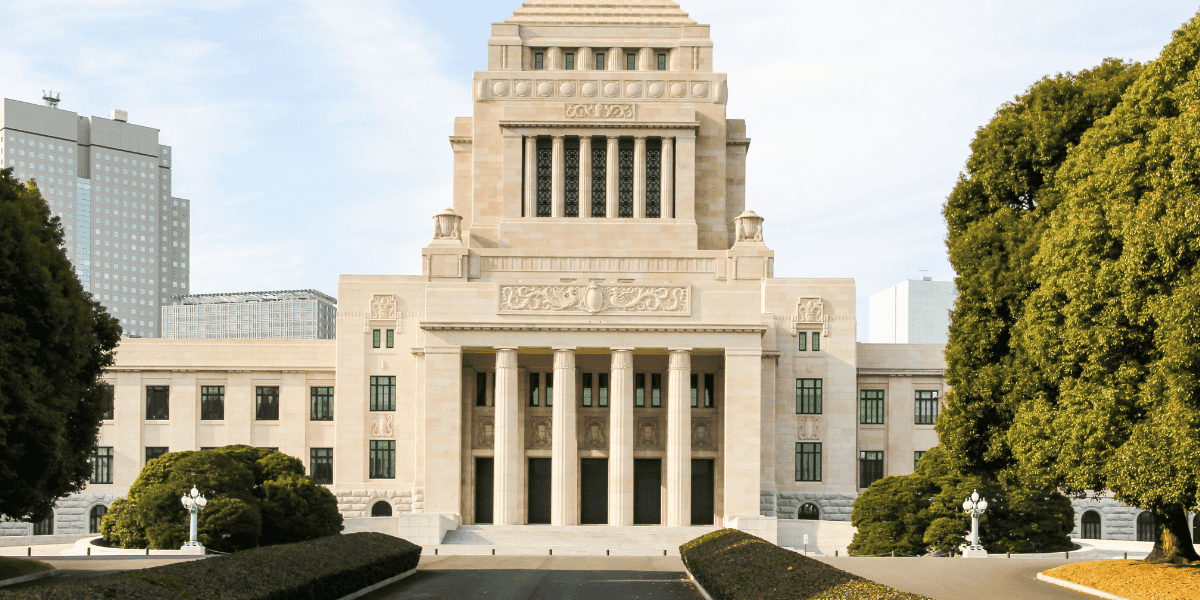

US and Japan sign trade deal, critical minerals pact

RF Report The US and Japan finalised a new trade agreement on 28 October 2025 that implements the terms of a July deal, easing tariff tensions and deepening economic cooperation. Under the arrangement, the US will apply a reduced 15% tariff on

See MoreUS: IRS announces reduced services amid federal shutdown

RF Report The US Internal Revenue Service (IRS) announced on 21 October 2025 that, despite its limited operations during the ongoing US government shutdown, taxpayers are still required to meet all regular tax obligations. Tax refunds will

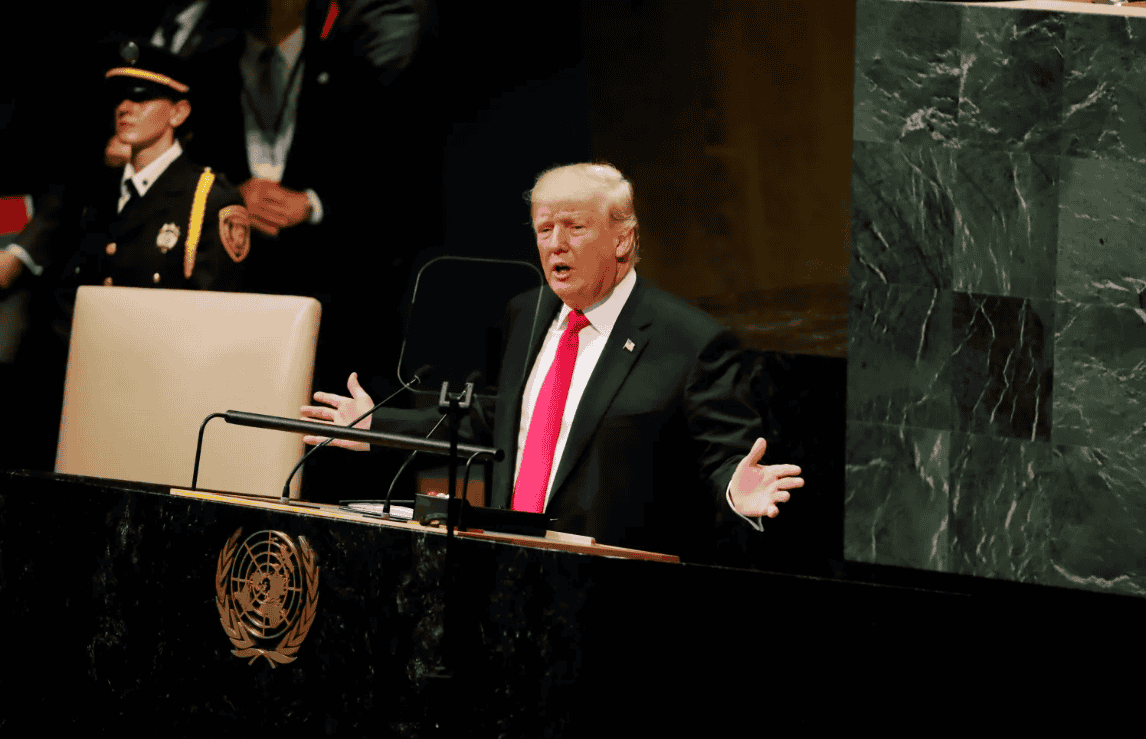

See MoreUS reduces Chinese tariffs post Trump-Xi meeting

RF Report US President Donald Trump announced a significant agreement with Chinese President Xi Jinping during their meeting at the APEC summit in South Korea on 30 October 2025. The two leaders agreed to reduce tariffs and address key trade

