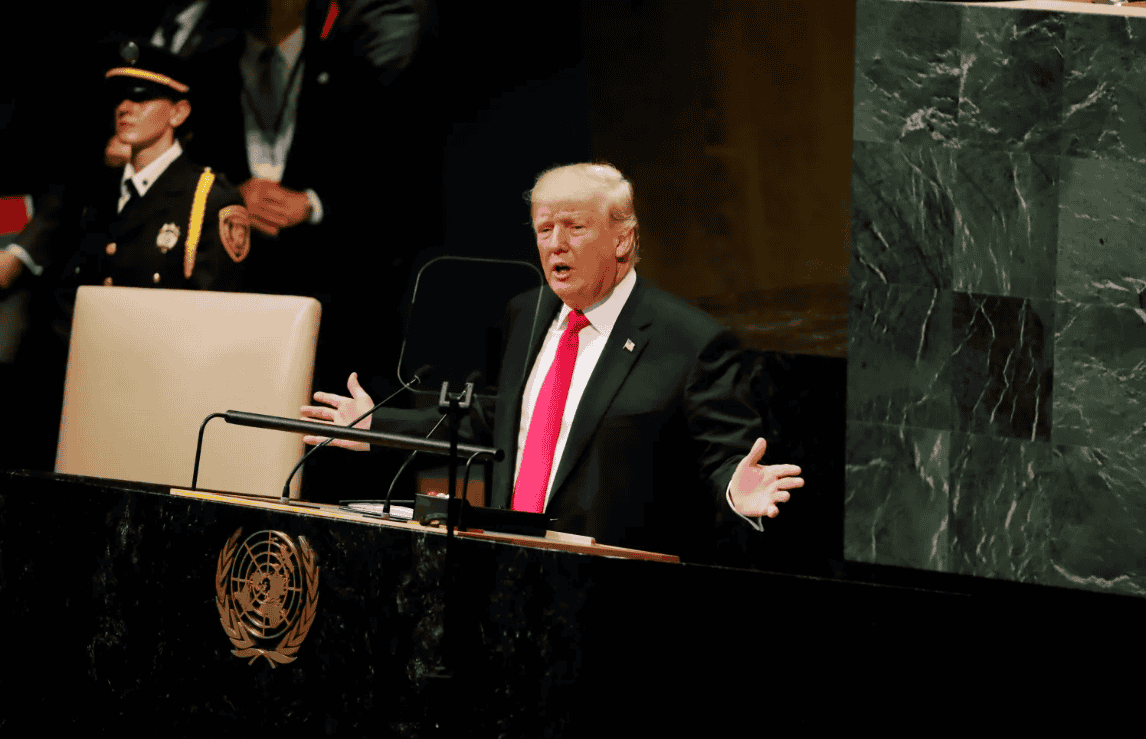

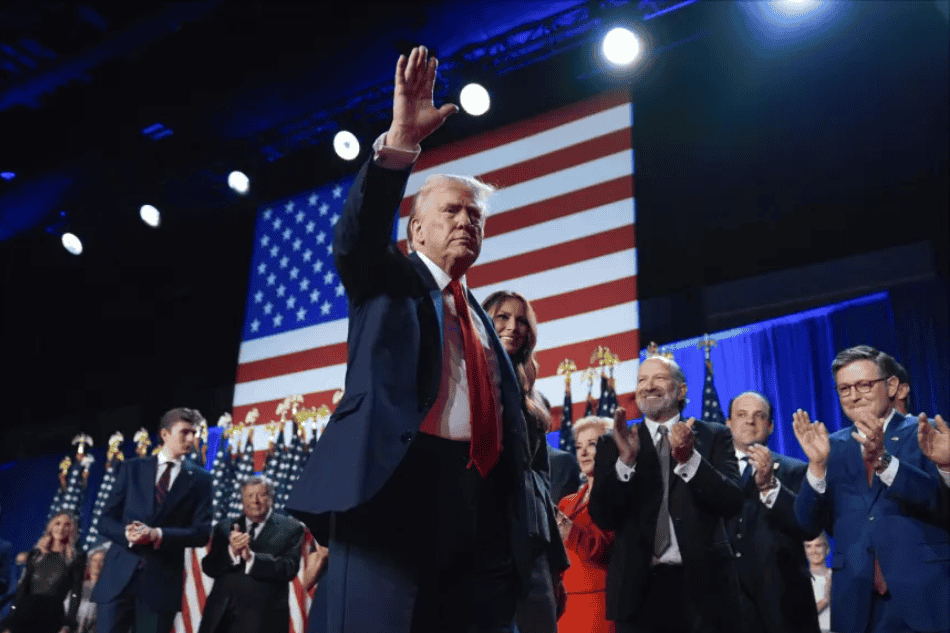

US: Appeals Court rules most Trump tariffs illegal, administration advances trade deals despite ruling

The US Appeals Court ruled that most Trump-era tariffs are illegal but allowed them to remain in place until 14 October pending a possible Supreme Court appeal. Despite the ruling, the administration continues trade talks with other

