Brazil: National Congress nullifies provisional measures on equity interest, financial entities taxes

Proposed tax changes under PM No. 1.303 will not take effect after the required approval is not secured by the deadline. Brazil's National Congress issued Declaratory Act No. 67 on 15 October 2025, which officially confirmed that Provisional

See MoreEthiopia: MoF announces 2025-26 budget, includes alternative minimum tax

Ethiopia's 2025–26 budget introduces major tax reforms, including an alternative minimum tax, revised personal and business income tax rates, digital economy taxation, withholding rules, cash transaction limits, and new measures for corporate

See MorePoland: Council of Ministers broadens withholding tax relief for foreign investors, pension funds to align with EU rules

The amendment adapts Poland’s CIT regulations to the rulings of the CJEU concerning investment and pension funds. Poland’s Council of Ministers has adopted a draft amendment to Poland's Corporate Income Tax (CIT) Act on 14 October 2025,

See MoreBrazil: Chamber of Deputies rejects higher taxes on equity interest, financial entities

Proposed tax changes under PM No. 1.303 will not take effect after failing to secure the required approval by the deadline. Brazil's Chamber of Deputies did not approve Provisional Measure (PM) No. 1.303 issued on 11 June 2025, which proposes

See MoreCosta Rica: DGT revises real estate transfer withholding tax

Resolution No. MH-DGT-RES-0051-2025 repeals the 2% withholding tax for residents on real estate gains while keeping the 2.5% final withholding tax for non-residents. Costa Rica tax administration (DGT) published Resolution No.

See MoreEl Salvador: DGII introduces Form F-935 to report withholding taxes by foreign agents, individuals, entities

The notice instructs foreign agents to report all withholding taxes on the Form by the 15th of the month after the taxes were withheld. El Salvador’s tax administration (DGII) released a notice on 30 September 2025, introducing Form F-935 for

See MoreCosta Rica: DGT overhauls withholding tax reporting returns, self-assessment procedures

Resolution No. MH-DGT-RES-0042-2025 establishes rules for taxpayers required to file both informative and self-assessment withholding tax returns, effective 6 October 2025. Costa Rica’s tax administration (DGT) published Resolution No.

See MoreNigeria mandates withholding tax on interest from short-term securities

FIRS announced that interest from short-term securities investments will now be subject to withholding tax. Nigeria’s Federal Inland Revenue Service (FIRS) issued a public notice on 17 September 2025, mandating withholding of tax on interest

