US, EU finalise trade agreement featuring 15% tariff on imports

The trade deal imposes a 15% tariff on most EU imports and zero tariffs on key strategic goods, including aircraft, certain chemicals, generic drugs, semiconductors, and raw materials. US President Donald Trump and European Commission President

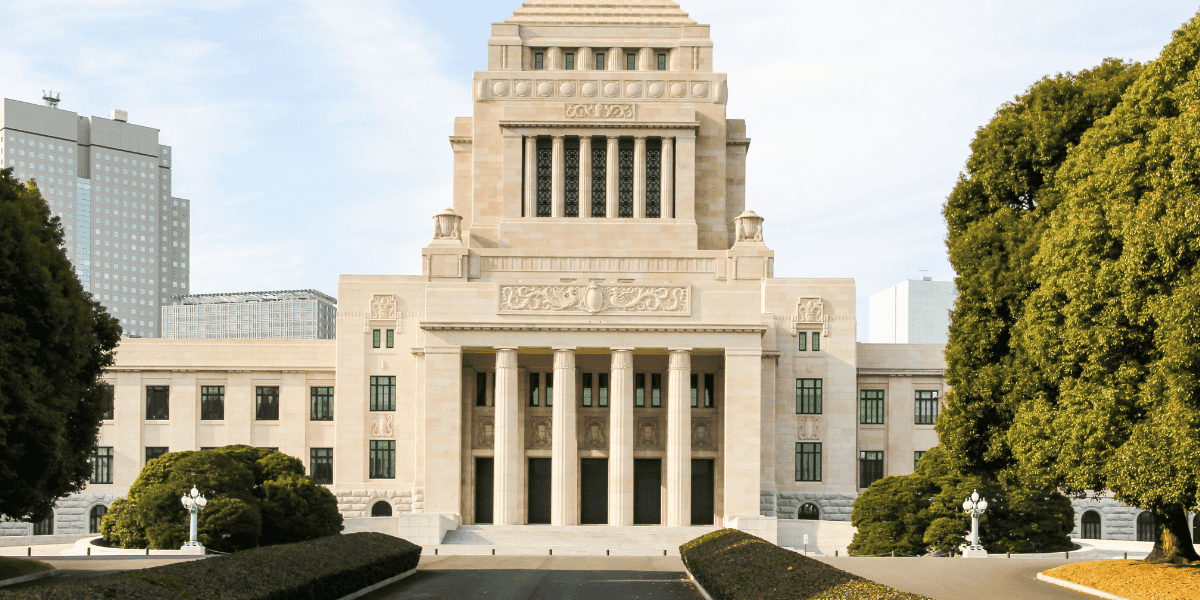

See MoreUS reduces tariffs on Japanese auto imports to 15% in new trade deal

The US and Japan struck a trade deal, which lowers tariffs on Japanese auto imports to 15%. In return, Japan committed to a USD 550 billion investment in the US, including Boeing planes, defence spending, and increased agricultural and rice

See MoreUS to possibly settle for 15% tariffs on EU imports

The EU and the US are reportedly nearing a trade agreement to impose a 15% tariff on EU goods imported into the US. According to EU diplomats, the EU and the US are moving towards a trade agreement that would impose a 15% tariff on EU goods

See MoreIndonesia to reduce tariffs, ease trade barriers in US trade deal

Indonesia and the US have reached a trade agreement that eliminates tariffs on over 99% of US goods and reduces non-tariff barriers. In return, the US lowered tariffs on Indonesian products to 19%, alongside significant purchases of US jets, energy,

See MoreBangladesh sends position paper to US, seeks tariff relief in final round of negotiations

Commerce ministry seeks to launch final round of tariff talks from 26 July; seeks 5–10-year transition period for labour and environmental reforms. Bangladesh formally submitted its position paper to the Office of the United States Trade

See MoreUS reduces reporting requirements for small businesses, freelancers, payment platforms

Recent tax law changes under President Trump's tax package reduce IRS reporting requirements for small businesses and freelancers, easing administrative burdens but potentially increasing income underreporting and widening the tax gap. Recent

See MoreUS: Trump administration considers eliminating capital gains tax on home sales

Under current law, US residents can exclude up to USD 250,000 in capital gains from taxable income when selling their primary residence. US President Donald Trump announced on 22 July 2025 that his administration is considering eliminating

See MoreIndonesia: Chief Economic Minister says 19% US tariff may take effect before 1 August

Trump imposed a 19% tariff on Indonesian goods as part of a new trade agreement, effective 1 August Indonesia's Chief Economic Minister, Airlangga Hartarto, announced on 21 July 2025 that the 19% tariff on Indonesian goods entering the US could

See MoreUS: IRS offers tax relief to New Mexico flood and storm victims

The tax filing and payment deadline has been extended to 2 February 2026 for New Mexico taxpayers. The US Internal Revenue Service (IRS) has issued NM-2025-03 on 16 July 2025, in which it announced tax relief for individuals and businesses in

