UN: Discussion of Protocol on Dispute Prevention and Resolution

In February 2026 the intergovernmental negotiating committee (INC) continued discussions on the UN Framework Convention on International Tax Cooperation, looking at the early Protocol on tax dispute resolution. Dispute resolution

See MoreUN: Intergovernmental Negotiating Committee Discusses Cross-Border Services Protocol

In February 2026 the intergovernmental negotiating committee (INC) continued discussions on the UN Framework Convention on International Tax Cooperation, looking at the early Protocol on taxation of cross-border services. With increasing

See MoreUN: Meeting of Committee to Discuss Framework Convention on International Tax Cooperation

The intergovernmental negotiating committee (INC) met in February 2026 to continue discussions on the UN Framework Convention on International Tax Cooperation and the two early Protocols on taxation of cross-border services and tax dispute

See MoreUN: Intergovernmental Negotiating Committee continues discussions on Framework Convention

The Intergovernmental Negotiating Committee (INC) on the UN Framework Convention met in Nairobi for further discussions from 10th to 19th November 2025. Discussions focused on a draft template of a Framework Convention published for consultation in

See MoreUN: 31st Session of Committee of Experts on Tax Cooperation

The UN Committee of Experts on International Cooperation in Tax Matters held its 31st session from 21 to 24 October 2025. This was the first meeting of the new membership of 25 tax experts appointed for a four-year term from 2025 to 2029. The new

See MoreUN issues draft framework for international tax cooperation

RF Report The United Nations has refreshed its webpage on Intergovernmental Negotiations for the UN Framework Convention on International Tax Cooperation, unveiling the Co-Lead’s Draft Framework Convention Template dated 24 October 2025. The

See MoreUN Tax Committee advances agenda on climate, wealth, health, gender taxation

The UN Tax Committee concluded its 31st session in Geneva, advancing work on environmental, wealth, health, and gender-related taxation while approving new subcommittee mandates. Regfollower Desk The United Nations Committee of Experts on

See MoreUN: Tax Committee sets four-year agenda with focus on developing countries, AI, green taxation

The 31st session of the UN Committee of Experts on International Cooperation in Tax Matters was held In Geneva from 21 to 24 October 2025. This was the first meeting of the newly-appointed membership of the Committee, consisting of 25 tax experts

See MoreUN Tax Committee progresses on extractives, digital tax, transfer pricing initiatives

The UN Tax Committee reviewed proposals to establish new workstreams on extractive industries, digital economy, and transfer pricing—aiming to enhance guidance on critical minerals valuation, digital services and remote work taxation, and transfer

See MoreUN Tax Committee begins 31st session to advance model convention, treaty manual update, and extractive industry taxation

The UN Committee of Experts opened its 31st session in Geneva on 21 October 2025 to discuss updates to the Model Tax Convention, revise the treaty negotiation manual, and address extractive industry taxation, forming subcommittees for the first two

See MoreUN Tax Convention discusses fast-track mechanism for tax protocols

On 13 August 2025, during the third day of the second session of the United Nations Framework Convention on International Tax Cooperation, delegates discussed creating a fast-track instrument to implement Protocol I on taxing income from

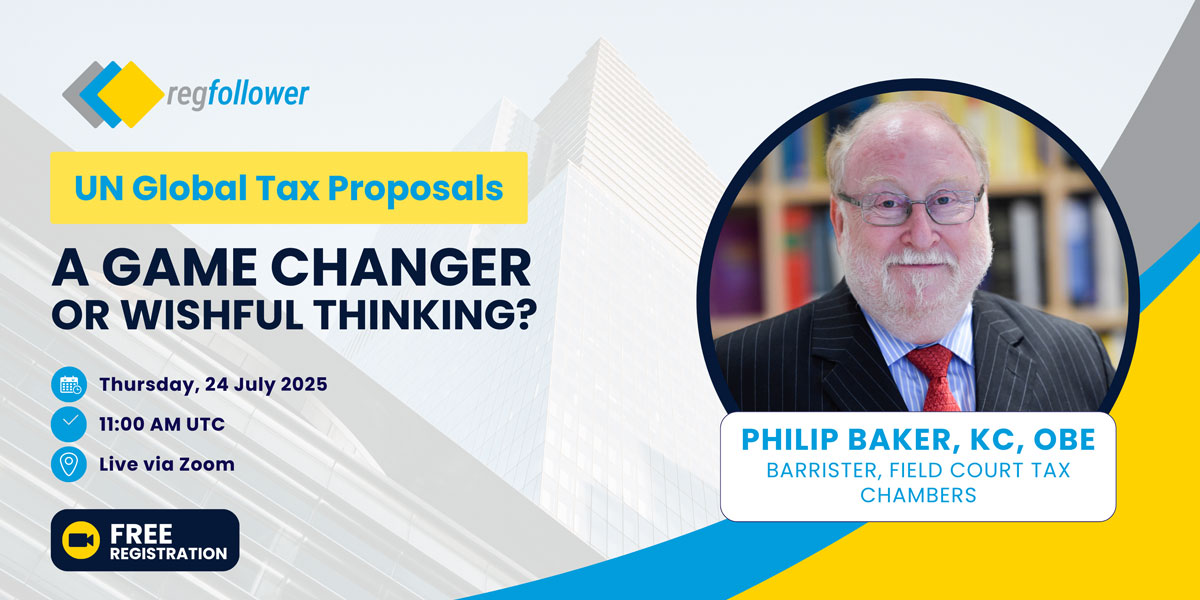

See MoreUN Tax Proposals: A game changer or wishful thinking?

Regfollower debuted its official podcast, Regtalks, live on 24 July 2025, with a compelling discussion with Philip Baker OBE KC, one of the world’s leading experts in international tax law. He unpacked two UN initiatives: the Framework

See MoreUN Tax Cooperation Framework releases key highlights from first virtual stakeholder session

The sessions aim to improve stakeholder engagement and transparency in advancing the Convention and its early protocols through topic-focused meetings. The Secretariat of the UN Framework Convention on International Tax Cooperation (UNFTC) is

See MoreUN Framework Convention on International Tax Cooperation releases Roadmap and Working Methods

The Intergovernmental Negotiating Committee on the UN Framework Convention on International Tax Cooperation has released a Roadmap and working methods on 4 April 2025 for developing the Framework Convention and two initial protocols. It outlines

See MoreUN urges US to exempt vulnerable nations from reciprocal tariffs

The UN Trade and Development (UNCTAD) has urged the US to exempt vulnerable developing economies from reciprocal tariffs on 14 April 2025. A recent report found that these tariffs would do little to reduce US trade deficits or generate

See MoreUN: ECOSOC tackles cross-border digital taxation

The UN Economic and Social Council (ECOSOC) has discussed a potential UN framework to address cross-border service taxation, including withholding and digital services taxes, in a special tax meeting on 28 March 2025. The Special Meeting of the

See MoreUN Tax Committee adopts major international tax reforms in 30th session

The UN Committee of Experts on International Tax Matters made key changes to global tax policies during its 30th session, which was held from 24 to 27 March 2025 in New York. About the Committee The Committee comprises 25 members, nominated by

See MoreUN Tax Committee: Report on Environmental Taxation

On 25 March 2025 the Subcommittee on Environmental Taxation submitted its final report to the UN Tax Committee, including an updated paper for approval and recommendations for future work to be considered by the new membership of the Tax Committee

See More