September 1, 2025

Treasury has launched a consultation from 28 August-10 December, 2025, to abolish 500 “nuisance tariffs”, with the intention of reducing...

August 29, 2025

The talks, hosted by the Tanzanian Embassy and Qatar’s General Tax Authority, aimed to prevent double taxation and strengthen measures...

August 29, 2025

The update provides detailed, box-by-box guidance for filling out Form GST F5, the standard form used for reporting GST. The...

August 29, 2025

Angola and the UAE signed a CEPA on 25 August 2025 to boost trade, investment, and sectoral cooperation. Angola and...

August 29, 2025

Cyprus and Oman’s first income tax treaty enters into force, effective 1 January 2026. The income tax treaty between Cyprus...

August 29, 2025

Irish Revenue released updated guidance on completing Corporation Tax Returns (Form CT1) for the 2023 and 2024 tax years. The...

August 29, 2025

FTA updates EmaraTax user manuals covering corporate tax payments, returns, period changes and de-registration. The UAE Federal Tax Authority (FTA)...

August 28, 2025

Colombia clarifies SIMPLE regime tax treatment of cross-border technical and consulting services with Ecuador under Andean Community rules. Colombia’s tax...

August 28, 2025

New Zealand introduces 2025–26 tax updates, including foreign investment income, GST, employee share schemes, and new exemptions. New Zealand Inland...

August 28, 2025

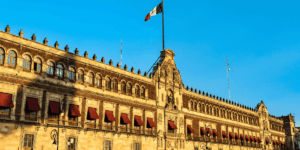

Mexico plans higher tariffs on Chinese imports to protect domestic industries and support a US-backed “Fortress North America” strategy. Mexico...

August 28, 2025

Luxembourg Tax Authorities clarify which investment funds qualify as ‘Collective Investment Vehicles’ under Article 168quater (2) LITL, outlining conditions for...

August 28, 2025

The Inland Revenue Authority of Singapore (IRAS) has revised its guidance regarding the cancellation of GST registration on 22 August...

August 28, 2025

The Greek Parliament is reviewing a draft bill, submitted on 26 August 2025, to ratify the exchange of notes with...

August 28, 2025

Denmark seeks public feedback on a bill that would let smaller startups offer unlimited tax-free employee shares under relaxed eligibility...

August 28, 2025

Uruguay unveils investment promotion package with tax incentives, streamlined procedures, and support for SMEs, large projects, tech, and housing. The...

August 28, 2025

SFTA confirmed that OECD guidance on hybrid arbitrage arrangements under the transitional CbCR safe harbour applies in Switzerland only to...

August 27, 2025

The guide outlines heirs’ tax obligations, including filing rules, exemptions, thresholds, asset valuation, and related income, VAT, and special consumption...

August 27, 2025

The UAE has signed the OECD’s Multilateral Competent Authority Agreement under the Crypto-Asset Reporting Framework, joining 51 countries in standardising...