Ukraine: Parliament withdraws draft law on online platform income tax

Ukraine’s parliament has withdrawn draft Law No. 14025 on the taxation of income earned by individuals from selling goods or providing services through online platforms, after it failed to secure sufficient votes. A 5% individual income tax was

See MoreUkraine: MoF consults draft anti-tax avoidance law

Ukraine’s Ministry of Finance (MoF) has launched a public consultation, on 24 February 2026, on the Draft Law “On Amendments to the Tax Code of Ukraine regarding the implementation of rules to counter tax avoidance practices that directly affect

See MoreUkraine: MoF consults transfer pricing reform bill

Ukraine’s Ministry of Finance (MoF) opened a public consultation on a draft law titled “On Amendments to the Tax Code of Ukraine Regarding Further Improvement of Transfer Pricing Rules” on 24 February 2026. The draft was prepared with the

See MoreJapan, Ukraine negotiate to update IPA

The Japanese Ministry of Foreign Affairs announced on 20 February 2026 that the fourth round of negotiations with Ukraine on revising the Investment Protection Agreement (2015) took place from 17 to 19 February 2026. Both parties committed to

See MoreUkraine: National Bank lowers key policy rate

The National Bank of Ukraine (NBU) has reduced its key policy rate from 15.5% to 15%, effective 30 January 2026, marking the start of a monetary easing cycle. This announcement was made on 29 January 2025. The move reflects a steady decline in

See MoreUkraine raises corporate tax rate for banks in 2026

Ukraine has enacted Law No. 4698-IX, published in the Official Gazette on 26 December 2025, introducing significant amendments to the country’s Tax Code and related legislation. Under the new law, banks will face a corporate income tax rate of 50%

See MoreAustralia, Ukraine sign income tax treaty

The treaty establishes the first bilateral agreement between Australia and Ukraine and aims to eliminate double taxation on income, capital, fringe benefits, and withholding tax while preventing tax evasion or avoidance. Australia and Ukraine

See MoreEU: Council to reduce or eliminate customs duties for several agri-food products for Ukraine

The Council approved the EU’s position in the EU-Ukraine Association Committee to reduce or remove customs duties on various agri-food products, including dairy, meat, and produce destined for Ukraine. The EU Council has adopted a decision on

See MoreUkraine: Government presents 2026 budget to parliament, proposes increased minimum wage

Draft Law No. 14000 proposes raising the minimum statutory monthly salary from UAH 8,000 to UAH 8,647 and the minimum subsistence level for employed individuals from UAH 3,028 to UAH 3,328. Ukraine’s government has presented Draft Law No.

See MoreUkraine: Cabinet of Ministers approves first income tax treaty with Australia

This is the first ever income tax treaty between Ukraine and Australia. Ukraine's Cabinet of Ministers approved the signing of an income tax treaty with Australia on 17 September 2025. The agreement will eliminate double taxation concerning

See MoreUkraine: Parliament considers tax on digital platform income

The draft proposes a 5% individual income tax for qualifying Ukrainian resident sellers. Ukraine’s parliament is reviewing draft law No. 14025 on 9 September 2025, which will tax income earned by individuals through online platforms. The

See MoreUkraine sets deadline for 2024 transfer pricing report, notification

STS has announced the deadline to submit 2024 transfer pricing report and notification of participation in an international corporate group of companies. Regfollower Desk Ukraine’s State Tax Service (STS) announced on 11 September that the

See MoreUkraine: STS clarifies CFC reporting penalties

Ukraine requires annual CFC reports, with penalties waived during martial law if filed within six months after it ends. Ukraine’s State Tax Service (STS) has clarified that, under the country’s controlled foreign company (CFC) rules, a

