US Appeals Court upholds stay on ruling on Trump tariffs

The US federal appeals court has upheld President Donald Trump's tariffs while reviewing a lower court's decision that claimed Trump exceeded his authority in imposing them. The US federal appeals court on Tuesday, 10 June 2025, upheld the

See MoreUS: IRS offers tax relief to Oklahoma wildfire and storm victims

The IRS announced tax relief for individuals and businesses in parts of Oklahoma affected by wildfires and straight-line winds starting on 14 March 2025. Impacted taxpayers have until 3 November 2025 to file federal tax returns and make

See MoreUS: IRS offers tax relief to Missouri wildfire and storm victims

The IRS announced tax relief for Missouri residents and businesses affected by severe storms, tornadoes, and wildfires starting on 14 March 2025. Impacted taxpayers have until November 3, 2025, to file federal tax returns and make payments. The

See MoreUS: IRS offers tax relief to Texas storm victims

The IRS has announced tax relief for individuals and businesses in parts of Texas impacted by severe storms and flooding starting on 26 March 2025. Affected taxpayers have until 3 November 2025 to file tax returns and make payments. The US

See MoreUS extends Section 301 tariff exemptions on Chinese imports through August 2025

The USTR has extended certain product exclusions from Section 301 tariffs on Chinese imports until 31 August 2025. The Office of the US Trade Representative (USTR) has announced an extension of specific product exclusions from Section 301 tariffs

See MoreUS: IRS offers assistance for taxpayers missing the filing deadline

The IRS announced resources for taxpayers who missed the 15 April tax filing deadline, offering guidance for handling owed taxes, interest, and penalties. The US Internal Revenue Service (IRS) released IR-2025-66 on 9 June 2025, highlighting

See MoreUS: IRS reminds taxpayers due date of second quarter estimated tax payment of 16 June

The IRS issued a reminder that the second quarter 2025 estimated tax payment is due on 16 June 2025. The US Internal Revenue Service (IRS) issued IR-2025-65 on 6 June 2025, reminding taxpayers that the second quarter 2025 estimated tax payment is

See MoreUS: IRS issues interim guidance on simplified option for CAMT calculation

The guidance offers a simplified method to determine "applicable corporation" status under IRC Sec. 59(k), increasing minimum thresholds and waiving some estimated tax penalties. The US Internal Revenue Service (IRS) issued Notice 2025-27,

See MoreUS: Trump imposes 50% tariffs on steel and aluminium imports

The Trump Administration has increased tariffs on US imports of steel, aluminium, and derivatives from 25% to 50%, effective June 4, 2024. Tariffs on UK imports remain at 25%. The Trump Administration has doubled the tariffs on US imports of

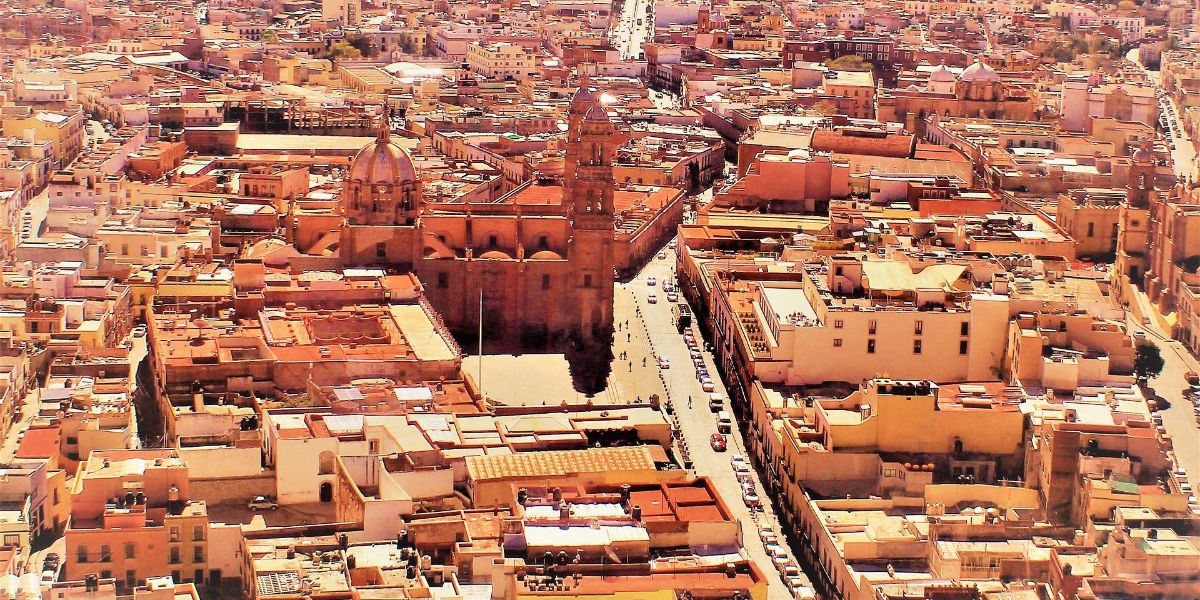

See MoreMexico objects US tax on cross-border remittances

The One, Big, Beautiful Bill (Act), which is now under Senate review, proposes a 3.5% tax on all remittances sent by non-US citizens to foreign countries, regardless of the transfer amount. The US House of Representatives passed the One,

See MoreUS: Hawaii introduces lodging tax for climate-change mitigation

The law adds a 0.75% "Green Fee" to the existing transient-accommodations tax of 10.25% and imposes a levy on cruise-ship passengers docking in the islands. Hawaii Governor Josh Green has signed SB 1396 into law, making Hawaii the first US

See MoreUS: Trump administration weighs 15% tariffs for 150 days

The Trump administration is reportedly considering using an existing law to impose 15% tariffs for 150 days on parts of the global economy. A final decision is yet to be announced. According to a Wall Street Journal report, President Donald

See MoreUS: Trump to double steel and aluminium tariffs to 50%

President Trump announced plans to double tariffs on imported steel and aluminum to 50% on 30 May 2025. US President Donald Trump announced on 30 May 2025 that his administration plans to raise tariffs on imported steel and aluminium from 25%

See MoreUS: Court of International Trade rules Trump tariffs unconstitutional, Court of Appeals issues administrative stay while it reviews appeal

Court of International Trade cited Congress's exclusive authority over taxes and commerce on 28 May 2025. On 29 May 2025, the US Court of Appeals for the Federal Circuit issued an administrative stay while it reviews an appeal from the Trump

See MoreUS: Trump pledges to negotiate ‘big, beautiful’ tax bill for Senate approval

Trump’s remarks came after Elon Musk said in a CBS interview that he was ‘disappointed’ with the bill’s massive spending, which undermines the Department of Government Efficiency (DOGE) efforts to reduce the US budget deficit US

See MoreUS: Washington adopts major business and occupation tax reforms

The law introduces significant changes to the B&O tax and extends the retail sales tax to computer-related services. Washington Governor Bob Ferguson signed two bills, Bill HB 2021 and Bill SB 5814, into law on 20 May 2025, introducing major

See MoreUS: Trump postpones 50% tariff on EU goods

President Trump announced on 26 May 2025 that the effective date for his new 50% tariffs, in addition to the previously announced 20% tariffs on EU goods, has been pushed to 9 July 2025 after a call with European Commission President Ursula von der

See MoreUS tariffs are reshaping transfer pricing strategies for multinationals

The Trump Administration’s latest tariffs are reshaping global trade policies and pushing multinational corporations (MNCs) to revise their transfer pricing policies. US President Donald Trump’s latest tariffs, including a 104% levy on

See More