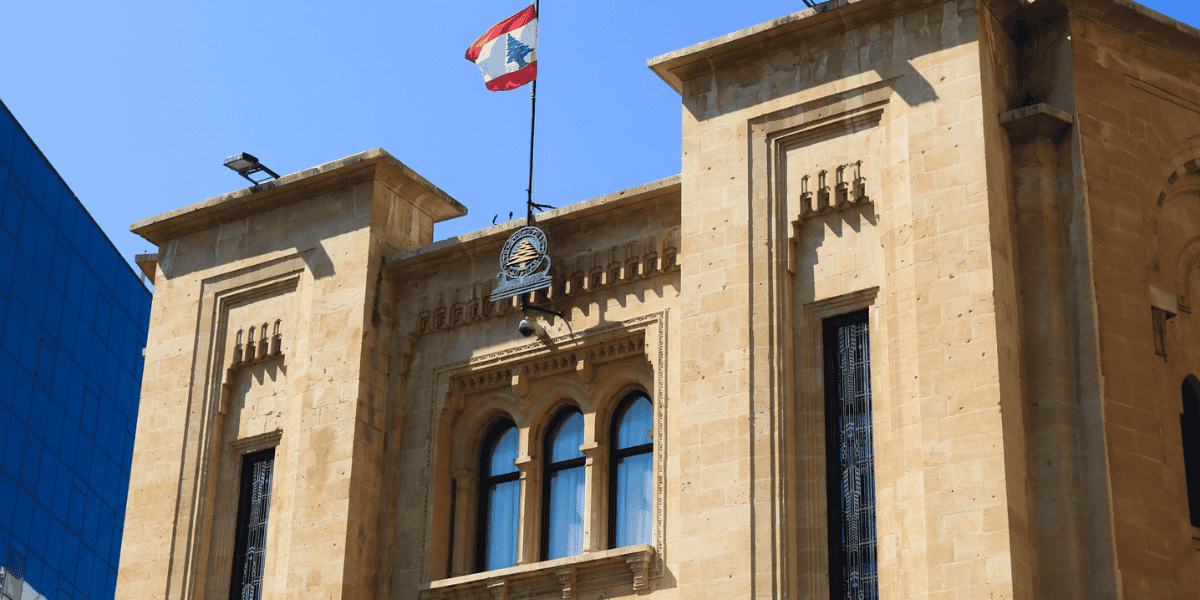

See MoreLebanon: Government tables 2026 budget law draft, introduces amendments to corporate income tax

Lebanon submitted its 2026 Draft Budget Law to the Council of Ministers, proposing wide-ranging reforms across corporate tax, VAT, customs, excise duties, digitalisation, and tax incentives, including stricter deduction rules, and targeted

See MoreCanada: CRA extends withholding tax relief for nonresident subcontractor reimbursements to June 2026

Taxpayers reimbursing non-residents for services in Canada via subcontracting can defer the 15% withholding tax and related interest or penalties until 30 June 2026. The Canada Revenue Agency (CRA) has extended its administrative relief policy

See MoreUS: IRS announces unchanged interest rates, tax underpayments and overpayments for Q4 2025

Under the Internal Revenue Code, the rate of interest is determined on a quarterly basis. The US Internal Revenue Service (IRS) released IR-2025-87 on 25 August 2025, in which it announced that interest rates will remain the same for the calendar

See MoreMalawi lowers tax for select non-resident companies

The Malawi government has abolished the 5% repatriation tax for non-resident companies, increased withholding tax on gambling winnings to 10%, and exempted bread from the 16.5% VAT. Malawi has implemented new tax laws through the Taxation

See MoreZambia advances 2025 tax reform, proposes 1% minimum alternative tax for businesses

Key proposals include a 1% MAT on turnover, 15% to 20% withholding tax on government securities, and excise duty hikes on cigarettes, alcohol, sugary drinks, and betting services. Zambia's National Assembly has advanced the Income Tax

See MoreAustralia: ATO issues guidance on foreign capital gains withholding credits from property sales

Clients subject to the foreign resident capital gains withholding (FRCGW) are required to file a tax return to claim withheld credits, regardless of income level. The Australian Taxation Office (ATO) has issued a guidance on 18 July 2025, on

See MoreBelgium: Chamber of Deputies approve participation exemption changes, exit tax rules, other tax reforms

From 2026, Belgium's tax changes include stricter participation exemption rules, exit tax on cross-border reorganisations, a permanent 6% VAT for residential demolition/reconstruction, and higher VAT on coal and fossil fuel boilers. The Belgian

See MoreItaly: Council of Ministers approves additional supplementary and corrective amendments to tax reform

The bill simplifies regulations, enhances transparency and fairness, revises the Taxpayer's Bill of Rights, and clarifies the self-assessment process with added sanctions. Italy’s Council of Ministers has preliminarily approved a Legislative

See MorePoland: MoF issues guidance on beneficial ownership for withholding tax

The guidance provides clarification of the application of the beneficial owner clause for withholding tax under Corporate and Individual Income Tax Laws. Poland’s Ministry of Finance has issued guidance on 3 July 2025, regarding the application

See MoreCzech Republic considers amendments to Income Tax Act, plans R&D tax incentive boost

The amendments propose abolishing withholding tax, removing the CZK 40 million capital gains cap, and increasing R&D allowances. The Czech Republic’s Chamber of Deputies is reviewing a draft legislation on the"Act on Single Monthly Employer

See More