Kuwait, Saudi Arabia income tax treaty enters into force

The treaty sets rules on residency, taxation, and anti-abuse measures, applying from 1 January 2026. Kuwait and Saudi Arabia’s income tax treaty took effect on 1 August 2025. It covers Kuwaiti income taxes, Saudi income tax, and Zakat. The

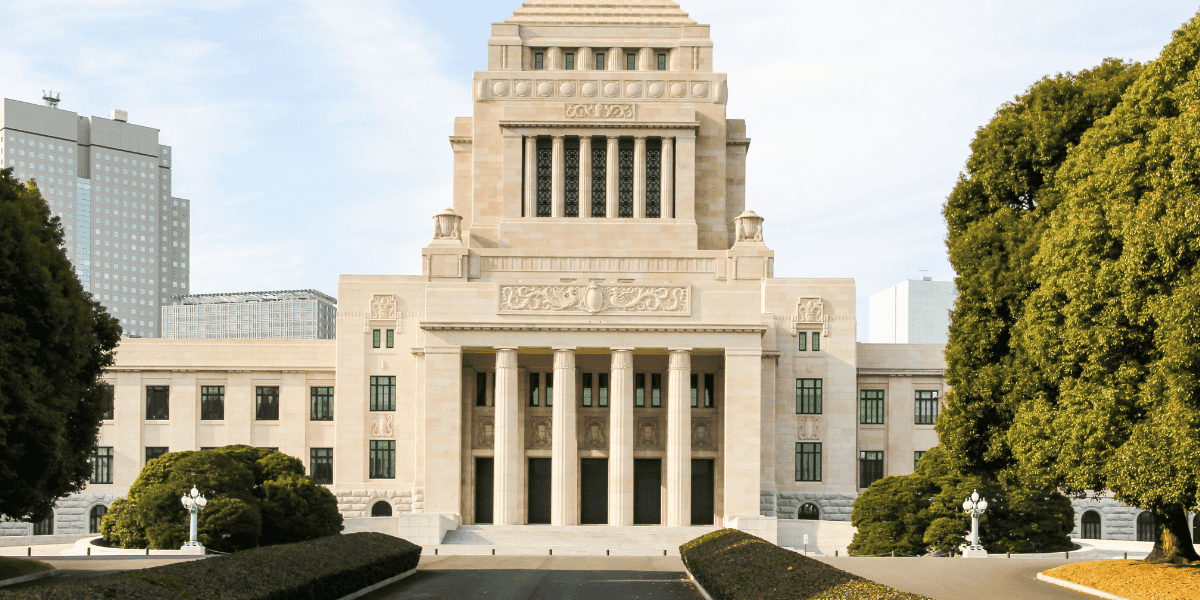

See MoreJapan, Ukraine tax treaty enters into force

The new tax treaty replaces the 1986 tax treaty between Japan and Ukraine. Japan’s Ministry of Finance announced on 2 July 2025 that the new income tax treaty between Japan and Ukraine entered into force on 1 August 2025. The new treaty,

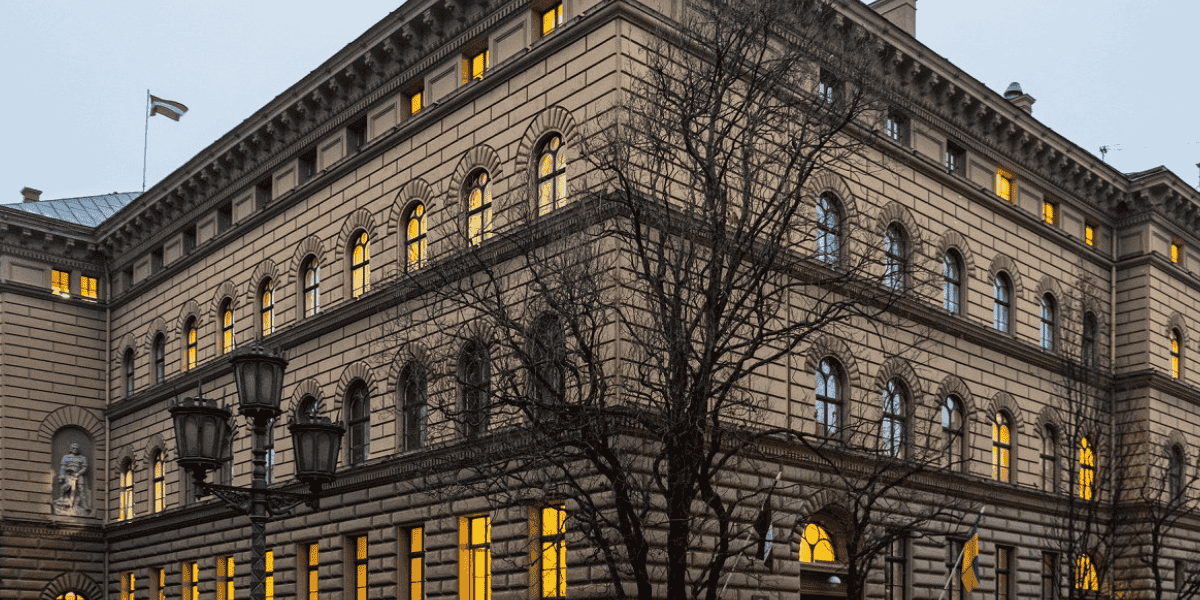

See MoreRussia, UAE tax treaty enters into force

The 2025 income and capital tax treaty between Russia and the UAE took effect on 18 July 2025, which replaces the 2011 limited tax treaty. The 2025 Russia–UAE income and capital tax treaty entered into force on 18 July 2025. The new

