Taiwan: Tax Authority extends deadline for monthly business tax filings

Taiwan’s Northern Area National Taxation Bureau of the Ministry of Finance has extended the deadline for businesses filing monthly business tax returns for January 2026 to 23 February, citing the consecutive Lunar New Year holidays. The

See MoreCambodia: GDT reminds self-assessed enterprises of 2025 annual income tax filing, payment deadlines

Cambodia’s General Department of Taxation (GDT) issued notice ( No. L202512110049TD3418) on 14 January 2026, reminding enterprises under the self-assessment regime of their obligations to file and pay annual income tax for the 2025 tax year, in

See MoreMexico announces FY2025 corporate tax returns deadline

Mexico’s tax administration, the Servicio de Administración Tributaria (SAT), has announced, on 12 January 2026, that the annual tax filing deadline for fiscal year 2025 for Mexican resident legal entities will fall on 31 March 2026. In-scope

See MoreMalta: MTA extends electronic corporate income tax filing deadlines for 2026

Malta’s Tax and Customs Administration (MTA) has announced extended deadlines for the submission of corporate income tax returns in 2026, specifically for electronic filings. Manual submissions and tax payments must still meet the deadlines set

See MoreTurkey further extends 2024 local minimum supplementary corporate tax deadline

Turkey’s Revenue Administration has announced an extension for the Local Minimum Supplementary Corporate Tax returns for the 2024 accounting period under Tax Procedure Law Circular No. 195 (VUK-195/2026-1). Under the authority of Article 28

See MoreQatar: GTA announces filing period for tax returns for 2025 financial year

Qatar’s General Tax Authority (GTA) announced on 31 December 2025 that the tax return filing period for the financial year ended 31 December 2025 will run from 1 January 2026 to 30 April 2026. This comes in compliance with the provisions of

See MoreHong Kong: IRD extends 2024-25 lodgement tax return deadline ending January–March 2025

The Hong Kong Inland Revenue Department (IRD) released a Circular Letter to Tax Representatives on the Block Extension Scheme for Lodgement of 2024/25 Tax Returns on 19 December 2025 stating that the IRD recognises the genuine difficulties being

See MoreSri Lanka: IRD further extends income tax deadline due to cyclone Ditwah

Sri Lanka’s Inland Revenue Department (IRD) has further extended the deadline for submitting Income Tax Returns for the 2024/2025 assessment year to 31 December 2025. The extension follows widespread disruption caused by Cyclone Ditwah, which made

See MoreCyprus extends filing deadlines for corporate and individual income tax returns for 2023, 2024

The Cyprus Tax Department, pursuant to Decisions K.D.P. 358/2025 and K.D.P. 359/2025, published an announcement on 28 November 2025 in the Official Gazette, the final deadline for the on-time submission of the company income tax return (T.F.4) and

See MoreHong Kong: IRD extends 2024/25 tax return filing deadline for year-ends January–March 2025

To assist businesses and practitioners with recent operational demands, through Circular Letter to Tax Representatives on the Block Extension Scheme for Lodgement of 2024/25 Tax Returns on 21 November 2025, the Inland Revenue Department (IRD)

See MoreLebanon: MoF extends CIT, income tax deadlines for 2023–24

Lebanon’s Ministry of Finance (MoF) issued Decision No. 899/1 and related measures on 29 October 2025, extending key filing and payment deadlines for corporate income tax (CIT) and income tax obligations for fiscal years 2023 and 2024. The

