Netherlands clarifies minimum tax to have little effect on incentives, cautions on new tax credits

The Netherlands State Secretary for Finance, in a letter to the parliament, stated that the global minimum tax would have limited effects on current tax incentives but highlighted that the newly introduced tax credits under Pillar Two could pose

See MoreChile updates tax compliance law, introduces changes to GAAR, transfer pricing, and CFC

Chile's Internal Revenue Service (SII) has announced that the Law on Compliance with Tax Obligations (Law No. 21.713) has been published in the Official Gazette on 24 October 2024. General and Special Anti-Avoidance Rules changes The General

See MoreSouth Africa proposes foreign exchange loss rule for non-trading companies

The 2024 Taxation Laws Amendment Bill, introduced in South Africa's Parliament, on 30 October 2024, by allowing them to carry forward foreign exchange losses. This change addresses an existing imbalance in the taxation of foreign exchange gains and

See MoreDominican Republic mandates corporate taxpayers to designate responsible individual for tax obligations

The Dominican Republic's General Directorate of Internal Revenue (DGII) has released Notice No. 21-24 on 25 October 2024 outlining the requirement for corporate taxpayers to identify the individual who will represent the company or entity before the

See MoreGermany: Lower House of Parliament passes Annual Tax Act 2024

Germany’s Lower House of Parliament of Germany (Bundestag) passed the Annual Tax Act 2024 on 18 October 2024. The Bundestag has implemented 59 changes to the draft law based on the Finance Committee's recommendation. The Annual Tax Act 2024

See MoreUS: Congressional Research Service reviews mortgage interest deduction

The Congressional Research Service (CRS) released the In Focus report (IF 12789 ) at the US Library of Congress on 22 October 2024. This report analysed the mortgage interest deduction, highlighting policy options that Congress may

See MoreBangladesh considers phasing out non-refundable minimum tax

The National Board of Revenue (NBR) in Bangladesh is planning to phase out its non-refundable minimum tax system according to local sources, a move aimed at aligning with global tax standards and encouraging investor confidence. The NBR plans to

See MoreUK announces 2024 autumn budget

The UK autumn budget announcements were delivered today, 30 October 2024. Corporation tax The main rate of corporation tax will stay at 25% until the next election. National insurance National Insurance contributions for employers is to

See MoreUS: Treasury publishes final rules on clean energy production tax credits

The US Treasury Department and the IRS published the final rules for the advanced manufacturing production tax credit under Internal Revenue Code (IRC) section 45X in the federal register on 28 October 2024. The final regulations ( RIN

See MoreIndia extends income tax return deadline for AY 2024-25

The India' Central Board of Direct Taxes (CBDT) has announced an extension for filing the return of income for the assessment year (AY) 2024-25 on 26 October 2024. The deadline, originally set for 31 October 2024, is now extended to 15 November

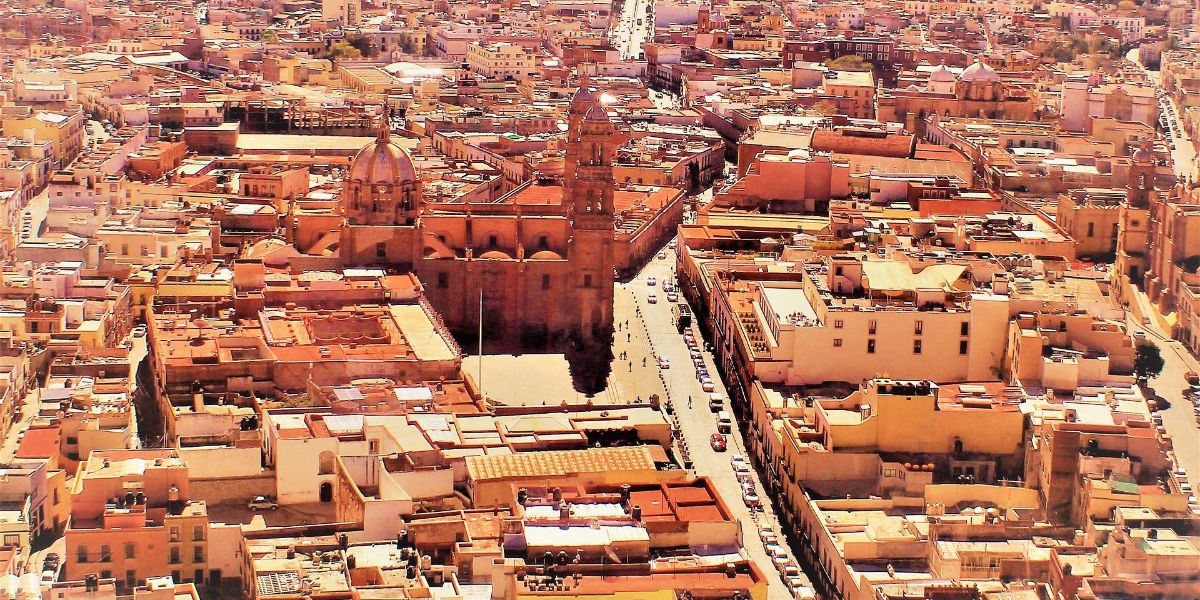

See MoreMexico updates list of taxpayers linked to suspected fake transactions

Mexico’s Tax Administration (Servicio de Administración Tributaria, SAT) has revised the final lists of taxpayers suspected of engaging in non-existent transactions under Article 69-B of the Federal Fiscal Code. The tax administration

See MoreSlovak Republic gazettes bill amending corporate tax and VAT, and bill introducing financial transaction tax

The Slovak Republic has gazetted the bill that amends various tax laws, including corporate tax and VAT rate changes, and the bill enacting the financial transaction tax. The bills are aimed at improving the country’s public finances. The

See MoreNew Zealand consults use of cost method for calculating foreign investment fund income

New Zealand Inland Revenue has initiated a public consultation the draft interpretation statement, PUB00458 Income Tax – Using the Cost Method to Determine Foreign Investment Fund (FIF) Income, explaining when a resident investor can choose to

See MoreUS: IRS extends temporary relief for foreign financial institutions required to report US TINs

The US Internal Revenue Service (IRS) issued Notice 2024-78 on 28 October 2024, in which it extended the temporary relief provided in Notice 2023-11, subject to the procedures and requirements of this notice, for certain foreign financial

See MoreHungary to amend local and EU tax laws, achieve social and policy objectives

Hungary’s government concluded a public consultation on a draft bill proposing changes to various tax laws on 24 October 2024. The proposal seeks to amend tax laws in response to EU and Hungarian legislation changes, targeting global minimum tax,

See MoreLuxembourg introduces updated online filing procedures for fund subscription tax returns

The Luxembourg Registration Duties, Estates and VAT Authority launched new online procedures N° 821 for submitting subscription tax returns for Undertakings for Collective Investment (UCI), Specialised Investment Funds (SIF), and Reserved

See MoreAustralia: ATO releases list of government entities eligible for e-invoicing

The Australian Taxation Office (ATO) released an updated list featuring 132 Australian government entities registered on the Peppol network On 22 October 2024. The Peppol is an extremely secure network used to exchange business-critical

See MorePortugal proposes several VAT measures in draft state budget law 2025

Portugal released the state budget law for 2025 (Law No. 26/XVI/1) on 10 October 2024, proposing various VAT measures. The draft Budget Law for 2025 proposes reduced corporate tax rates for companies and SMEs and revised personal income tax rates,

See More