See MoreCambodia, Malaysia, Thailand sign agreement to scrap implementation of digital services taxes on US firms

Regfollower Desk The White House recently announced trade agreements with Cambodia, Malaysia, and Thailand, which include commitments from these nations to avoid imposing digital services taxes (DSTs) or similar measures that could unfairly

See MoreUS: Senate approves bill to overturn Trump’s tariffs on Brazilian imports

Regfollower Desk The US Senate, led by Republicans, has passed a bill to overturn President Donald Trump's tariffs on Brazil by ending the national emergency he declared in July. This emergency was in response to Brazil prosecuting its

See MoreUS: IRS urges tax professionals to renew PTINs ahead of 2026 filing season

All paid tax return preparers and enrolled agents must renew their PTINs annually, as 2025 PTINs will expire on 31 December 2025. Regfollower Desk The US Internal Revenue Service (IRS) issued a notice on 27 October 2025, reminding more than

See MoreUS: Trump imposes 10% tariff increase on Canada following World Series ad

US President Donald Trump announced a 10% tariff increase on Canadian goods after criticising an Ontario government ad he deemed misleading, escalating trade tensions and halting negotiations despite Canada’s move to pause the ad campaign. US

See MoreUS: Trump administration signs trade deals on rare-earth and critical minerals with Malaysia, Cambodia, Thailand, Vietnam

The US has signed trade and critical minerals agreements with Malaysia, Cambodia, Thailand, and Vietnam to address trade imbalances and secure alternative rare earth supply chains amid China’s export restrictions. The Trump Administration has

See MoreUS: Iowa retains corporate tax rates for 2026

The 2026 corporate income tax rates will remain the same as corporate income tax rates for tax years beginning in 2024 and 2025. The Iowa Department of Revenue issued an Order 2025-02 on 21 October 2025 regarding corporate income tax rates for

See MoreUS, China agree on rare earth framework amid Trump’s tariff warning

The US and China reached a preliminary trade deal in Malaysia to avert major tariffs and export restrictions, paving the way for upcoming talks between Trump and Xi on trade balance. US Treasury Secretary Scott Bessent announced on 26 October

See MoreUS: IRS releases guidance on credit, refund limits for employee retention credits

The FAQs discuss the limitation generally, when a claim is considered to be timely filed, and what appeals rights are available if an ERC claimed on a return is disallowed. The US Internal Revenue Service (IRS) has announced the issuance of the

See MoreUS: Trump administration terminates trade talks with Canada

President Trump halted all trade talks with Canada, citing a “fraudulent” Ontario government and misrepresenting former President Reagan’s views. US President Donald Trump announced on Thursday, 23 October 2025, that his administration has

See MoreUS: IRS updates Form 1099-K guidance under the One, Big, Beautiful Bill

The IRS clarified that under the One, Big, Beautiful Bill, third-party payment processors must file Form 1099-K only if a payee receives over USD 20,000 and more than 200 transactions, reinstating the pre-ARPA threshold. The US Internal Revenue

See MoreIndia, US near deal to slash import tariffs

India and the US near deal to cut tariffs, with energy and agriculture in focus. India and the US are reportedly nearing a trade deal that would cut US tariffs on Indian imports from 50% to about 15–16%. The agreement is expected to focus on

See MoreUS: Trump anticipates trade agreement with China, including soybean exports

President Trump expressed confidence in reaching agreements with President Xi during their upcoming South Korea meeting, covering trade issues, including China’s Russian oil imports. U.S. President Donald Trump expressed his optimism on

See MoreUS: Treasury, IRS provide transition relief for 2025 for businesses reporting car loan interest under the One, Big, Beautiful Bill

The notice provides penalty relief and guidance to certain lenders for new information reporting requirements for car loan interest received in 2025 under the OBBB. The Department of the Treasury and the Internal Revenue Service (IRS) issued

See MoreUS: USTR moves to impose 100% tariffs on Nicaragua imports over labour violations, seeks public comments

The USTR is considering tariffs of up to 100% on Nicaraguan goods over alleged labour and human rights violations affecting US trade. The US Trade Representative's office announced that the Trump administration is considering imposing tariffs of

See MoreUS: Trump considers increasing tariffs on Colombia amid drug trade feud

President Trump announced plans to raise US tariffs on Colombian imports and suspend financial aid, citing alleged Colombian involvement in drug trafficking. US President Donald Trump announced on Truth Social, on 19 October 2025, plans to

See More