Switzerland updates CRS MCAA participant list

Switzerland has updated its list of participating jurisdictions under the Multilateral Competent Authority Agreement on Automatic Exchange of Financial Account Information (CRS MCAA). The update was formalised in Decision No. RO 2026 57, gazetted

See MoreSwitzerland sets 2026 interest rates for loans in CHF, foreign currencies

The Swiss Federal Tax Administration has issued two circulars outlining Financing in Swiss Francs on 29 January 2026and Financing in Foreign Currencies on 30 January 2026. Financing in Swiss Francs The following details outline the

See MoreSwitzerland: FTA sets 2026 Safe-Harbour rates for related-party loans

The Swiss Federal Tax Administration ( FTA) has released circulars outlining the safe-harbour interest rates for loans between shareholders and related parties. The circular covering loans in Swiss Francs (CHF) was issued on 29 January 2026,

See MoreSwitzerland to adopt FATCA Model 1 with US from 2028

Switzerland’s transition to a Foreign Account Tax Compliance Act (FATCA) Model 1 agreement with the United States is now expected to take effect on 1 January 2028, one year later than previously anticipated, the State Secretariat for International

See MoreSwitzerland updates CbC reporting list

Switzerland has updated its list of jurisdictions for the automatic exchange of Country-by-Country (CbC) reports under the Multilateral Competent Authority Agreement on Automatic Exchange of Country-by-Country Reports (CbC MCAA). Decision No. RO

See MoreUS to reduce Swiss tariffs under new trade deal

The US will reduce tariffs on Swiss goods from 39% to 15% under a new trade framework, the Swiss government announced today. The agreement also includes a commitment by Swiss companies to invest USD 200 billion in the US by 2028. The framework

See MoreSwitzerland: Federal Council consults on VAT amendments

The Swiss Federal Council opened a consultation on amendments to the Value Added Tax Act on 5 December 2025. The changes aim to implement two parliamentary motions: the extension of platform taxation to electronic services (Motion WAK-S 23.3012)

