US: IRS urges taxpayers to review withholding for next year

The US Internal Revenue Service (IRS) issued IR-2025-52 on 17 April 2025, in which it reminded taxpayers that proper tax withholding now is key to avoiding surprises when they file their tax return next year. Making any needed adjustments earlier in

See MoreBrazil retaliates with economic reciprocity law against US tariffs

Brazil’s government has published and enacted Law No. 15.122 of 11 April 2025 in the Official Gazette on 14 April 2025. This legislation, also known as the “Economic Reciprocity Law, enables Brazil to impose import duties and suspend trade

See MoreUS: California sues Trump administration over tariffs

California Governor Gavin Newsom and California Attorney General Rob announced that they have filed a lawsuit in federal court, challenging the tariffs imposed by the Trump Administration on 16 April 2025. In the lawsuit, Governor Newsom and

See MoreUS: Trump administration advances plans to impose semiconductor tariffs

US President Donald Trump has moved forward with plans to impose tariffs on semiconductors and pharmaceutical products. His administration has announced investigations into the national security risks associated with importing goods such as

See MoreUS: IRS urges taxpayers to file late returns quickly to minimise penalties

The US IRS has issued a statement urging taxpayers who missed the filing deadline to file their tax returns promptly in order to reduce interest and penalties on 16 April 2025. The IRS encourages taxpayers who missed the filing deadline to

See MoreUS: Georgia speeds up corporate tax rate cuts

The US state of Georgia Governor Brian P. Kemp signed the House Bill (HB) 111 into law on 15 April 2025, expediting the planned reduction of the corporate and individual income tax. The individual income tax rate cut was established by HB 1437 in

See MoreUS: Trump administration plans to impose 245% tariff on China

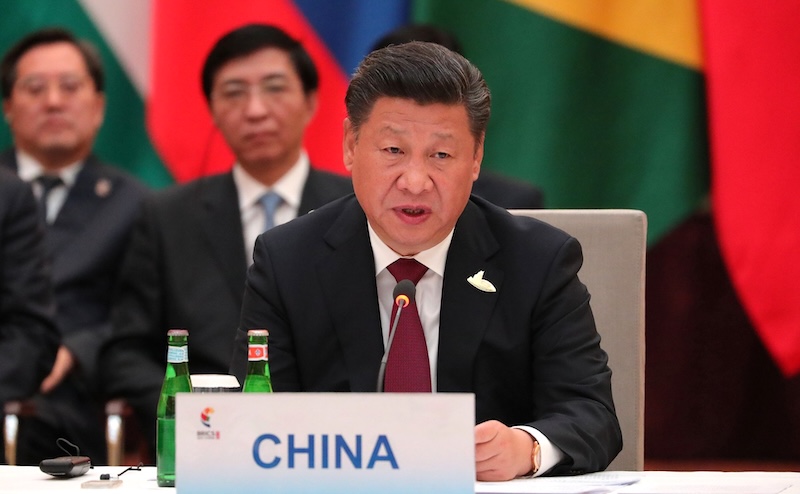

The tariff wars between two of the world's largest economies, the US and China, show no signs of slowing down. In the latest move, the Trump Administration said that China could face tariffs as high as 245% in response to its retaliatory measures.

See MoreUS: IRS announces over USD 1 billion in 2021 in unclaimed tax refunds, requests taxpayers to check their eligibility

The US Internal Revenue Service (IRS) issued IR-2025-46 on 11 April 2025, reminding the 1.1 million people who didn’t file their tax year 2021 federal tax returns that they may be eligible for a refund if they file by the 15 April 2025

See MoreUS: Trump overturns digital asset reporting regulations

US President Donald Trump signed into law H.J.Res.25 (Congressional Review Act Disapproval Resolution on Cryptocurrency Broker Reporting from the IRS) on 10 April 2025, a joint resolution of disapproval aimed at overturning the final regulations

See MoreUS: IRS offers tax relief for storm affected taxpayers in Arkansas and Tennessee

The US Internal Revenue Service (IRS) has issued IR-2025-49 (Arkansas) and IR-2025-47 (Tennessee) on 14 April 2025, announcing tax relief for individuals and businesses in Arkansas and Tennessee impacted by the severe storms, tornadoes, and flooding

See MoreUS: IRS updates practice unit on deductions and credits for late corporate tax returns

The US Internal Revenue Service (IRS) has released an updated practice unit on the Allowance of Deductions and Credits for 1120-F Delinquent Returns on 25 March 2025. Form 1120-F serves as the US income tax return specifically for foreign

See MoreUS: Trump administration grants reciprocal tariff exceptions for smartphones, computers, and electronics from China

The Trump Administration released a memorandum titled “Clarification of Exceptions Under Executive Order 14257 of April 2, 2025, as Amended” on 11 April 2025. The clarification broadens the reciprocal tariff exception for "semiconductors" to

See MoreTrade war escalades: China imposes 125% tariffs on US imports

Beijing announced it has increased its tariffs on US imports to 125% earlier today, 11 April 2025. "The US side's imposition of excessively high tariffs on China seriously violates international economic and trade rules, runs counter to basic

See MoreCanada: Countermeasures against auto imports from the US enters into force

Canada’s finance minister François-Philippe Champagne confirmed on 8 April 2025 that Canada’s new countermeasures, announced on 2 April 2025, in response to the unjustified tariffs imposed by the US on the Canadian auto industry came into force

See MoreUS: IRS announces Q1 deadline for estimated tax payments for 2025

The US Internal Revenue Service (IRS) issued IR-2025-45 on 10 April 2025 reminding self-employed individuals, retirees, investors, businesses and corporations that 15 April is the deadline for first quarter estimated tax payments for tax year

See MoreUS: Trump pauses tariffs for 90 days for all countries, hits China harder with 125%

US President Donald Trump announced a three-month suspension of all “reciprocal” tariffs that took effect on 9 April 2025, excluding those applied to China. The sweeping tariffs will remain for China, the world’s second largest economy and

See MoreUS: IRS updates guidance on branch-level interest tax

The US Internal Revenue Service (IRS) has released an updated practice unit on Branch-Level Interest Tax Concepts. Below is a general overview of the key points covered in this publication: Note: This Practice Unit was updated to remove

See MoreUS: Michigan, Texas offer state tax relief after disasters

In response to recent natural disasters that have heavily impacted communities, Michigan and Texas have announced tax filing and payment relief for individuals and businesses. Michigan: Relief for people and businesses hit by severe winter

See More