See MoreCroatia, Liechtenstein tax treaty enters into force

The treaty takes effect from 1 January 2026. Liechtenstein has published the income and capital tax treaty with Croatia in the Official Gazette on 18 July 2025, which includes the notice that the treaty entered into force on 26 July

See MoreBelarus, Zimbabwe tax treaty enters into force

The treaty applies from 1 January 2026. The Belarus Ministry of Taxes and Duties announced that the income and capital tax treaty between Belarus and Zimbabwe came into effect on 2 July 2025. Signed on 31 January 2023, this is the first tax

See MoreJapan, Ukraine tax agreement comes into effect

The Ministry of Finance confirmed the 2024 tax treaty with Ukraine will take effect on 1 August 2025. Japan’s Ministry of Finance announced on 2 July 2025 that the 2024 tax treaty and protocol with Ukraine will come into effect on 1 August

See MoreLatvia, Andorra tax treaty enters into force

Latvia and Andorra's agreement to eliminate double taxation and prevent tax evasion came into effect on 16 June 2025. Andorra announced in the Official Gazette that the income and capital tax treaty between Andorra and Latvia entered into force

See MoreAndorra, Montenegro tax treaty enters into force

The Andorra-Montenegro tax treaty introduces new rules on income, capital gains, and withholding taxes, with effect from 1 January 2026. The income and capital tax treaty between Andorra and Montenegro entered into force on 1 July 2025, following

See MoreBahrain, UAE tax treaty enters into force

The income tax treaty between Bahrain and the UAE will take full effect from 1 January 2026. Bahrain's National Bureau for Revenue announced that the income tax treaty with the UAE has entered into force starting 1 May 2025. The treaty was

See MoreBrazil, China protocol to tax treaty entered into force

The amended Brazil-China tax treaty (effective 14 June 2025) sets withholding tax rates for dividends, interest, and royalties. The amending protocol to the 1991 income tax treaty between Brazil and China took effect on 14 June 2025. Signed on

See MoreBrazil, Sweden: Amending protocol enters into force

The amending protocol to the 1975 Brazil-Sweden Income Tax Treaty will take effect on 13 June 2025. The amending protocol to the Brazil-Sweden Income Tax Treaty (1975) will take effect on 13 June 2025, however withholding and other taxes will

See MoreBrazil, China: Amending protocol to tax treaty enters into force

The amendment to the 1991 Brazil-China Income Tax Treaty takes effect on 14 June 2025. The amending protocol to the Brazil-China Income Tax Treaty (1991) will take effect on 14 June 2025, however withholding and other taxes will take effect

See MoreAmending protocol between France and Luxembourg enters into force

France issued Decree No. 2025-382 in the Official Gazette on 28 April 2025, confirming that the amending protocol to the 2018 income and capital tax treaty between France and Luxembourg came into effect on 4 March 2025. Earlier, France published

See MoreHong Kong, Bahrain tax treaty enters into force

Hong Kong's Comprehensive Avoidance of Double Taxation Agreement (CDTA) with Bahrain, signed in March last year, came into force on 4 March 2025, after completion of relevant ratification procedures. The CDTA will be applicable to Hong Kong tax

See MoreKorea (Rep.), Andorra tax treaty enters into force

South Korea's Ministry of Foreign Affairs has announced that the income tax treaty with Andorra has entered into force on 1 April 2025. The withholding tax rate on dividends is 5% if the owner is a company that has held at least 10% of the

See MoreChina, Italy new tax treaty enters into force

The new income tax agreement between China and Italy was enacted on 19 February 2025. Signed on 23 March 2019, it replaces the 1986 treaty between China and Italy. The agreement aims to eliminate double taxation on income and prevent tax

See MoreMoldova, Slovak Republic tax treaty protocol goes into effect

The protocol to amend the 2023 Moldova—Slovak Republic Income and Capital Tax Treaty will take effect on 1 May 2025. The protocol, signed on 10 September 2024, aligns the treaty with the latest international standards based on OECD/G20 BEPS

See MoreMauritania, Saudi Arabia income and capital tax treaty enters into force

The income and capital tax treaty between Mauritania and Saudi Arabia entered into force on 1 January 2025. A tax treaty is a bilateral agreement between two countries to address issues related to the double taxation of both passive and active

See More