March 20, 2025

The Indian Central Board of Direct Taxes (CBDT) has issued a clarification on 15 March 2025 regarding Circular No. 1/2025...

March 20, 2025

The Thai Cabinet gave its approval to a draft Ministerial Regulation, proposed by the Ministry of Finance (MoF) on 21...

March 20, 2025

Austria’s Budget Restructuring Measures Bill 2025 (Budgetsanierungsmaßnahmengesetz 2025) entered into force following its publication in the Official Gazette on 18...

March 19, 2025

Peru and Spain will resume income tax treaty negotiations from 26 to 28 March 2025 in the fifth round of...

March 19, 2025

Officials from Bhutan and Singapore met in Paro, Bhutan, from 10 to 14 March 2025 to begin negotiations on their...

March 19, 2025

Turkey’s government has announced changes to the special consumption tax (SCT) rates and fixed tax amounts for certain tobacco products...

March 19, 2025

The UAE Federal Tax Authority (FTA) released a VAT Public Clarification VATP040 addressing the amendments to the VAT Executive Regulations...

March 19, 2025

Uganda Revenue Authority (URA) informs all taxpayers that a new basis for payment has been introduced on the URA web...

March 19, 2025

India has proposed a temporary 12% safeguard duty on certain steel products for 200 days, to protect its domestic industry...

March 19, 2025

The government of Turkey has raised the minimum amount for value added tax (VAT) refund claims in cases involving reduced...

March 18, 2025

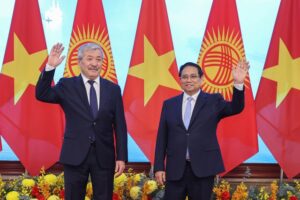

Kyrgyzstan and Vietnam have agreed to sign a tax treaty and an investment protection agreement (IPA) during the official visit...

March 18, 2025

Vietnam has shown interest in negotiating a tax treaty and an investment protection agreement (IPA) with the Solomon Islands on...

March 18, 2025

The National Assembly of South Korea (Rep.) has approved the ratification of the protocol to the 2012 income and capital...

March 18, 2025

Indonesia’s palm oil exports surged 62.2% in February 2025, reaching 2.06 million metric tons, the highest in four months, fueled...

March 18, 2025

The French government has issued Ordinance No. 2025-230 on 12 March 2025, introducing reforms to the legal framework for UCITS...

March 18, 2025

Ecuador has introduced a series of tax benefits to support female entrepreneurs with the enactment of the Organic Law for...

March 18, 2025

The Greek Public Revenue Authority (AADE) has announced the commencement of corporate and personal income tax return filing for the...

March 17, 2025

The Saudi Zakat, Tax, and Customs Authority (ZATCA) has outlined the criteria for the 21st phase of integration under the...