See MoreEU halts retaliatory tariffs on US imports until 6 August ‘25

This follows EU's warning on 14 July 2025 that it may implement countermeasures if ongoing trade negotiations with the US fail to prevent the imposition of 30% tariffs scheduled to begin on 1 August. The European Union has decided to halt the

See MoreUS: Trump imposes 19% tariff on Indonesia after trade talks

The trade agreement imposes stricter penalties for transhipment and Indonesia’s commitment to purchasing 50 Boeing jets and USD 19.5 billion in US energy and agricultural products. US President Donald Trump announced a 19% tariff on Indonesian

See MoreBangladesh, US to hold final tariff negotiations before August 25

Bangladesh and the US to hold final tariff negotiations next week to avert 35% export duty. Bangladesh will commence a third and final round of negotiations with the US next week to avert a 35% tariff on its exports, scheduled to take effect on 1

See MoreUS: IRS exempts US-owned pass-throughs from international tax reporting

Starting in the 2024 tax year, domestically owned pass-through entities with only U.S. shareholders or partners are exempt from filing IRS international tax forms Schedule K-2 and K-3. The US Internal Revenue Service (IRS) issued updated guidance

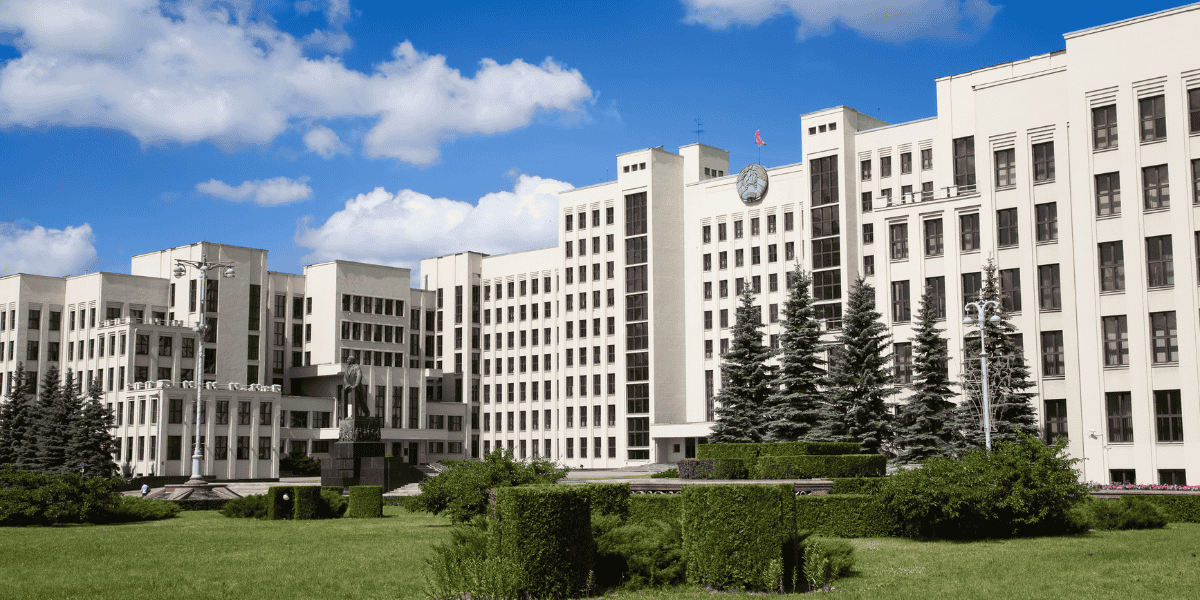

See MoreBelarus: Tax ministry sets FATCA filing deadline for 2024

The Belarus Ministry of Taxes announced the 12 August 2025 deadline for 2024 FATCA filings under the Belarus-US Model 1B Agreement. The Belarus Ministry of Taxes and Duties announced on 7 July 2025 that the deadline for FATCA filing under the

See MoreUS imposes 17% tariff on Mexico tomato imports

The 17% duty on Mexican tomatoes was imposed after the US withdrew from a 2019 agreement that suspended an antidumping investigation on Mexican tomatoes. The Trump administration announced a 17% duty on Mexican fresh tomato imports on 14 July

See MoreUS: IRS offers tax relief to Texas flood and storm victims

The tax filing and payment deadline has been extended to 2 February 2026 for Texas taxpayers. The US Internal Revenue Service (IRS) released TX-2025-04 on 9 July 2025, in which they announced tax relief for individuals and businesses in parts

See MoreUS: Trump to impose higher tariffs on major trading partners including Canada, EU, Mexico starting August ’25

Trump announced 35% tariffs on Canadian imports, 30% on imports from Mexico and the EU, and 20% to 50% tariffs on 23 other trading partners, including Japan and Brazil. US President Donald Trump announced a 35% tariff on Canadian imports and

See MoreUS: Sales tax applies to resold goods under Trump tariffs, says SSTGB

The SSTGB confirmed that sales tax applies to tariffs on imported goods resold in its 24 member states. The Streamlined Sales Tax Governing Board (SSTGB) has confirmed that sales tax applies to tariffs on imported goods, including those recently

See More