2024 and the Income Tax (Unit Trust in Relation to Income Received in Malaysia from Outside Malaysia)

See MoreChile announces tax submission deadlines for 2025

Chile’s Internal Revenue Service (SII) issued Resolution Ex. SII No. 91-2024 on 12 September 2024, outlining the deadlines for submitting various tax forms in 2025. The resolution went into effect on the date of publishing. The forms and

See MoreCyprus sets deadline for ultimate beneficial owners information

The Department of Registrar of Companies and Intellectual Property (DRCIP) of Cyprus has declared that all companies and partnerships registered under the Companies Law, including European Public Limited Liability Companies, should log into the UBO

See MoreSingapore: IRAS urges timely corporate tax filing, warns of penalties for late returns

About 262,000 companies are expected to file CIT Returns in Singapore this year. The Inland Revenue Authority of Singapore (IRAS) has issued a reminder, on 26 September 2024, to all companies, including those with no business activities or those

See More