Taiwan: Instalment payment for overdue tax cases under enforcement

Taiwan's Ministry of Finance has issued a notice regarding the option of instalment payments for overdue tax cases that have been referred for enforcement on 20 November 2024. The National Taxation Bureau of Taipei, Ministry of Finance, stated

See MoreColombia issues ruling on taxation for non-resident entities with significant economic presence

Colombia’s tax authority, DIAN, recently issued Ruling 890 on 17 October 2024, offering guidance on several tax matters for non-residents with a significant economic presence (SEP) in Colombia. Earlier, on 27 November 2023, the Colombian Ministry

See MoreNetherlands submits third bill to amend Tax Plan 2025, updates funds for joint account regulations

The Netherlands government has presented the third amending bill to the Tax Plan 2025 to the lower house of parliament on 6 November 2024. This bill aims to eliminate an unintended, temporary tax liability for funds held in joint accounts

See MoreCosta Rica sets rules for initial premiums on state debt payments

Costa Rica has issued Resolution MH-DGH-RES-0053-2024 in the Official Gazette on 4 November 2024. This Resolution outlines procedures for paying initial premium payments on state debt installment plans, covering taxes, fees, and contributions

See MoreUAE urges Resident Juridical Persons to register for corporate tax before end of November

The Federal Tax Authority (FTA) has urged Resident Juridical Persons with Licences issued in October and November, irrespective of the year of issuance, to promptly submit their Corporate Tax registration application no later than 30 November

See MoreBolivia: “Twelfth Taxpayer Group” to adopt online billing

Bolivia’s tax authority, Servicio de Impuestos Nacionales, released guidance RND No. 102400000025 on 10 October 2024 detailing the 12th group of taxpayers required to update and implement digital billing systems. Beginning 1 March 2025, the

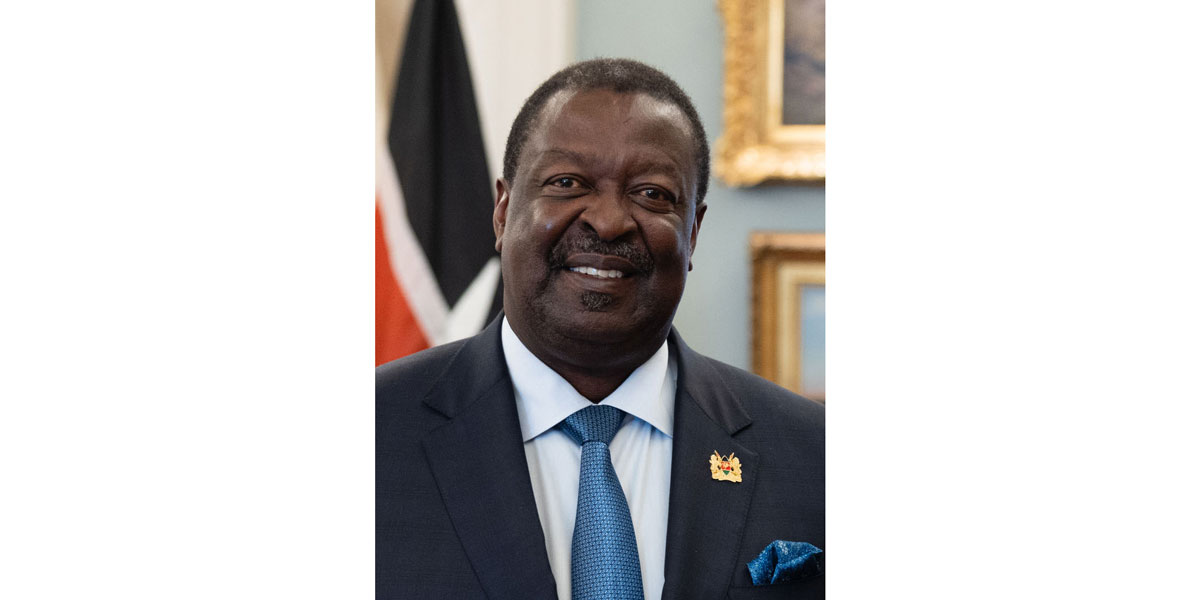

See MoreKenya: KRA to leverage AI and tech to promote tax compliance

The Kenya Revenue Authority (KRA) Commissioner General (CG) HE Dr Musalia Mudavadi plans to use artificial intelligence (AI), the Internet of things (IoT), big data, and blockchain to improve tax administration, enhance transparency, and tackle tax

See MoreTaiwan clarifies withholding tax rules

Taiwan's Ministry of Finance has released a notice detailing the revised withholding tax rules, which were approved on 7 August 2024 and will come into effect on 1 January 2025. To enhance the protection of the rights and interests for tax

See MoreNigeria to launch e-invoicing for improved tax compliance

Nigeria’s Federal Inland Revenue Service (FIRS) announced it will introduce the FIRS e-invoicing system under the the Tax Administration and Enforcement Act 2007 on 18 September 2024. The FIRS e-invoicing system will be an online digital

See MoreItaly: Council of Ministers approve draft of consolidated tax payment code

Italy’s Council of Ministers preliminary approved a legislative decree on 17 September 2024, introducing a consolidated text for the code governing tax payments and collections. The text contains current provisions from different regulatory

See MoreCyprus extends 2019 onwards withholding tax declarations deadline to 31 October 2024

In an announcement, the Cyprus tax authority declared that withholding tax and contribution declarations (TF 7) for the years 2019 and onward may be submitted without penalties until 31 October 2024. After this date, the penalties as per by law will

See MoreTaiwan sets new e-invoice and withholding tax deadlines

Taiwan announced new deadlines for e-invoice submissions and revised withholding tax deadlines, following updates approved by the President on 7 August 2024. E-Invoice submission deadlines: The updated regulations require that

See MoreArgentina annuls intermediary withholding of VAT, income tax

Argentina’s tax authority (AFIP) announced, in a release, that the withholding regimes for value-added tax (VAT) and income tax on electronic payments will be repealed, effective from 1 September 2024. This follows after Argentina’s Ministry

See MoreAustralia releases guidance on new debt deduction creation rules

The Australian Taxation Office (ATO) has released guidance on the new debt deduction creation rules, explaining how the rules apply to private businesses and privately owned groups in relation to the Division 7A loan rules. The new rules came

See MoreTurkey extends submission, payment deadlines for Q2 income and corporate tax

Turkey's Revenue Administration has extended the return submission and payment deadline for the second quarter tax period of the 2024 accounting period for income and corporate tax from 19 August 2024 to 27 August 2024. The announcement was made

See MoreSaudi Arabia extends penalty exemption

The Saudi Zakat, Tax, and Customs Authority (ZATCA) has announced an extension of the penalty exemption initiative until 31 December 2024. ZATCA urges all taxpayers to leverage from the “Cancellation of Fines and Exemption of Penalties

See MoreBolivia extends corporate income tax deadlines

Bolivia’s National Tax Service has extended the deadlines for corporate income tax (IUE) until 30 August 2024, published Resolution No. 102400000016 on 27 July 2024. Under Resolution of the Directory (RND) No. 101800000004 of 2 March, 2018, the

See MoreMalaysia updates e-invoicing guidelines

Malaysia’s Inland Revenue Board (IRBM) released updates regarding electronic invoicing (e-invoicing) guidelines on 30 July, 2024. These include revised versions of the e-invoice guideline (version 3.2) and the e-invoice specific guideline (version

See More