Taiwan: Instalment payment for overdue tax cases under enforcement

Taiwan's Ministry of Finance has issued a notice regarding the option of instalment payments for overdue tax cases that have been referred for enforcement on 20 November 2024. The National Taxation Bureau of Taipei, Ministry of Finance, stated

See MoreCosta Rica sets rules for initial premiums on state debt payments

Costa Rica has issued Resolution MH-DGH-RES-0053-2024 in the Official Gazette on 4 November 2024. This Resolution outlines procedures for paying initial premium payments on state debt installment plans, covering taxes, fees, and contributions

See MoreBolivia: “Twelfth Taxpayer Group” to adopt online billing

Bolivia’s tax authority, Servicio de Impuestos Nacionales, released guidance RND No. 102400000025 on 10 October 2024 detailing the 12th group of taxpayers required to update and implement digital billing systems. Beginning 1 March 2025, the

See MoreKenya: KRA to leverage AI and tech to promote tax compliance

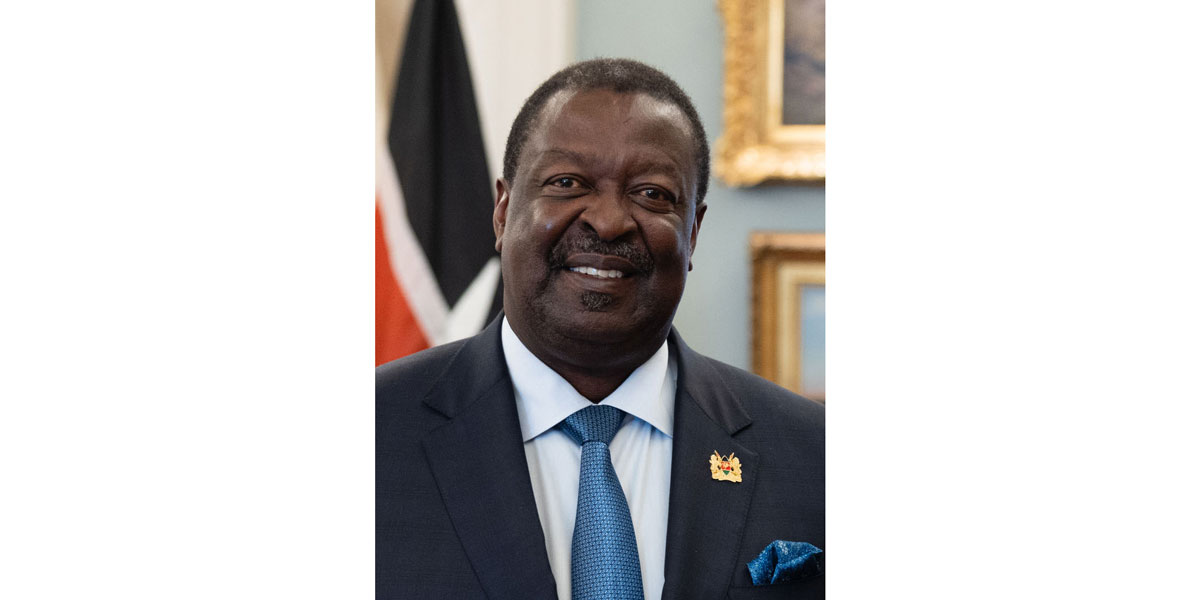

The Kenya Revenue Authority (KRA) Commissioner General (CG) HE Dr Musalia Mudavadi plans to use artificial intelligence (AI), the Internet of things (IoT), big data, and blockchain to improve tax administration, enhance transparency, and tackle tax

See MoreTaiwan clarifies withholding tax rules

Taiwan's Ministry of Finance has released a notice detailing the revised withholding tax rules, which were approved on 7 August 2024 and will come into effect on 1 January 2025. To enhance the protection of the rights and interests for tax

See MoreNigeria to launch e-invoicing for improved tax compliance

Nigeria’s Federal Inland Revenue Service (FIRS) announced it will introduce the FIRS e-invoicing system under the the Tax Administration and Enforcement Act 2007 on 18 September 2024. The FIRS e-invoicing system will be an online digital

See MoreItaly: Council of Ministers approve draft of consolidated tax payment code

Italy’s Council of Ministers preliminary approved a legislative decree on 17 September 2024, introducing a consolidated text for the code governing tax payments and collections. The text contains current provisions from different regulatory

See MoreAustralia releases guidance on new debt deduction creation rules

The Australian Taxation Office (ATO) has released guidance on the new debt deduction creation rules, explaining how the rules apply to private businesses and privately owned groups in relation to the Division 7A loan rules. The new rules came

See MoreMalaysia updates e-invoicing guidelines

Malaysia’s Inland Revenue Board (IRBM) released updates regarding electronic invoicing (e-invoicing) guidelines on 30 July, 2024. These include revised versions of the e-invoice guideline (version 3.2) and the e-invoice specific guideline (version

See MoreMalaysia updates e-invoicing guidance, confirms implementation timeline

Malaysia’s Inland Revenue Board (IRBM) has published updated Guidance and FAQs on 19 July, 2024, regarding its upcoming B2B e-Invoicing system. This follows after IRBM released updates regarding electronic invoicing (e-invoicing) on 28 June,

See MoreUS proposes regulations for tax payments by commercially acceptable means

The Department of the Treasury and the IRS have proposed regulatory changes regarding the payment of taxes through commercially acceptable means on 2 July, 2024. These updates align with the legislative changes introduced by the Taxpayer First

See MoreMalaysia updates e-invoice guidelines

The Inland Revenue Board of Malaysia (IRBM) released updates regarding electronic invoicing (e-invoicing) on 28 June, 2024. These include revised versions of the e-invoice guideline (version 3.0) and the e-invoice specific guideline (version

See MoreRussia issues tax guidance on interest payments to French residents

The Russian Ministry of Finance has issued Guidance Letter No. 03-08-05/11484 on 12 February 2024, outlining the taxation of interest payments to French residents following the suspension of the Russia-France tax treaty under Decree No. 585 on 8

See MoreTurkey adjusts tax debt instalments in force majeure extension

Turkey's Revenue Administration has released Presidential Decision No. 8515, adjusting instalment payments for tax debt restructuring under previous laws, which includes Law No. 7256 of 11 November 2020, and Law No. 7326 of 3 June 2021, in response

See MoreBangladesh possibly faces shortfall in tax collection target

Bangladesh's National Board of Revenue (NBR) is likely to miss its ambitious tax collection target for the fiscal year 2023-24, according to economists and research agencies. Despite a 16% year-on-year growth in collections for the first 10

See MoreTaiwan introduces instalment option for settling significant supplementary taxes

On 7 May 2024, the Ministry of Finance in Taiwan released a notification regarding instalment alternatives for settling significant supplementary taxes. The notification states: The National Taxation Bureau of the Northern Area (NTBNA), MOF

See MoreGreece extends tax payment options with incentives for the tax year 2023

On 5 April 2024, Greece enacted legislation to establish income tax payment terms for the tax year 2023. Greek authorities are offering taxpayers with extended payment options for 2023. This applies to both individuals and entities operating as

See MoreSouth Africa: SARS issues updated guide on taxation

On 1 November 2023, the South African Revenue Service (SARS) issued an updated guide on taxation. This guide providing a high-level overview of the most significant tax legislation administered in South Africa by the Commissioner for the South

See More