See MoreUS: IRS issues guidance on elections, amended returns, accounting method changes for R&E costs under OBBBA

The guidance covers procedures for amortising domestic R&E costs, obtaining automatic consent for accounting changes, and extended deadlines for certain 2024 returns. The IRS released Revenue Procedure 2025-28, outlining rules for elections,

See MoreUS: Trump administration permanently ends low-value package tariff exemption

CBP guidance states parcels will incur fees of USD 80, USD 160, or USD 200 based on Trump-era duty rates: under 16% (e.g., UK, EU), 16-25% (e.g., Indonesia, Vietnam), and over 25% (e.g., China, Brazil, India, Canada), respectively. The Trump

See MoreUS: 50% tariffs on Indian imports enters into force

US to impose extra 25% tariffs on Indian imports from 27 August 2025, raising total duties to 50%. The US’ tariffs on Indian imports under Executive Order 14329 is taking effect today, 27 August 2025, starting 12:01 AM EDT. Most Indian

See MoreUS: Rhode Island to raise property transfer tax from October 2025

Rhode Island will increase its real estate conveyance tax rate from USD 2.30 to USD 3.75 per USD 500 for property sales exceeding USD 100, effective 1 October 2025. The Rhode Island Department of Revenue has published ADV 2025-13 on 21 August

See MoreUS: Trump threatens China with 200% tariffs if rare-earth magnets remain on restricted export list

In response to US tariff hikes, China, which dominates 90% of global rare-earth magnet production, added magnets to its export restriction list in April. US President Donald Trump stated that China must supply the US with rare-earth magnets or

See MoreChile: SII clarifies that tax treaty with US allows digital content creators to claim foreign tax credit

Ruling No. 1617-2025 permits digital content creators in Chile to claim a tax credit for US taxes paid, provided the US holds taxing rights over the income. Chile’s Tax Administration (SII) has published Ruling No. 1617-2025 of 14 August 2025

See MoreUS: IRS announces unchanged interest rates, tax underpayments and overpayments for Q4 2025

Under the Internal Revenue Code, the rate of interest is determined on a quarterly basis. The US Internal Revenue Service (IRS) released IR-2025-87 on 25 August 2025, in which it announced that interest rates will remain the same for the calendar

See MoreUS: Trump warns of additional tariffs on nations imposing digital taxes

President Donald Trump warned that countries maintaining digital taxes on major US tech firms such as Google and Amazon would face additional tariffs. US President Donald Trump has threatened countries with additional tariffs if they do not

See MoreUS: Trump administration launches tariff review on furniture imports

This investigation mirrors previous probes into various industries like wind turbines, semiconductors, and critical minerals, all citing national security concerns under Section 232. President Donald Trump has announced, on Truth Social, a

See MoreCanada to exempt retaliatory tariffs on US imports under CUSMA

Canada’s government decision to abolish all tariffs on US goods under CUSMA will take effect on 1 September 2025. Canada’s Prime Minister Mark Carney announced on 22 August 2025 that Canada will eliminate tariffs on US goods covered under the

See MoreUS: IRS, Treasury release FAQs for the accelerated termination of select OBBBA energy provisions

These FAQs provide guidance on several energy credits and deductions that are expiring under OBBBA and their termination dates. The US Internal Revenue Service (IRS) has released a fact sheet with FAQs (FS-2025-05) on 21 August 2025 to clarify

See MoreUS, EU reaches agreement on a framework for trade deal

This joint statement is aimed at solidifying the US-EU commitment to equitable trade and investment, strengthening one of the world’s most significant economic relationships, and driving reindustrialisation. The Trump Administration announced

See MoreUS: Treasury, IRS propose new reporting rules for partnership interest sales

Public comments are open until 18 September 2025. The US Department of the Treasury and the Internal Revenue Service (IRS) have proposed regulations modifying information reporting obligations with respect to sales or exchanges of certain

See MoreUS: IRS revises payment loss rules (DLP), extends transition relief for dual consolidated loss and GloBE model rules

Notice 2025-44 proposes the withdrawal of the disregarded payment loss (DPL) rules finalised in January 2025 and extending the transition relief for the interaction of dual consolidated loss (DCL) rules with the OECD/G20 BEPS GloBE model

See MoreUS: Commerce Department expands steel and aluminium tariffs to include 407 more products

The steel and aluminum used in these products will be subject to a 50% duty rate. The US Department of Commerce’s Bureau of Industry and Security has expanded the steel and aluminium tariffs to include 407 additional product categories covered

See MoreUS rejects IMO proposal for global shipping emissions tax

A joint statement criticises the proposal as a “global carbon tax on Americans” imposed by an unaccountable UN body, which warns of potential retaliation or remedies against supporting countries if US efforts to oppose the framework are

See MoreUS: IRS proposes rules on F reorganisations involving US real property transfers

Notice 2025-45 announces plans to propose regulations modifying the application of Sections 897(d) and (e) to certain inbound F reorganisations under Section 368(a)(1)(F) involving US real property interests. The US Internal Revenue Service (IRS)

See More