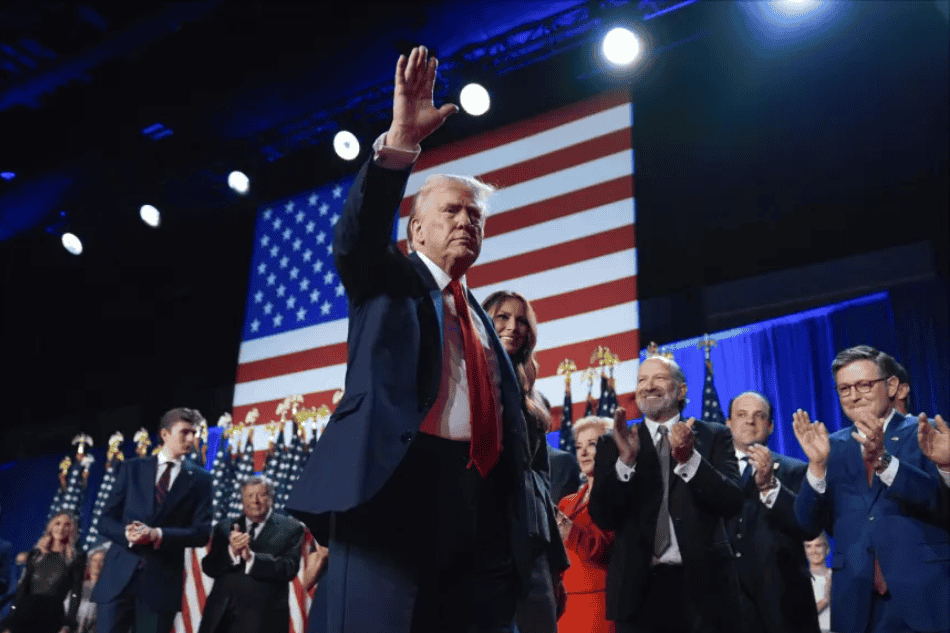

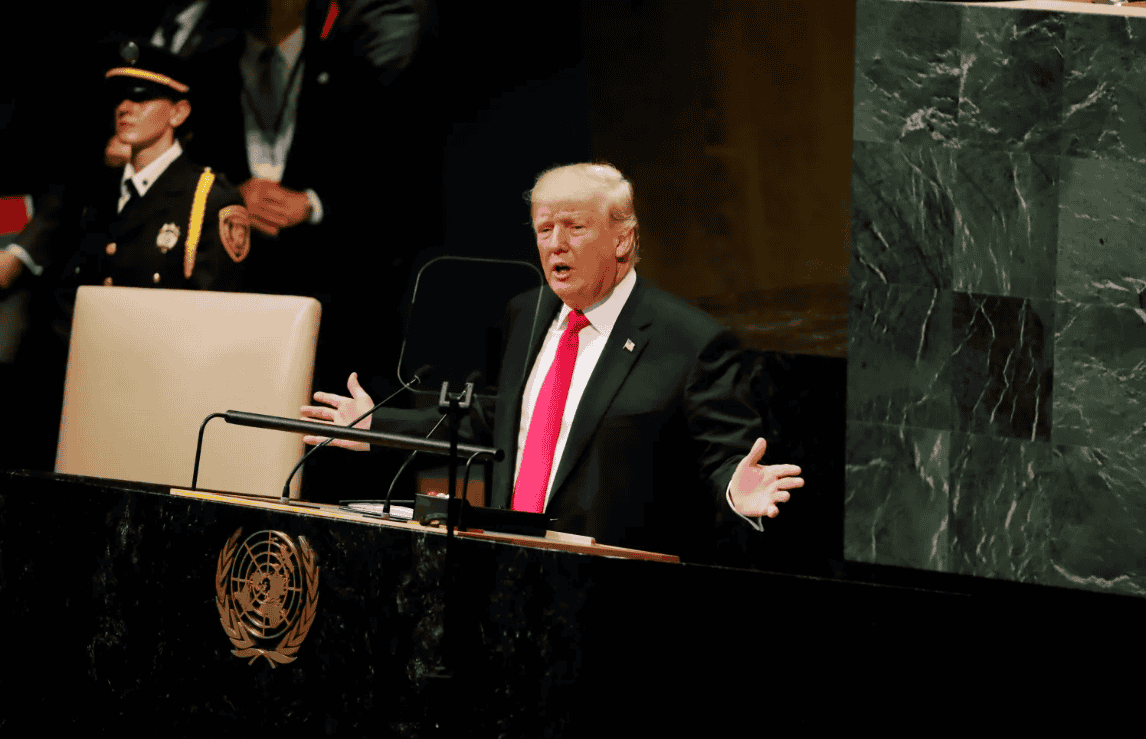

US: Trump administration to levy modest tariff on pharmaceutical imports

The Trump administration is reviewing the pharmaceutical sector for national security, with potential tariffs starting at 25% but capped at 15% under an EU agreement, despite Trump’s earlier mention of rates up to 200%. US President Donald