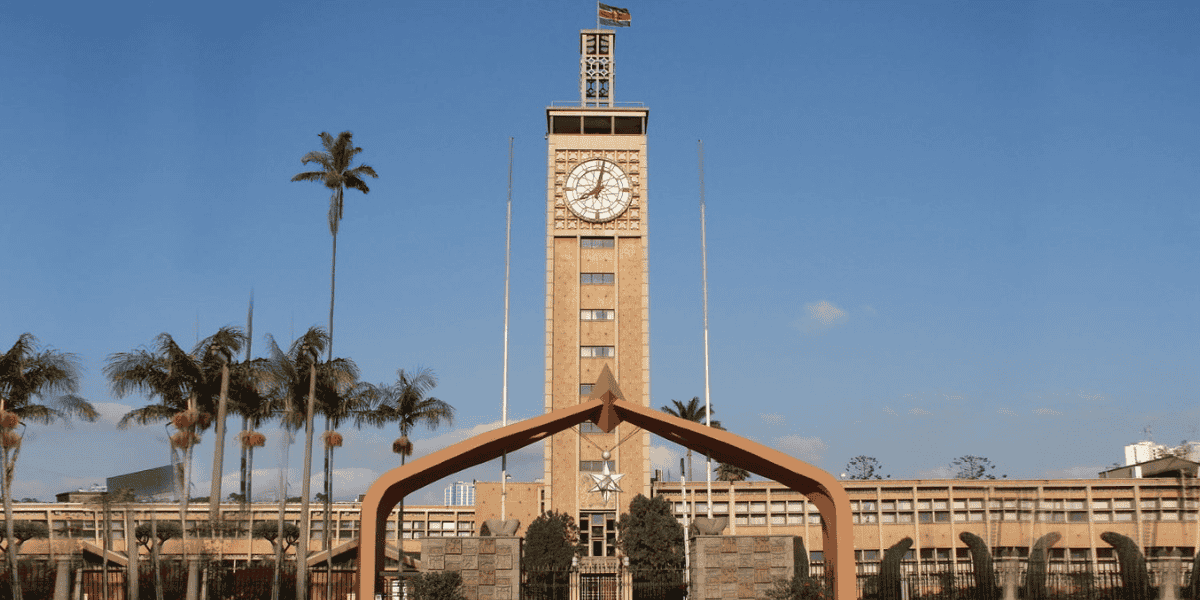

See MoreKenya: KRA to cross-check tax returns against official data sources

The Kenya Revenue Authority announced on 11 November 2025 that, beginning 1 January 2026, it will start cross-checking income and expenses reported in both individual and non-individual tax returns against specific data sources. Validation of

See MoreBolivia: SIN extends agricultural unified tax system obligations deadline for 2024 fiscal year

The deadline was extended because agricultural associations requested more time. Bolivia’s tax authority (SIN) has issued Resolution RND 102500000039 on 10 October 2025, granting an extension for obligations related to the Unified

See MorePakistan: FBR extends 2025 income tax return deadline

FBR extended the Tax Year 2025 corporate income tax return filing deadline to 31 October 2025, after earlier pushing it to 15 October. Pakistan’s Federal Board of Revenue (FBR) announced on 15 October 2025, that the deadline for filing of

See MoreCosta Rica: DGT extends October tax deadlines amid TRIBU-CR system transition

Resolution MH-DGT-RES-0047-2025 grants a one-time extension, moving the deadline for self-assessment tax returns and July–August 2025 information returns. Costa Rica’s tax administration (DGT) published Resolution No. MH-DGT-RES-0047-2025 in

See MoreHong Kong: IRD extends filing deadline for 2024-25 profits tax returns

IRD extended the 2024/25 Profits Tax return filing deadline for ‘M’ code cases. The Hong Kong Inland Revenue Department (IRD) has announced on 2 October 2025 an extension for the lodgement of 2024/25 Profits Tax returns under the Block

See MoreUS: IRS extends filing, payment deadlines for taxpayers impacted by ongoing conflict in Israel

IRS is providing separate but overlapping relief to taxpayers who may be unable to meet a tax-filing or tax-payment obligation, or may be unable to perform other time-sensitive tax-related actions. The US Internal Revenue Service (IRS) announced,

See MorePakistan: FBR extends 2025 corporate income tax return deadline

The extension has been granted in response to requests made by various trade bodies, tax bar associations and the general public. Pakistan’s Federal Board of Revenue (FBR) announced, on 30 September 2025, that the deadline for filing of

See More