Mongolia: MLI instrument goes into effect on January 2025, announces direct and indirect tax measures

Mongolia has ratified the Multilateral Convention to Implement Tax Treaty Measures to Prevent Base Erosion and Profit Shifting (MLI) on 30 September 2024, which takes effect on 1 January 2025. As of February 2025, the Organisation for Economic

See MoreArgentina introduces VAT and income tax withholding for mining

Argentina’s tax authority has issued General Resolution 5663/2025, which amends General Resolution 5333 on 10 March 2025. General Resolution No. 5333 introduced the "Fiscal Registry of Mining Activities," creating withholding regimes for

See MoreEstonia to cancel 2% security tax on corporate profits

The Estonian government is planning to cancel the 2% security tax on company profits, which was part of the Security Tax Act (512 SE) passed in December 2024. While the company tax may be canceled, it is still unclear what will happen with

See MoreAustralia: ATO raises concerns on restructures to exploit MIT withholding rules

The Australian Taxation Office (ATO) issued Taxpayer Alert (TA) 2025/1 on 7 March 2025, raising concerns about restructures and arrangements aimed at accessing the managed investment trust (MIT) withholding regime (including deemed capital gains tax

See MorePoland: CJEU rules tax exemption for external investment funds breaches EU law

The Court of Justice of the European Union (CJEU), in its ruling C-18/23 on 27 February 2025, established that the Polish tax exemption for externally managed nonresident investment funds violated the free movement of capital under EU law. Under

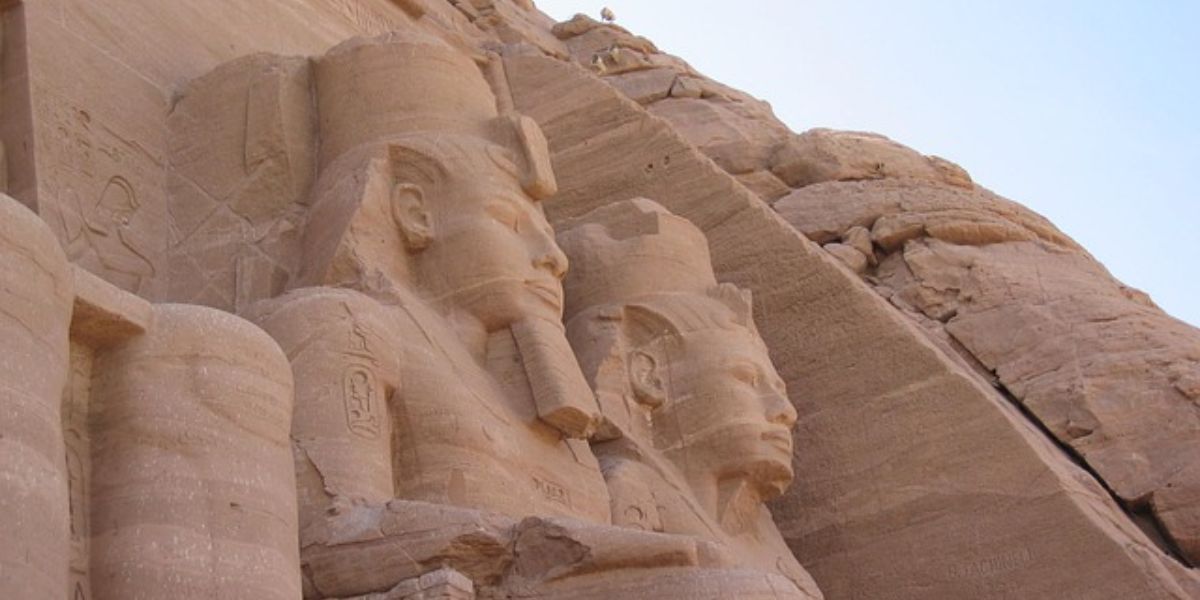

See MoreEgypt introduces tax relief and dispute settlement law

The Egyptian Tax Authority (ETA) has introduced Law No. 5 of 2025, effective from 13 February 2025, offering tax relief and dispute settlement opportunities to enhance compliance and resolve outstanding tax matters. Key provisions include: Under

See MoreArgentina cuts late tax payment interest rates

Argentina has reduced late tax payment interest rates and fixed them from 1 March 2025. The compensatory interest rate drops to 4.0% per month (from 7.26%) and the punitive rate to 5.0% per month (from 8.38%). Tax refunds will accrue interest at

See MoreHong Kong announces Inland Revenue (Amendment) (Tax Concessions) Bill 2025

The Hong Kong Inland Revenue Department has announced the Inland Revenue (Amendment) (Tax Concessions) Bill 2025, introducing a one-off reduction of profits tax, salaries tax, and personal assessment tax for the 2024/25 assessment year, as proposed

See MoreSingapore: IRAS updates exchange rate tool for tax computations

The Inland Revenue Authority of Singapore (IRAS) has made updates to its Exchange Rate Search Function tool (XLSX) to assist taxpayers in preparing their tax computations for the 2024 year of assessment returns. A tax computation is a statement

See MoreSingapore: IRAS releases standard corporate income tax calculators for AY 2024

The Inland Revenue Authority of Singapore (IRAS) has announced an update to its "Preparing a Tax Computation" webpage, introducing two new Basic Corporate Income Tax Calculators (BTCs) for taxpayers submitting Corporate Income Tax Returns for the

See MoreAustralia: ATO guide debunks common Division 7A misconceptions

The Australian Taxation Office (ATO) has published a guide aimed at clarifying Division 7A by dispelling common misconceptions. The ATO explains, the Division 7A is an integrity rule that prevents private company profits from being provided to

See MoreQatar launches six month tax penalty exemption initiative

The General Tax Authority of Qatar has announced the launch of a 100% financial penalty exemption initiative, effective from 1 March 2025. Running for six months, this initiative aims to offer relief to taxpayers, reflecting the Authority's

See MoreSaudi Arabia introduces beneficial ownership reporting rules

Saudi Arabia’s Ministry of Commerce has announced new beneficial ownership reporting requirements, effective from 3 April 2025, as part of the country’s updated Commercial Registry system. The regulations aim to enhance corporate transparency,

See MoreCzech Republic clarify tax-related charges remissions

The Czech Republic’s General Financial Directorate has issued Decree D-67, which replaces Decree D-58, on 21 February 2025, providing guidance on waiving tax-related charges. This decree ensures consistent and fair consideration of requests to

See MoreLithuania expands deductible corporate gift expenses

Lithuania's tax authority expanded the range of corporate gifts eligible for tax deductions as representational expenses, effective 17 February 2025. The updated regulations now include items such as sweets, edible gift sets, and alcoholic

See MoreBelgium: Court rules no unfair discrimination between cash and in-kind contributions in withholding tax on small company dividends

Belgium’s Constitutional Court has published Decision No. 4/2025 on 16 January 2025, responding to a preliminary question submitted by the Court of First Instance in Liège. The ruling clarifies when small companies can apply the reduced

See MoreMalaysia grants tax exemptions on payments to/from Labuan firms

Malaysia has released the Income Tax (Exemption) Order 2025 in its Official Gazette on 13 February 2025. This order grants tax exemptions on specific payments made to or received from Labuan companies. A Labuan company is incorporated under the

See MoreKenya introduces new income tax exemption rules for charities

The Kenya Revenue Authority has published a notice on 13 February 2025 regarding the implementation of the Income Tax (Charitable Organisations and Donations Exemption) Rules, 2024. These rules, which came into force on 18 June 2024, outlines the

See More