See MoreEU halts trade countermeasures following US agreement

The suspension is effective from today, 6 August 2025. The European Union has published Commission Implementing Regulation (EU) 2025/1727 of 5 August 2025 in the Official Journal of the European Union on 5 August 2025, which suspends the

See MoreUS imposes 50% tariffs on India for Russian oil trade

President Trump imposed an additional 25% tariff on top of the existing 25% tariff on Indian goods, citing India’s high tariffs, trade barriers, ties with Russia, and imports of Russian oil. US President Donald Trump issued an executive order

See MoreSwitzerland signals willingness to revise US offer in response to heavy tariffs

Switzerland plans to revise its trade offer following the US announcement of 39% import tariffs amid rising economic concerns. The Swiss government is preparing to revise its offer to the US following the announcement of 39% import tariffs set

See MoreTaiwan confirms temporary 20% US tariff, highlights ongoing chip tariff talks

Taiwan President Lai Ching-te said the new 20% US tariff on Taiwanese imports is "temporary” and plans to negotiate for a lower rate. Taiwan President Lai Ching-te stated that the U.S. government’s new 20% tariff on Taiwanese imports,

See MoreUS cuts tariff on Bangladeshi imports to 20%

The US has lowered its tariff on imports from Bangladesh to 20%, down from the previous steep rate of 35%. The US has reduced its reciprocal tariff rate on imports from Bangladesh to 20%, down from the previous 35%, following intense final

See MoreUS: Trump raises tariff on Canada to 35%

Goods transshipped to evade the 35% tariff will be subject, instead, to a transshipment tariff of 40%. US President Donald Trump signed an executive order on 31 August 2025, raising tariffs on Canadian goods from 25% to 35% for products not

See MoreUS: New Jersey adopts graduated rates for property interest transfers

The new law replaces the flat 1% fee on transfers over USD 1 million with a graduated rate from 1% for transfers under USD 2 million up to 3.5% for transfers above USD 3.5 million. New Jersey’s governor has signed the Fiscal Year 2026 Budget

See MoreUS: Trump administration imposes 10%–41% reciprocal tariffs on multiple countries

The development follows Trump’s warning that countries failing to reach a trade deal with the US by 1 August would face higher export tariffs. US President Donald Trump signed an executive order on 31 July 2025, imposing high tariffs on exports

See MoreBangladesh: Government approves purchase of 220k metric tons of wheat from US to ease trade tensions

This government-to-government deal is part of Bangladesh’s efforts to reduce trade tensions with the US and avoid high tariffs on its exports. Bangladesh has approved the purchase of 220,000 metric tons of wheat from the US for USD 302.75 per

See MoreUS: Treasury publishes list of countries requiring cooperation with an international boycott with no changes

The list includes Iraq, Kuwait, Lebanon, Libya, Qatar, Saudi Arabia, Syria, and Yemen. The US Department of the Treasury published a notice in the Federal Register on 31 July 2025, listing countries that may require participation or

See MoreUS announces 25% tariff on India, cites trade barriers and Russian ties

The new tariffs will enter into force on 1 August 2025. The Trump Administration will impose 25% tariffs on Indian imports, citing India's high tariffs, trade barriers and ongoing defence and energy ties with Russia. US President Donald Trump

See MoreUS: Trump to set 15% tariff on South Korean imports under new trade deal

President Trump announced a reduced 15% tariff on South Korean imports, down from a planned 25%, as part of a new trade deal. US President Donald Trump announced a reduced 15% tariff on imports from South Korea on 30 July 2025, down from the

See MoreUS: Trump administration imposes 50% tariffs on Brazilian imports

The new tariffs will take effect on 6 August 2025. US President Donald Trump imposed 50% tariffs on most Brazilian imports on 30 July 2025. However, key sectors like aircraft, energy, orange juice, pig iron, and fertilisers will be

See MoreUS: IRS issues temporary CAMT guidance for partnerships, new rules expected

The IRS issued interim guidance on applying the Corporate Alternative Minimum Tax (CAMT) to partnerships and announced plans to revise and replace the September 2024 proposed regulations. The US Internal Revenue Service (IRS) issued Notice

See MoreUS, Philippines reach new trade agreement on export tariffs

The US and the Philippines have agreed on a trade deal with a 19% tariff on Philippine exports and zero tariffs on US goods. The US and the Philippines have concluded a trade agreement that lowers the planned US tariff on Philippine exports from

See MoreUS: IRS releases temporary guidelines to enhance LB&I audit procedures

The memo outlines plans to phase out the acknowledgement of facts process by 2026, expand accelerated issue resolution to large corporate cases, and strengthen review of fast track settlement denials. The US Internal Revenue Service (IRS)

See MoreUS: IRS clarifies BEAT exception rules; states services cost method not mandatory, documentation essential

The IRS clarified that under BEAT rules, taxpayers may exclude the cost portion of service payments to foreign related parties using the Section 59A(d)(5) exception, even without applying the specific transfer pricing method. The US Internal

See More