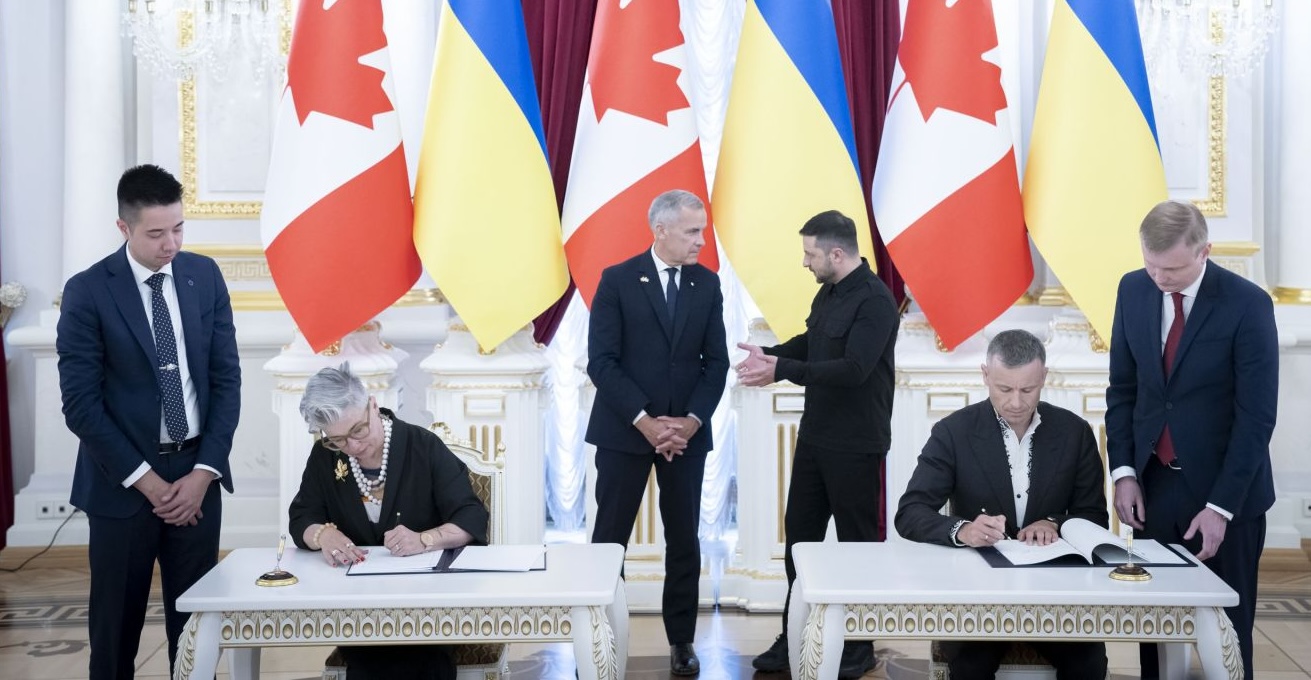

See MoreCanada, Ukraine sign agreement on mutual administrative assistance in customs matters

This agreement aims to address customs violations amid growing bilateral trade between the two countries. Canada and Ukraine signed an agreement on mutual administrative assistance in customs matters on 24 August 2025. The signing took place

See MoreJapan, Ukraine hold first round of investment pact revision negotiations

Japan and Ukraine held their first round of negotiations to revise the 2015 Investment Protection Agreement from 29 to 31 July 2025. Japan and Ukraine held the first round of negotiations to revise their 2015 Investment Protection Agreement

See MoreJapan, Ukraine tax treaty enters into force

The new tax treaty replaces the 1986 tax treaty between Japan and Ukraine. Japan’s Ministry of Finance announced on 2 July 2025 that the new income tax treaty between Japan and Ukraine entered into force on 1 August 2025. The new treaty,

See MoreUkraine clarifies transfer pricing penalty changes effective from March 2025

These amendments, which took effect on 25 March 2025, adjust the penalties applicable to late or missing submissions of TP-related reports and notifications. The Ukrainian State Fiscal Service issued a clarification on upcoming changes to the Tax

See MoreJapan, Ukraine tax agreement comes into effect

The Ministry of Finance confirmed the 2024 tax treaty with Ukraine will take effect on 1 August 2025. Japan’s Ministry of Finance announced on 2 July 2025 that the 2024 tax treaty and protocol with Ukraine will come into effect on 1 August

See More