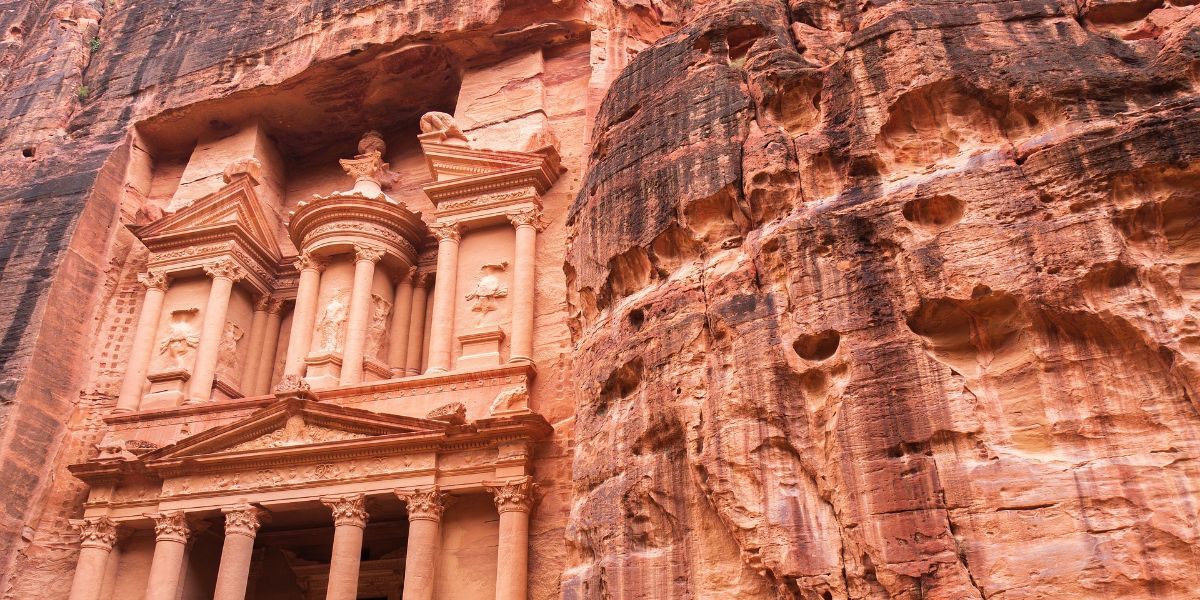

See MoreJordan, Switzerland income tax treaty enters into force

The income tax treaty between Jordan, Switzerland entered into force on 4 December 2025. Signed on 13 December 2023, the agreement aims to prevent double taxation on income and curb tax evasion between Jordan and Switzerland. It applies to

See MoreSwitzerland: Federal Council announces CRS update, new crypto reporting rules

Switzerland’s Federal Council has announced amendments to the Ordinance on the International Automatic Exchange of Information in Tax Matters (AEOI Ordinance), updating rules to align with the OECD’s Common Reporting Standard (CRS) and

See MoreSwitzerland: Federal Council approves amending protocol to tax treaty with Croatia

The Swiss Federal Council confirmed on 26 November 2025 the adoption of the dispatch for the protocol amending the 1999 income and capital tax treaty with Croatia. Signed on 18 July 2025, the protocol makes updates to the OECD Model Double

See MoreGermany, Switzerland tax treaty amending protocol comes into effect

The Swiss State Secretariat for International Finance announced that the protocol amending the 1971 income and capital tax treaty with Germany came into force on 27 November 2025. The protocol, signed on 21 August 2023, updates the treaty to

See MoreSwitzerland: Federal Council adopts protocol to income tax treaty with Belgium

The Swiss Federal Council adopted the dispatch on 26 November 2025 for a protocol to the income tax treaty with Belgium. The protocol implements minimum standards for such treaties, including an abuse clause to prevent arrangements or

See MoreSwitzerland: Voters reject mega-inheritance tax proposal

Swiss voters decisively rejected a proposed 50% tax on inheritances of CHF 50 million (USD 62 million) or more on 30 November 2025, with 78% voting against it. This was higher than the two‑thirds opposition predicted in polls. The plan, put

See MoreSwitzerland approves amendment to AEOI rules ahead of 2026 entry into force

The Swiss Federal Council has approved amendments to the Ordinance on the International Automatic Exchange of Information in Tax Matters (AEOI Ordinance), confirming that the revised rules will take effect on 1 January 2026 alongside the amended

See MoreCroatia: Parliament approves amending protocol to tax treaty with Switzerland

Croatia’s parliament approved the ratification of the amending protocol to the 1999 income and capital tax treaty with Switzerland on 21 November 2025. Signed on 18 July 2025, the protocol makes updates to the OECD Model Double Taxation

See MoreEU Council signs updated tax cooperation agreements with Andorra, Liechtenstein, Monaco, San Marino, Switzerland

The EU Council approved updated tax cooperation agreements with Andorra, Liechtenstein, Monaco, San Marino, and Switzerland, extending automatic financial account information exchanges to cover electronic money products and digital currencies on 20

See MoreEU Parliament endorses protocols to expand AEOI-CRS agreements with Andorra, Monaco, San Marino, Liechtenstein, Switzerland

The European Parliament approved Legislative Resolution Nos. P10_TA(2025)0269 (Andorra), P10_TA(2025)0270 (Monaco), P10_TA(2025)0271 (San Marino), P10_TA(2025)0272 (Liechtenstein) and P10_TA(2025)0273 (Switzerland), authorising the conclusion of

See MoreHungary, Switzerland: Amending protocol to tax treaty enters into force

The amending protocol the 2012 income and capital tax treaty between Hungary and Switzerland entered into effect on 16 November 2025. The protocol will generally take effect from 1 January 2026 for withholding and other taxes. Changes under

See More