Sri Lanka: IRD launches e-services for 2023/24 tax returns

The Sri Lanka Inland Revenue Department (IRD) has announced the launch of its "e-services" platform for the electronic filing of annual tax returns for the assessment year 2023/2024. Taxpayers must submit their returns electronically by 30 November

See MoreCzech Republic, Sri Lanka income tax treaty enters into force

The income tax treaty between the Czech Republic and Sri Lanka entered into force on 16 October 2024. The announcement was made by the Czech Ministry of Finance on 15 October 2024. Both countries apply the credit method for the elimination of

See MoreSri Lanka to sign first income tax treaty with Austria

At a press briefing on Cabinet decisions from 2 September 2024, Sri Lanka's Cabinet announced its approval for signing an income tax treaty with Austria. According to the convention, Sri Lanka will be taxed at a rate not exceeding 10% of the

See MoreSri Lanka releases estimated income tax statement for 2024-25

The Sri Lanka Inland Revenue Department (IRD) has released the Statement of Estimated Income Tax Payable for the year of assessment 2024/2025. It also issued the Statement of Estimated Tax (SET) - Credit Schedule and the Instructions for completing

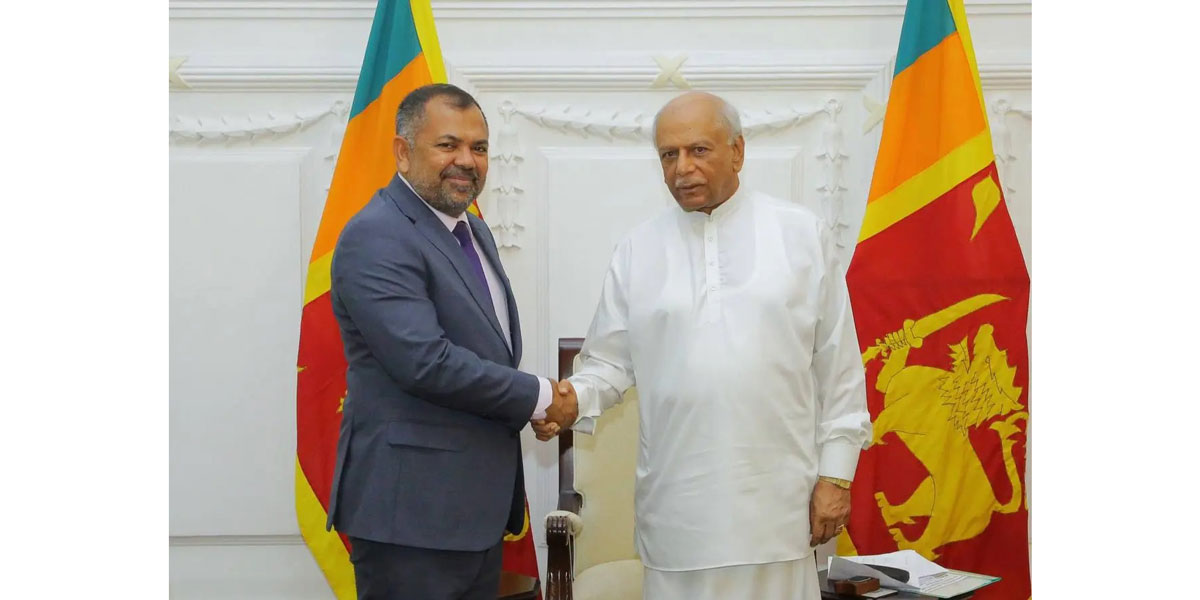

See MoreSri Lanka, Maldives to sign tax treaty

Officials from Sri Lanka and the Maldives met to discuss strengthening bilateral relations and cooperation, including the signing of an income tax treaty, on 6 June 2024. This follows after the Maldives ' Minister of Foreign Affairs, Moosa

See MoreSri Lanka publishes guidance on tax residency certificates

On 1 April 2024, the Sri Lanka Inland Revenue Department (IRD) issued a notice to taxpayers outlining the necessary procedures to secure a tax residence certificate (TRC). The requirements include: a) A request for TRC should be made to the

See MoreIMF Report Comments on the Sri Lankan Economy

On 19 January 2024 the IMF issued a report following discussions with Sri Lanka. The report notes that the economic reform program implemented by Sri Lanka is helping economic recovery with positive real GDP growth in the third quarter of 2023,

See MoreSri Lanka releases circular on VAT registration for exempt goods and services

On 4 January 2024, Sri Lanka’s Inland Revenue Department (IRD) published Circular No. SEC/2024/E/01 announcing the VAT registration requirements for suppliers of rubber, tea, and coconut products. As per the amendments made to the Value Added

See MoreSri Lanka increases VAT rate to 18%

On 28 December 2023, Sri Lanka’s Inland Revenue Department (IRD) issued the Notice to VAT Registered Persons announcing the new VAT rate of 18% from 15%—effective 1 January 2024. The notice also states that any advance payment made before 1

See MoreSri Lanka: IRD releases latest tax return forms for AY 2022-23

On 15 September 2023, the Sri Lanka Inland Revenue department (IRD) released the income tax return forms for the assessment year (AY) 2022-23. The returns include: Income tax return for individuals (Form ASMT IIT 001 E). Income tax return

See MoreSri Lanka extends deadline for submitting quarterly AIT statements

On 26 July 2023, the Inland Revenue Department of Sri Lanka issued Circular No. SEC/2023/E/05, which extended the deadline for submitting quarterly advance income tax (AIT) statements. This extension applies to the reporting for the quarter ending

See MoreSri Lanka: IRD releases guidelines for calculating income tax

On 9 May 2023, the Sri Lankan Inland Revenue Department (IRD) released Circular No: SEC/2023/E/03. This circular provides detailed guidelines for calculating income tax for the assessment year beginning on 1 April 2022. The circular takes into

See MoreSri Lanka restricts deductions by cash payments

The Sri Lankan Inland Revenue Department (IRD) has recently released the Inland Revenue (Amendment) Act, No. 04 of 2023. This act was certified on 8 May 2023, has now been officially published in the Official Gazette on 12 May 2023. The IRD also

See MoreSri Lanka: IRD publishes MAP guidelines

On 8 May 2023, the Sri Lanka Inland Revenue Department (IRD) has published Mutual Agreement Procedure (MAP) guidelines. The guidelines provide several key aspects related to Mutual Agreement Procedure (MAP) requests in Sri Lanka. The guidelines

See MoreSri Lanka: IRD clarifies amendment to dividend taxation

20 January 2023, the Sri Lankan Inland Revenue Department (IRD) published a notice regarding changes in the taxation of dividends. As the National Budget of 2023 presented and passed in Parliament, following proposals specified under item No.1.3 of

See MoreSri Lanka removes concessionary tax rates and several exemptions

On 19 December 2022, the Inland Revenue Department (IRD) has published the Inland Revenue (Amendment) Act No. 45 of 2022. The IRD has also issued notices to taxpayers regarding significant tax changes. The changes are effective from 1 January

See MoreSri Lanka declares penalty relief measure

On 1 July 2022, Sri Lankan Inland Revenue Department (IRD) has published a notice on penalty relief for the payment of taxes due up to financial year 31 December 2021. The summary of notice is following: The penalty relief measure is

See MoreOECD: New Transfer Pricing Country Profiles Published

On 9 June 2022 the OECD released new transfer pricing country profiles for Egypt, Liberia, Saudi Arabia and Sri Lanka. The OECD transfer pricing profiles cover the OECD member countries and a number of member countries of the Inclusive

See More